Luckbox Leans in with Charles Hoskinson

On bitcoin’s entropy, cardano’s opportunity, the next generation of digital currencies and libertarian ideals

Charles Hoskinson, amathematician and tech entrepreneur,served as founding chairman of the Bitcoin Foundation’s education committee and helped establish the Cryptocurrency Research Group in 2013. He was among the ethereum blockchain’s eight founders but left in 2017 to help start Input Output Hong Kong, or IOHK, with former Ethereum colleague Jeremy Wood. As IOHK’s CEO, Hoskinson is leading the research, design, development and adoption effort to make cardano a mainstream digital currency.

How did you get started in digital currencies?

I was in the mathematics world and decided to jump from academics into the cryptocurrency space as a miner and a speculator in 2013. Since then, I’ve started three companies, and the one that I’m focused on is Input Output, my current company. I’ve been running that for six years. We built Cardano and have a large portfolio of products and services that we offer—from identity to transformational services to consulting. It’s been a hell of a journey. We’ve grown from two people to 500 people in 52 countries.

You’ve said cryptocurrency has entered its third phase. Where are we in terms of scalability and interoperability?

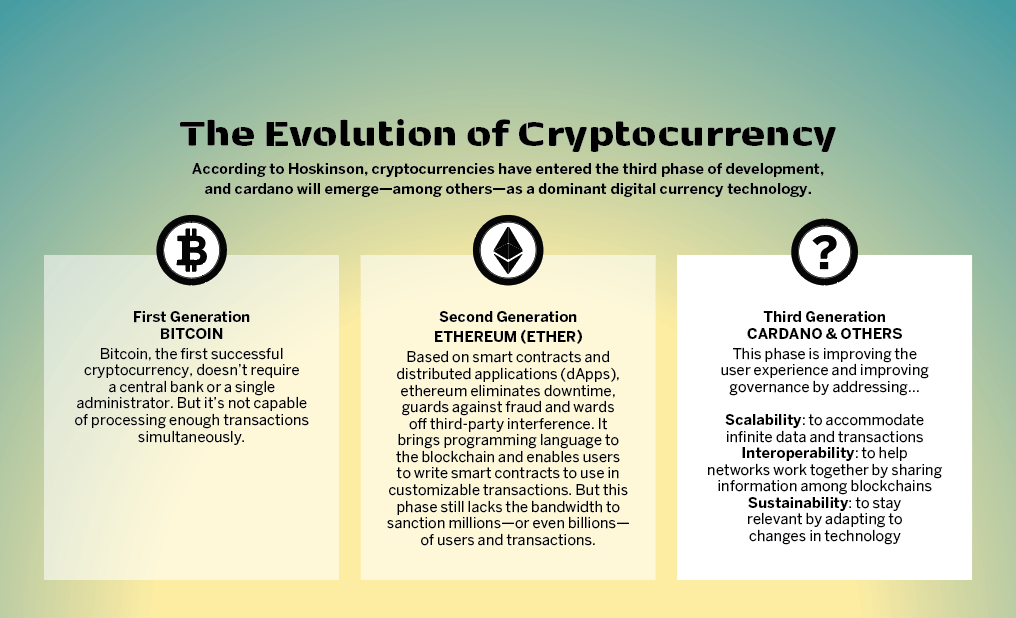

I created the three generations as a way of explaining where we’ve been, where we’re going and what challenges we face to get to the next level. The first two phases were about proofs of concept and introducing cryptocurrencies to the general public. The third phase is really about adoption. So, Phase 1 was asking if it’s possible to have a decentralized movement of value. Because we’d never figured that out and we’d always needed some trusted third party to sort the whole marketplace out. And that’s what bitcoin delivered to us. That’s a magical, amazing thing.

But the minute that we got it, people started saying, “Well, this is kind of stupid. The only thing I can do is push bitcoin around. I can’t issue my own assets. I can’t do stable coins or lending or insurance.”

Luckbox caught up with Charles Hoskinson at his farm outside Denver.

And so you needed programmability in the transaction. You need JavaScript to make that happen. Well, that’s what we did. We created ethereum. And when JavaScript came to the browser, the smart contract came to the blockchain.

Suddenly, you could do peer-to-peer lending and offer insurance and issue assets. That was amazing. The problem is [bitcoin and ethereum] were built to demonstrate the concepts, but the minute you start thinking how these concepts live in the world, you need interoperability.

What is the importance of interoperability?

Imagine if WiFi was particular to the manufacturer—your Apple phone could connect only to your Apple router. Your Google phone could only connect your Google. It’d be a mess. You’d have to have a different phone for every hotel you went to.

So instead, it’s universal. There’s interoperability. You can be in Iran, Israel, South Korea, Russia, China, America—those countries agree collectively on nothing, but your phone can connect to the WiFi in the hotel lobby in every single one of them. So that’s interoperability. You need that.

Second, these systems were never designed to work at scale, for millions to billions of people. That’s why the transaction fees are so high on ethereum, and bitcoin has historically had those problems. You need scalability so the protocol can grow to billions of people.

And then finally, you have a governance issue. How do you pay to continue evolving and growing the protocols? Who gets to decide where the protocols go? If you don’t have governance of that, it’s just chaos. Here we’re talking about your voting, your property, financial institutions, regulation, transactional regulation and the movement of trillions of dollars every day.

So, the third generation is really about sorting out the standards for interoperability, how to make a system scale and have a governance layer that evolves with the system so that it can always meet its needs. That’s where we are today, and there are a lot of competitors brutally hitting each other with a lot of great protocol ideas. It’s just like when the internet came out and there were 25 search engines and 25 web browsers. It will consolidate at some point into a collection of standards with winners and losers. Some will become Netscape and some will become Google.

What prevents bitcoin from evolving?

Well that’s the lowest entropy state? There’s a tendency when you’re the market leader to slow down and prevent the market from changing because you enjoy your monopoly. We saw this with Microsoft in the 1990s and 2000s. We saw this with IBM and their monopoly. We saw this with Standard Oil and their monopoly. We saw this so many times before. You are super-innovative in the beginning, and that’s what allows you to take over everything. You’re doing something so new.

Then, once you’re the king, you don’t want anybody else to be king but you don’t really have to work too hard. Who’s going to yell at you for sleeping in? The anti-competitive nature of monopolies is usually the undoing of the monopoly in some way.

Where did ethereum come from? It was a project of frustration. All the core founders of ethereum came from the bitcoin space, and they were working to make bitcoin better. It’s so hard to innovate with bitcoin. No monopolies are sustainable in a fast-evolving technological world, and bitcoin is really showing its age. It operates at a clock rate of only seven transactions per second. It’s horrendously expensive to maintain resources, or resources are ultra scarce. The metadata standards are substandard. There’s no provision for regulation or identity. You can only do push transactions—like credit card payments. You can’t do pull transactions, like subscription payments. There’s no programmability that’s worth anything. It’s very hard to build overlay protocols like lightning or mastercoin. Interoperability is non-existent. Bitcoin is not aware that there’s a world outside of itself. I can go on and on.

So, out of necessity, the industry is building competitors, and at some point those competitors will overtake bitcoin. If you look at bitcoin dominance, it used to be like 80/20—80% of all the value is in bitcoin and then 20% in the entire remainder of the altcoin market. But now, this is one of the few years where all coins collectively are worth more than bitcoin.

You’ve said that a “God Protocol” will never dominate the cryptocurrency scene for long.

That’s right because we don’t have that anywhere in human life. There isn’t one language, one religion or one gender.

You’ve maintained that Cardano will “eliminate the middleman.” How so?

The concept of disintermediation is a big deal in the cryptocurrency space. We don’t like the idea that one person or a small group of people get to tell you how you should live your life. The whole point of these protocols is very libertarian. We put you in charge for better or worse. So, on the one hand, you’ve maximized personal freedom. On the other hand, if you lose your private keys you lose your money.

The big evil with the financial markets as they are today is that you don’t get to choose how a lot of stuff works. You don’t get to choose who’s in control, what regulations you’re under or what compliance regime you’re under. You’re just told this is the way it is.

I was moving a wire transfer from one of my bank accounts to another, and the compliance department froze it. I’m moving money from myself to myself, from one U.S.-regulated financial institution to another U.S.-regulated financial institution. I’m the ultimate beneficial owner of both accounts.

“What the fuck are you doing?” they said. “You have to answer a bunch of questions about compliance before we’ll let this happen.” And I say, “I’m sorry, but who owns the money here? This is my money. I’m not sending it to another person, but to myself.” I don’t want to live in that system, so that’s the point of our industry in general.

But then there’s the question of how you do that. We don’t live in a libertarian utopia. There are governments, there are checks and balances, and there are external people and actors. There are safety nets, in some cases to protect ourselves from ourselves. So, you need a system that extends beyond ourselves, but I should have a say in how that extension works.

That’s one of the reasons we built cardano. We wanted to create a new financial operating system for the world. We wanted to disintermediate what I call the middleman of necessity—not the middleman of value, but the middleman of necessity.

And if you can do those things, you’re transforming the marketplace in such a way that it’s much more efficient. It’s intrinsically global, and it’s inclusive instead of exclusive. And it’s fair that Bill Gates has the same experience as the farmer in Senegal. So then it’s all about merit—the good rise to the top.

Do you think libertarian principles will continue to underpin cryptocurrency as it becomes more commercial?

Well, everybody’s libertarian until an event happens, right? So I don’t really care about the ideological purity of Person X or Y. In this space, the protocols carry the ideology—not the people.

What makes crypto unique is that it is a synthetic law of physics. It’s synthetic gravity. It’s a synthetic, standard model. Once you set those physics, the world works that way. It’s consistent, even if it’s inconvenient to a particular actor, just like gravity has been very inconvenient to at least one skydiver and one mountain climber at least once in history. Gravity won’t change to accommodate anyone’s whims. Social systems make exceptions, but crypto doesn’t. And that’s what makes it special.

Ludwig von Mises is smiling right now. Thank you, Charles.