These Global Indices Set New All-Time Highs

Despite subpar global economic growth, the major market indices in Germany, France, India, Turkey and the United Kingdom have all set all-time highs in 2023.

The American stock market has been soaring higher in 2023—so far this year, the S&P 500 is up 14%, while the Nasdaq Composite is up 30%.

The rallies in the major U.S. indices have been so strong that the all-time closing highs of these key stock market indicators are now back on the radar. The S&P 500’s all-time closing high is 4,796, while the Nasdaq Composite’s is 16,057.

That means the S&P 500 and the Nasdaq Composite need to rally by about 10% and 18%, respectively, to get back to their previous peaks.

Interestingly, however, some key global stock markets have already crossed into all-time-high territory in 2023. Five of them count among the world’s 20 largest economies, including France’s CAC 40 Index, Germany’s DAX Index, India’s BSE Sensex Index, Turkey’s BIST 100 Index and the United Kingdom’s FTSE 100 Index.

In addition to those five key markets, Japan’s Nikkei 225 Index has also set a scorching pace in 2023. The Nikkei 225 is up roughly 31% year-to-date, and while it hasn’t yet surpassed its previous all-time closing high, it still deserves an honorable mention.

To learn more about the specific dynamics in each of the aforementioned indices, readers can check out the detailed information below.

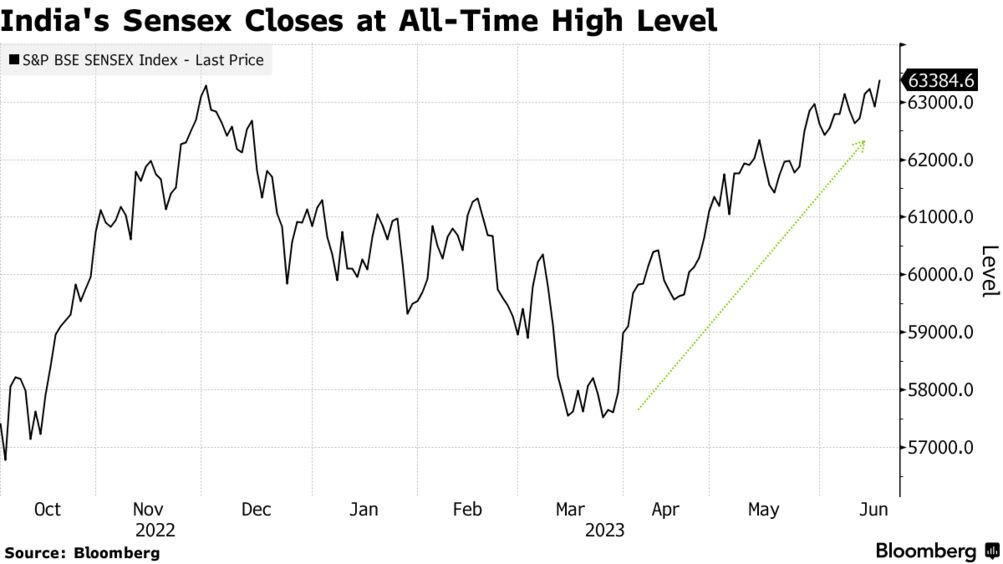

India’s BSE Sensex Index

One of the global markets that most recently set a fresh all-time high was India’s BSE Sensex, which notched its latest record on June 16.

India’s stock market was one of the lone outperformers in 2022, when most of the world’s best-known indices were overtaken by bearish sentiment.

The BSE Sensex set its previous all-time record high on Dec. 1, 2022 at 63,284. On June 16 of this year, the Sensex surged past that level and closed at 63,384.

The BSE Sensex is made up of 30 companies from the Bombay Stock Exchange (BSE). Much like in the U.S., the tech sector has been a key driver of recent gains in Indian shares.

Beyond that, other high-flyers in the Indian market hail from the following sectors: real estate, utilities, healthcare and basic materials.

One of the key reasons behind the current rally appears to stem from recent growth in the country’s gross domestic product (GDP). Like most countries, India’s GDP dipped during the COVID-19 pandemic, but it was one of the first to show signs of strength in 2021.

In 2020, India’s GDP was roughly $2.7 billion, but grew steadily in 2021 and 2022. Last year, India posted a GDP of roughly $3.2 billion, which was 18% higher than the level observed in 2020.

The fact that India is one of the largest countries on earth by population certainly doesn’t hurt the situation either. India is expected to surpass China as the world’s most populous country at some point in 2023, according to projections released by the United Nations.

Interestingly, India has now also become the world’s third-largest ecosystem for startups, hosting 100+ so-called “unicorns” with a combined value in excess of $350 billion.

Later this year, India will have a great chance to showcase its emergence as a global innovator when it hosts the 2023 G20 Leaders’ Summit for the first time in history.

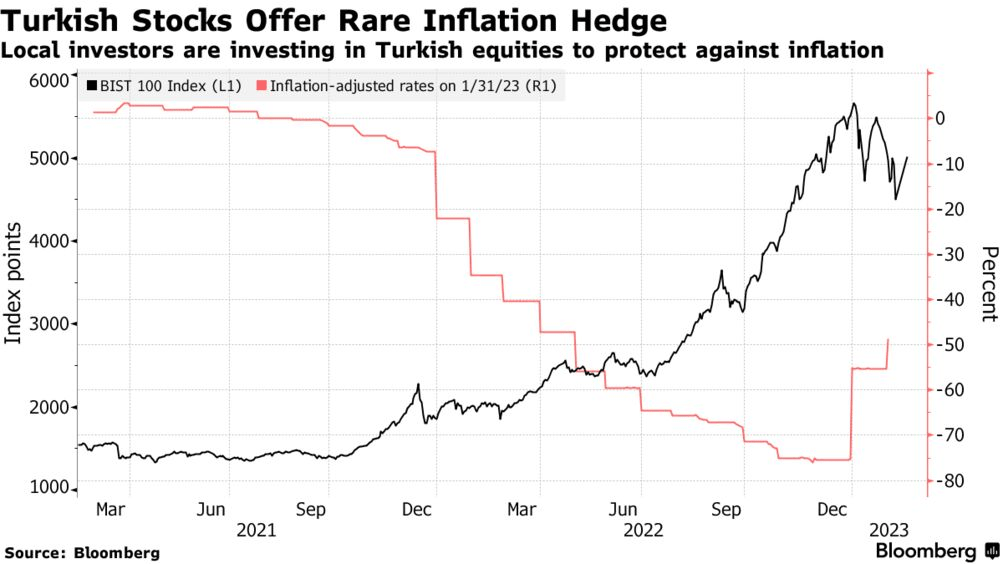

Turkey’s BIST 100 Index

Performance in the Turkish stock market has also been notable over the last year, but there’s a lot more to the story than just a fresh all-time high.

After suffering devastating earthquakes in early February this year, the country is still struggling to recover and is likewise battling rampant inflation. Today, inflation is reportedly running just under 40% in Turkey.

Even worse, the Turkish lira has been ravaged and is down nearly 80% over the last five years. A couple of years ago, roughly nine liras were enough to buy a single U.S. dollar, but that figure has now spiraled to nearly 24.

In an effort to protect their wealth from the slumping lira, many Turkish citizens have piled their savings into the Turkish stock market. As a result, the primary Turkish index—the BIST 100—set a fresh all-time high in early 2023 and is up more than 100% over the last 52 weeks.

In June of last year, the BIST 100 was trading at roughly 2,500, whereas today it trades at nearly 5,200. The all-time high in the BIST 100, which was set in early 2023, is closer to 5,700.

Many of the world’s leading central banks have been hiking interest rates to help combat inflation. Turkey, however, actually cut rates as recently as February—a tactic deployed to help boost lending in the aftermath of the earthquakes. However, that move has also arguably exacerbated the inflation problem.

These complicated dynamics make it difficult to predict how Turkish stocks could move going forward.

If inflation is finally reigned in—which would theoretically be a positive for the Turkish economy—that could actually trigger selling in the stock market, as Turkish citizens attempt to convert their stock holdings back into cash.

Germany’s DAX Index

Another global index that blew through its previous all-time high in 2023 is the German DAX.

The DAX notched a fresh all-time record high in May, climbing above 16,331, and is currently up about 14% on the year. As of June 21, the DAX trades at roughly 16,357.

The DAX consists of 40 stocks that trade on the Frankfurt Stock Exchange, including blue chip companies such as Adidas (ADDYY), Airbus (EADSY), Mercedes-Benz (MBGYY) and Volkswagen (VWAPY).

The DAX has actually rallied by almost 50% since 2018, but a good chunk of that was due to the fact that the index expanded from 30 stocks to 40 stock in 2021. The previous all-time high in the DAX was set in November 2021.

In 2023, optimism in the DAX appears to stem from improved retail spending figures, which suggests the Eurozone may be emerging from the economic slowdown observed in the last two quarters. The Eurozone economy shrunk by 0.1% in Q1 2023.

The European Central Bank raised benchmark rates again on June 15 from 3.25% to 3.50%, which may help explain why the DAX has recently slowed down.

However, rates in the Eurozone are still well below those in the United States, which are closer to 5.50%. This slight discrepancy may help explain why stocks in the Eurozone started 2023 on stronger footing than those in the U.S.

France’s CAC 40 Index

Like the DAX, France’s CAC 40 Index also hit a fresh all-time high in 2023. That occurred back in April when the CAC 40 closed above 7,500.

In Q1, the rally in French stocks was attributed to the reopening of China, which triggered increased demand for French luxury goods. The CAC 40 is up roughly 10% in 2023, and almost 30% since hitting its 52-week low back in September 2022.

Unfortunately, as the recovery in China has petered out, so has the rally in the CAC 40. Since April, the CAC 40 has traded mostly sideways, and recently closed at roughly 7,260. That’s about 3% lower than the all-time high observed in April.

Some of the highest-quality and best-known consumer brands hail from France, including Hermes (HESAF), L’Oréal (LRLCY), LVMH (LVMUY) and Michelin (MGDDY). Those four companies are included in the CAC 40, along with other well-known brands such as Carrefour (CRERF), Danone (DANOY) and Renault (RNLSY).

As with the DAX Index, the recent rate hike by the European Central Bank may be weighing on optimism. Going forward, the fortunes of the CAC 40 may hinge on whether the stimulus measures currently being deployed in China will help rejuvenate the world economy.

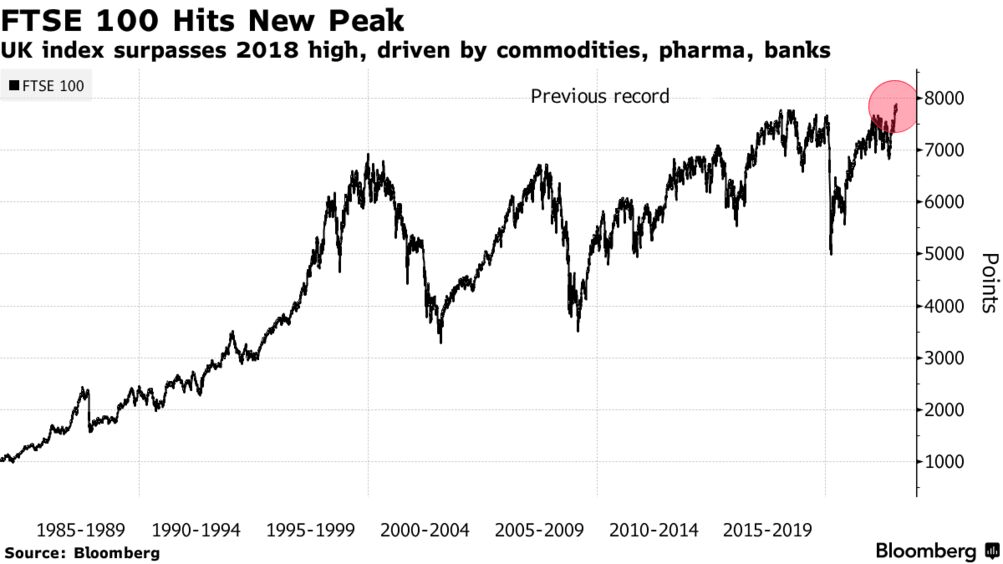

United Kingdom’s FTSE 100 Index

Like its counterparts in France and Germany, the UK’s FTSE 100 also set a fresh all-time high earlier in 2023.

That occurred back in February, when the FTSE 100, referred to as the “Footsie,” climbed above 8,000. The previous all-time high in the Footsie was set back in May 2018 at roughly 7,900.

However, since setting that all-time high, the Footsie has also mostly retraced and is now sitting at 7,550.

The FTSE 100 is comprised of the 101 largest companies by market capitalization listed on the London Stock Exchange. However, the FTSE 100 isn’t necessarily representative of the domestic economy in the UK, because many of the companies in the Footsie are internationally-focused.

The FTSE 100 also doesn’t offer much when it comes to the technology sector, which is why many have criticized it for being too representative of the “old world” economy. For context, there are 74 technology stocks in the S&P 500, while only seven stocks in the FTSE 100 hail from the tech sector.

Several of the highest-capitalized companies in the FSTE include the internationally-focused AstraZeneca (AZN), Shell PLC (SHEL), Unilever PLC (UL), Diageo PLC (DGE) and HSBC Holdings (HSBC).

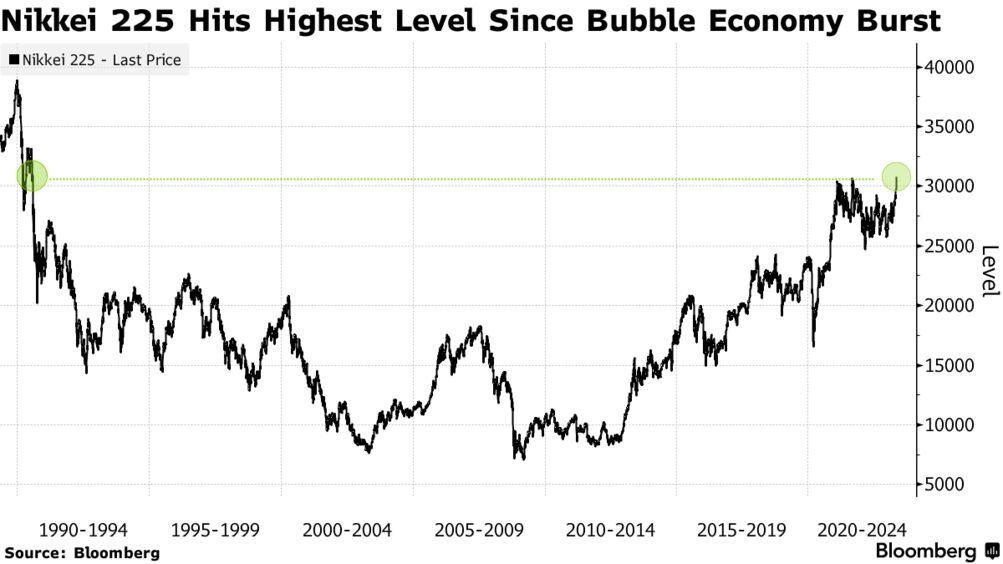

Japan’s Nikkei 225 Index

Japan’s Nikkei 225 Index hasn’t set a new all-time closing high in 2023—at least not yet. But in early June, the index did notch its highest close in 33 years when it crossed above 32,000.

Moreover, the Nikkei 225 has also been one of the best-performing international indices in 2023, rising by 13% year-to-date, which is on pace with the Nasdaq Composite. Today the Nikkei 225 trades for about 33,500.

The Nikkei’s all-time closing high is 38,915, which was set all the way back in December of 1989.

In 2023, momentum in the Japanese market appears to have been assisted by a huge influx of foreign capital. Warren Buffett started increasing his exposure to Japanese stocks back in 2020, and has reportedly added to those positions in 2022 and 2023.

Buffett personally traveled to Japan earlier this year, which appears to have catalyzed increased investor interest in the territory. Foreign-owned investments in Japan are now sitting at some of the highest levels on record, which is another reason the Nikkei 225 belongs on this list.

It appears that Japan has also benefited from growing investor trepidation over Chinese investments, due to rising tensions between the U.S. and China.

That’s clearly reflected in the respective performance of Chinese stocks as compared to Japanese stocks. The Shanghai Composite is up only 4% so far this year, while the Hang Seng index in Hong Kong is actually down nearly 5% on the year.

It should be noted that South Korea’s KOSPI index is also up roughly 17% in 2023, but is still trading well short of its all-time high. The KOSPI peaked above 3,300 in June of 2021 and currently trades closer to 2,600.

For more background on trading global stock markets, check out this episode of Options Jive on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.