Trades

12 of the Most Boring Stocks

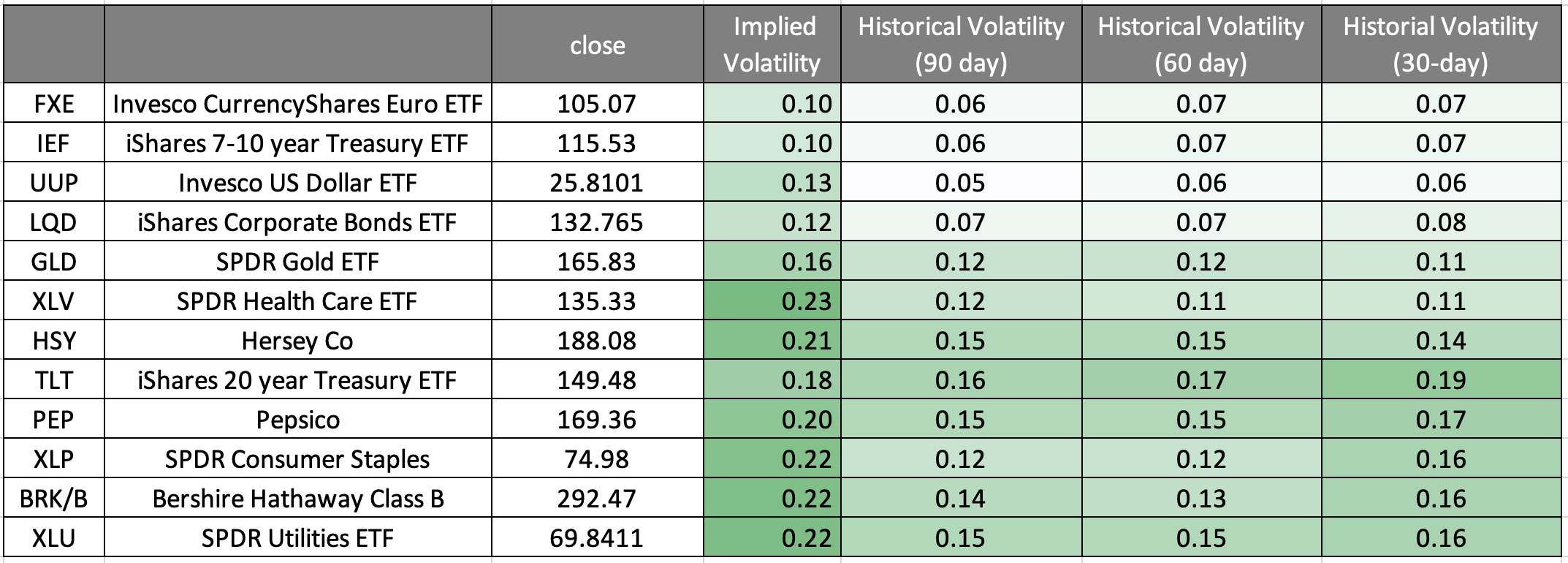

Traders are not a monolithic group. Some have a high risk tolerance, while others are more risk averse. Those with higher risk tolerance would probably prefer to trade TSLA, while those that are more risk averse would lean toward XLU.

Here are 12 of the most “boring” stocks and ETFs as measured by a combination of historical and implied volatility. All have options, so it is possible to reduce theoretical risk by selling calls against positions held.

Historical Volatility is simply a measure of how much the stock has moved with respect to price. This is different from Implied Volatility which is a measure of how much the stock is expected to move with respect to move going forward.

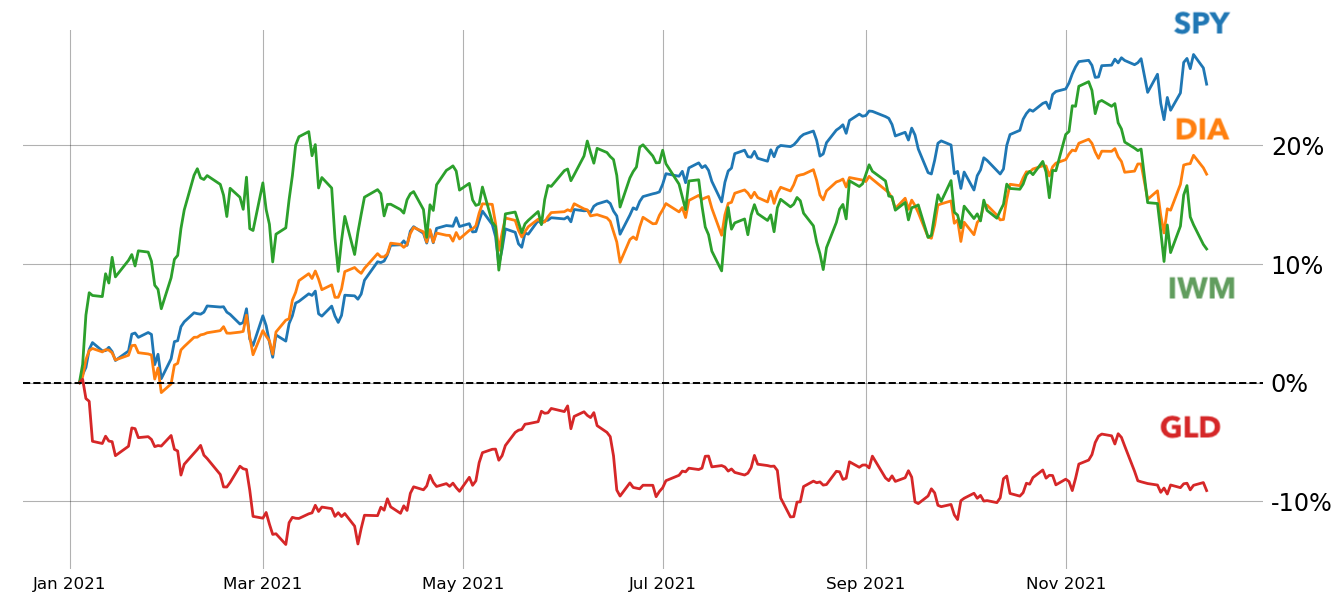

2021 so far

Here are the ETFs returns for the S&P 500, Dow Jones, Russell 2000 and Gold from the beginning of the year to now.

The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique insights from the geekiest of geeks. Conquer the market with confidence … get Cherry Picks today!

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Research and Development at tastytrade; and James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade.

Cherry Picks

-

The Diversification Myth

|Buying a wider variety of stocks won’t decrease risk much if their prices are closely correlated -

Fundamental Intelligence

|Getting smart about these AI stocks begins with an understanding of the basics Be smart picking stocks in the artificial intelligence sector by considering the fundamentals of 12… -

Good Pharma Karma

|The healthcare sector is set to contribute to your bottom line The market downturn has been kind to the healthcare sector. The S&P 500 (SPY) dropped 16% since the beginning… -

Affordable Futures

|Retail investors can use new smaller futures contracts to hedge their portfolio bets Hedge fund managers and other big investors have been using futures to reduce risk for years, but… -

Six Traders, Six Trades

|A trading committee offers long- and short-term strategies for the new year Tony “BAT” Battista Bullish investors looking to take a long-term view could consider a very wide broken wing… -

2 Trades for the Cautious Gold Bug

|Here’s how investors can make money from the glittering precious metal, even when it’s declining in value Many in the financial world think of gold as a safe investment and… -

Home in on Cyclical Stocks

|Use a counter position to take advantage of the volatility of equities that move with the market -

The Blunt Truth About Pot Stocks

|Cannabis-related stock prices are falling as the nation awaits federal decriminalization After the 2020 U.S. presidential election, cannabis stocks reached new highs as the nation waited for President Joe Biden… -

6 Looks at Energy Stocks

|Crude oil prices of more than $100 a barrel are boosting stock prices in the petroleum sector, but the effect on the S&P 500 is limited because the commodity accounts… -

Futures Notional Values, the Crude Oil Curve and Current Index Skew

|Current Futures Notional Values Below are the current notional values for popular futures contracts. We also included their ETF approximate share equivalence, as well as their correlations to the ETFs.… -

Drawdowns, Data Sources and Trades Ideas

|What kind of drawdowns can be expected if you bought at the absolute worst time every month? Here are the 30-day drawdowns, over the past five years, of buying at… -

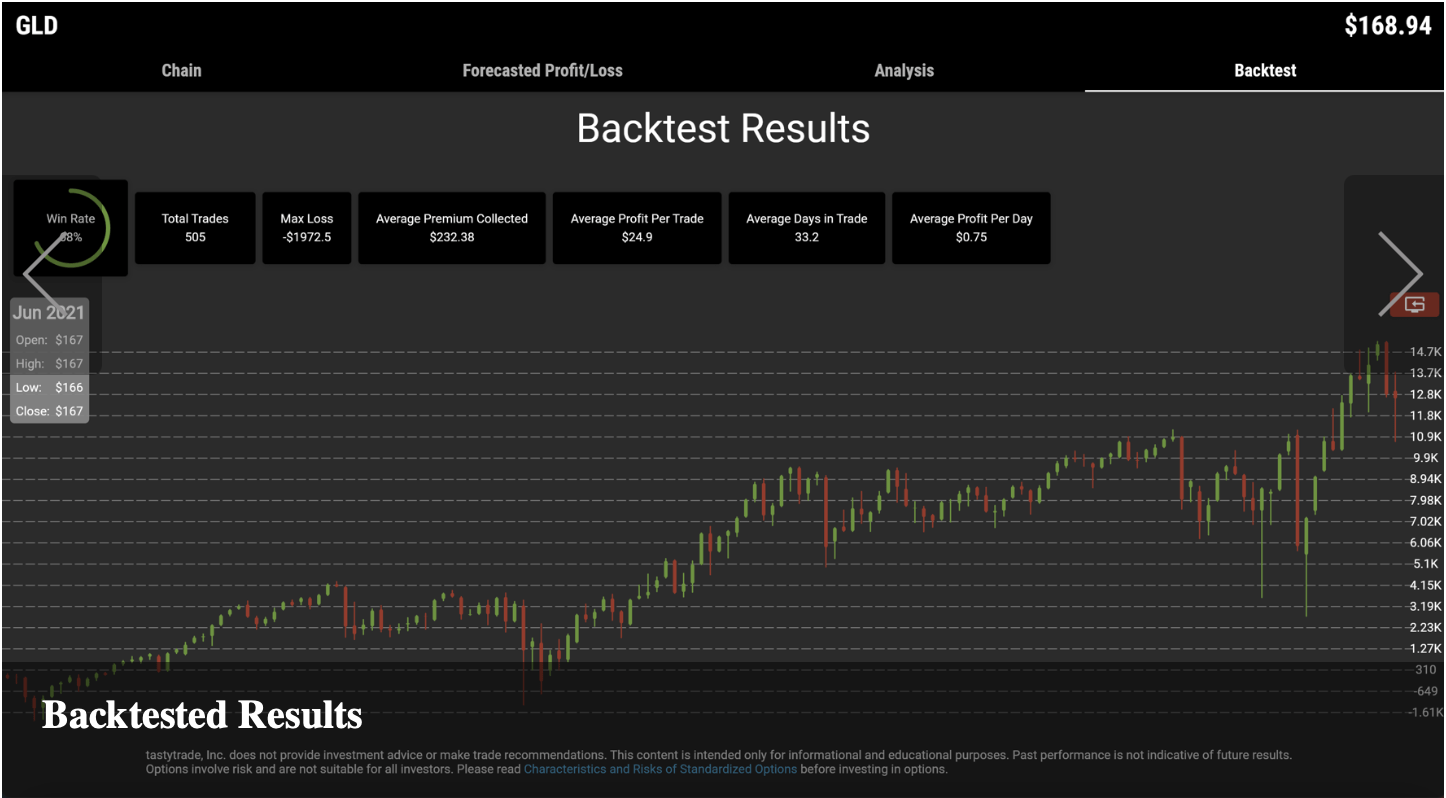

Backtest and Forward Test with Lookback

|See how a strategy performs before risking money on a trade Lookback, a free options analysis tool from tastytrade, provides two ways of examining the profit and loss around an… -

Correlations, Volatilities and Meta

|If you like X, you might also like A, B and C Take a look at the three most correlated stocks for every stock in the Nasdaq 100. We are… -

Historical Volatility and Implied Volatility

|Free Download – Historical Volatility and Implied Volatility In this morning’s Cherry Picks, we are providing a free download of approximately 1,100 stocks and ETFs along with their historical and… -

The One with All the Earnings

|Earning Season, Birds of a Feather Flock Together Earning Season “officially” begins with the big banks. See the graphic below that shows the number of sectors that report per day.… -

Yields, S&P Sector Performance and Earnings

|Yields on the Move With all the discussion of yields in the news lately, it is nice to see what’s moving. As seen on the graphic below, most of the… -

Seeking Diversity

|Rather than seeking to predict the next big thing, consider buying any of these 20 tickers to diversify a portfolio in the new year When all of the stocks and… -

What’s going on with the market?

|Take a look at the major indices (SPY, IWM, QQQ) and the equity sectors. Discretionary (XLY) is down the most over the past month, while Health Care (XLV), Real Estate…