Cardano Rising

Is cardano the next ethereum? Smart people continue to point to the integration of their own smart contract development.

Let’s look at the hype surrounding what they’ve built behind the scenes.

While the massive base in price has attracted the attention of technical analysts, cardano’s protocols can drive demand in a way similar to ethereum and to a lesser degree solana, polkadot and cosmos.

Cardano plans to launch its Alonzo update soon. That will enable developers to build their own programs on the network.

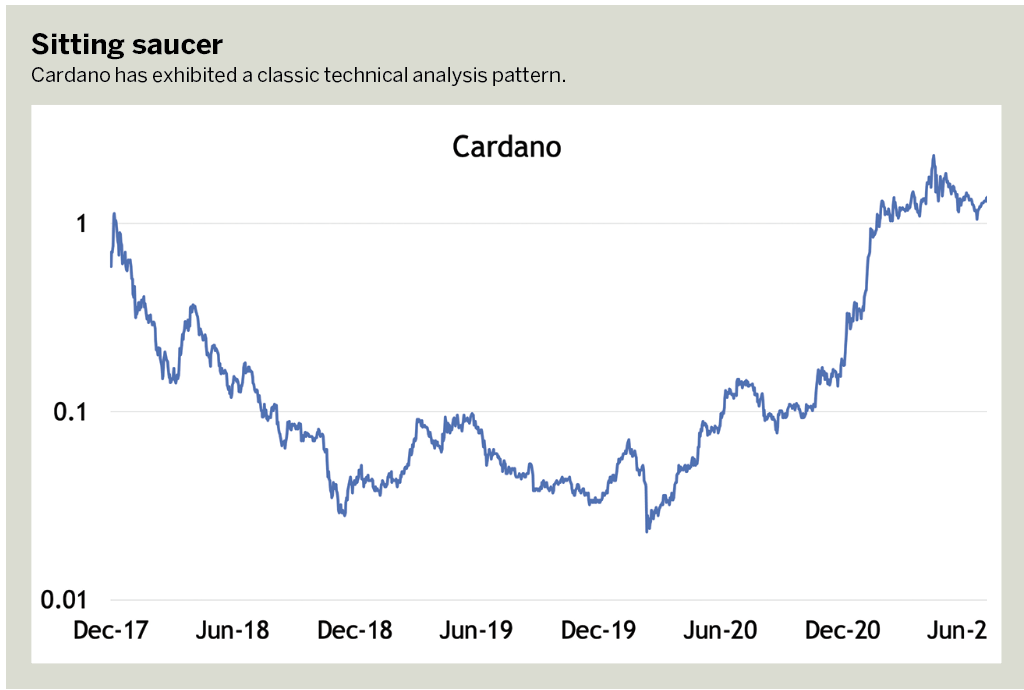

But stories aside, it’s only price that pays, right? The only way to make money in this market—or any market—is to sell it at a price higher than where it was bought. And in the case of cardano, this classic pattern deserves attention.

Back in the 1940s, technical analysts Robert Edwards & John Magee would call this a saucer bottom. (See “Sitting saucer,” above). The kids these days like to refer to it as a “Kardashian bottom.”

The rule of thumb from technical analysts Louise Yamada and Alan Shaw goes like this: “The bigger the base, the higher in space,” meaning that the longer the period of accumulation, the more explosive the eventual move becomes once the pattern is completed.

Accumulation takes time, particularly from the largest players. The chart above shows exactly that.

There’s a similar pattern in gold, although it has yet to break out. In the case of cardano, those former highs in 2018 were around $1.40. So, traders should be long only if cardano is above $1.40, and they should avoid exposure if it’s below that.

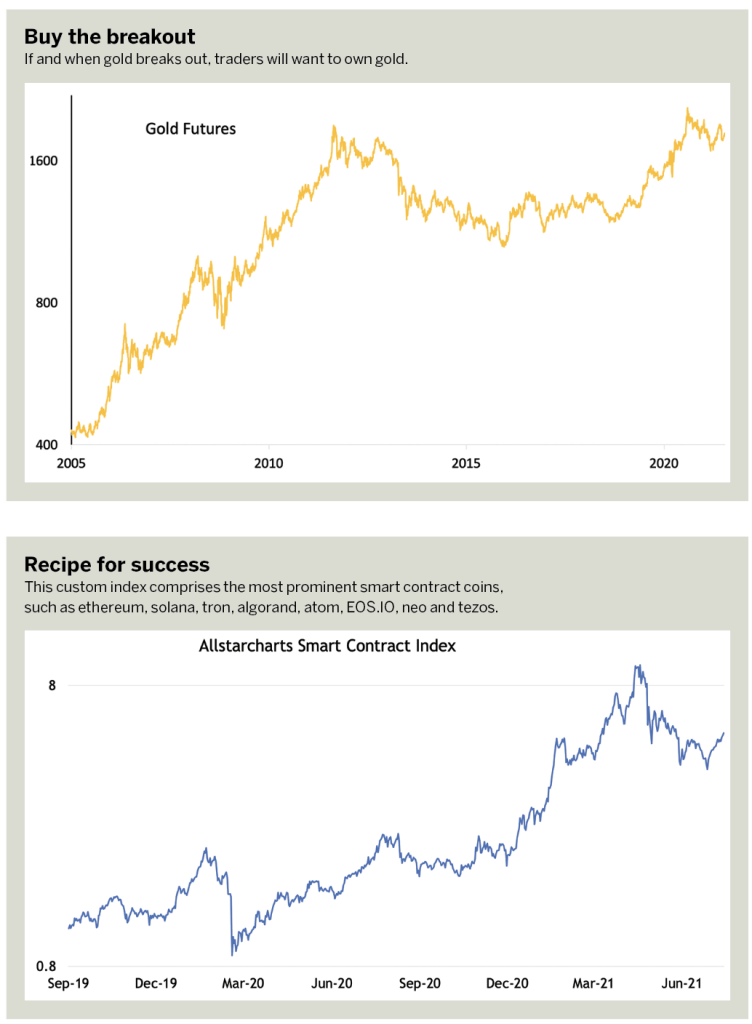

In the case of gold, it’s the same idea. The 2011 all-time highs were just under 2,000. If it’s below that, then traders should want no part of it. But ultimately, if and when gold breaks out, like cardano is attempting in August, then they’ll want to own gold. (See “Buy the breakout,” below.)

In the meantime, traders should want to own assets that have completed these accumulation periods. And cardano is at the top of that list.

Market speculation is a weight-of-the-evidence game. Traders should position themselves for the highest probability of success.

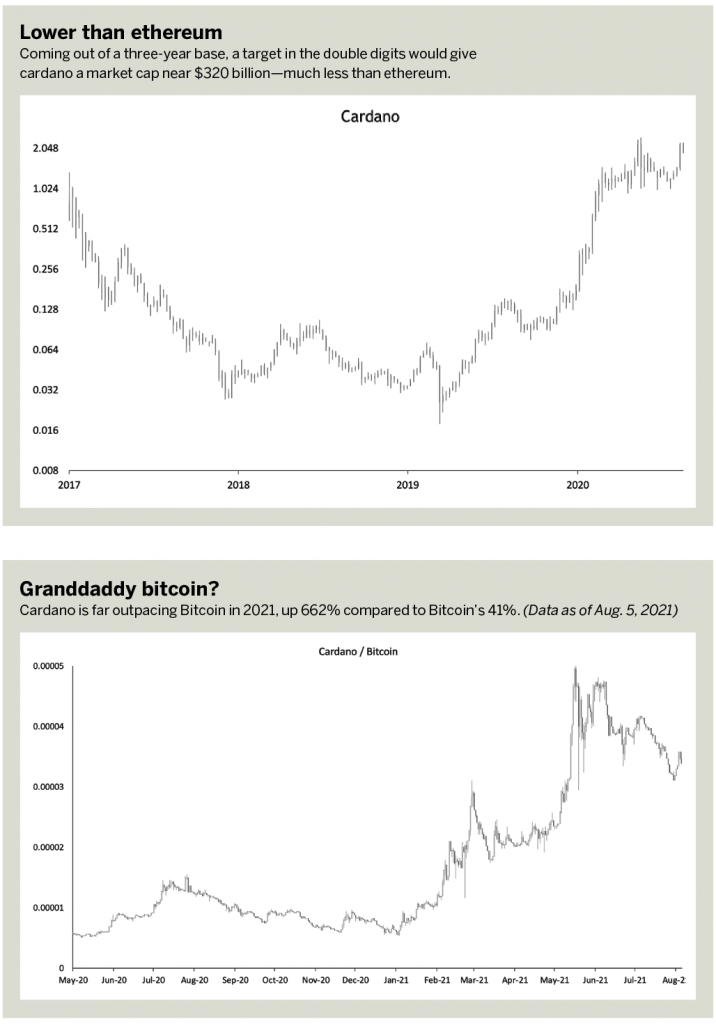

So, when buying cardano, look around and see what others in the group are doing. A chart shows this is not just a cardano story. There’s strength in the entire group. (See “Recipe for Success,” below).

This custom index is composed of the most prominent smart contract coins like ethereum (ETH), solana (SOL), tron (TRX), algorand (ALGO), atom (ATOM), EOS.IO (EOS), neo (NEO) and tezos (XTZ).

The weight of the evidence is pointing up.

But take this one step further. For cardano bulls, seeing some outperformance over ethereum would be incredibly constructive.

That hadn’t happened at press time, but that may turn and thus confirm the new leadership emerging in cardano.

How high can prices go?

With a three-year base like this completed, a $10 target isn’t far-fetched. Granted, an analyst would still have to take out those former highs from earlier in the year, and $10 is a long way. But coming out of a three-year base, a target in the double digits would give cardano a market cap near $320 billion—much less than ethereum’s nearly $400 billion market cap (See “Lower than Ethereum, below.)

Broadening even more, compare cardano with the granddaddy of them all, bitcoin. If cardano is going to start a period of outperformance, this would be a logical area for that to occur.

Viewing it from the point of view of the Fibonacci extension level, a tool traders can use to calculate how much prices may change, it has bounced at 261.8% from the 2020 consolidation.

The stars are aligning for this one.

Breaking out on an absolute basis? Check.

Outperforming bitcoin? Check.

The risk versus reward ratio is in traders’ favor? Check.

That last one factor is the most important of all. Traders must always be able to answer one question: Where are we wrong?

That gets left out too often.

It’s not about being right—it’s about making money. It doesn’t matter how high traders think it can go or how much money they think they can make. It’s about how quickly they can learn they are wrong so they can move on to something else.

And in the case of cardano, that level is $1.40.

Traders want to be long this name only if they’re above those late 2017 and early 2018 highs. If not, then they cannot make the argument that they are completing this massive base.

In fact, if it’s below $1.40 that means this (potential) accumulation period is still underway.

How high it can go is anyone’s guess. The next Fibonacci extension levels calculated from that last cycle peak are $2.25, $3.65, $5.90 and $9.55.

So, it’s a stair-step higher situation that can take it to each of those targets and beyond.

Again, traders can knock off all of the targets and still be substantially smaller than ethereum is at

this writing.

The reward potential is exponential. The risk is well-defined. The trend is up. That’s what matters most.

JC Parets founded All Star Charts, a research platform covering stocks, interest rates, commodities and forex

for institutional and retail investors. @allstarcharts.