2 Trades for the Cautious Gold Bug

Here’s how investors can make money from the glittering precious metal, even when it’s declining in value

Many in the financial world think of gold as a safe investment and a counter to the overall stock market. But as equities decline and the economy shows signs of weakness, gold isn’t increasing in price.

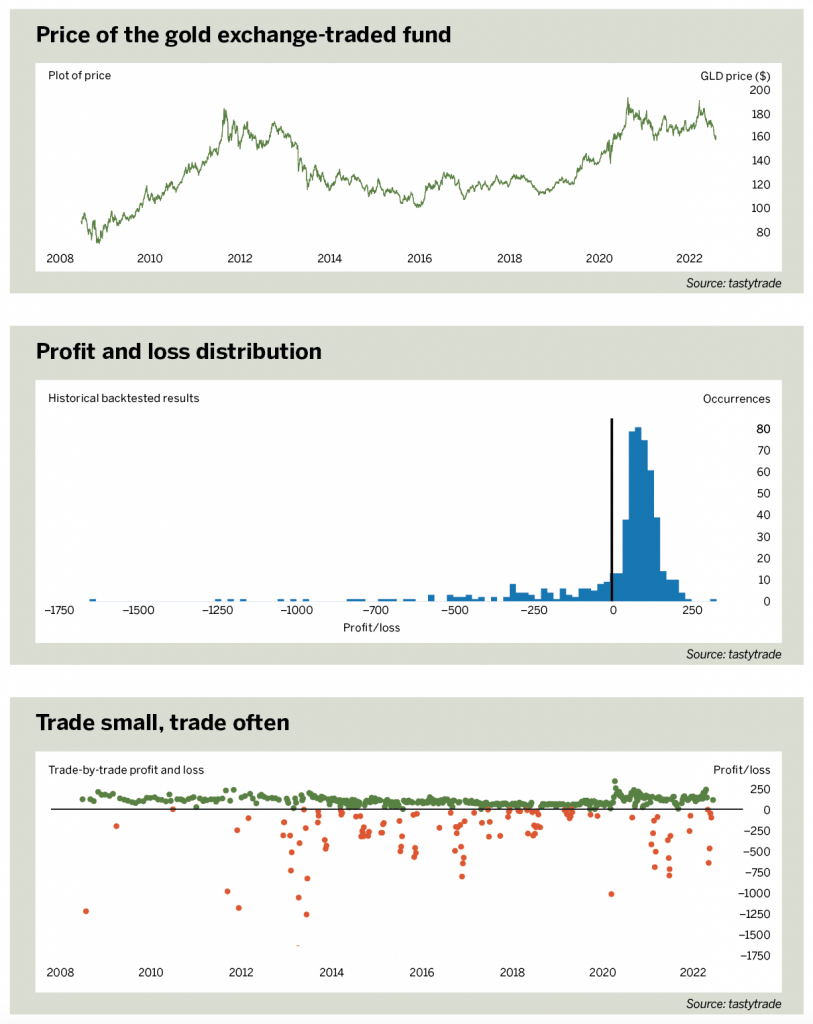

Instead, it’s doing the opposite. Since April, the price of the S&P 500 and the price of the Gold Exchange-Traded Fund (GLD) have both declined by 15%.

That makes it tough being a gold bug—bullishness may have turned to cautiously optimistic bullishness.

But investors who still want to be long gold might consider two strategies that can make money when the price is bullish, neutral or decreasing only slightly.

The first strategy

Using a short put is a bullish strategy but provides downside protection in case one is wrong about the direction of the underlying stock. It even made money when the price of gold declined between 2012 and 2016.

Consider the following strategy:

Sell 1x put in GLD using the closest monthly expiration 30 days away.

Choose the strike closest to 30 deltas.

Over the past 15 years, a bullish short put has been profitable 79% of all months. The distribution of the profit and loss shows losses can be large but still manageable.

Here are the results over the years, with each dot representing a different trade:

– Largest profit was $332 in March 2020.

– Worst loss was -$1,656 in March 2013.

– Median profit/loss was $79.

– Average profit/loss was $13.

The second strategy

The skewed strangle in GLD:

Sell 1x put in GLD using the closest monthly expiration 30 days away. Sell the strike closest to 30 deltas.

Sell 1x call in GLD using the same month. Sell the strike closest to 10 deltas.

It’s “skewed” because it’s a slightly bullish trade. If it goes up or down too much, it loses money. Selling the call brings in money that can protect against a larger-than-expected move to the downside.

Here are the results. Note the largest loss is slightly smaller than the most significant loss from the first strategy, which called for placing only the short put. Usually, short strangles have larger losses than a single position alone, but that’s not what happens when backtesting this strategy:

– Percentage of profitable trades was 75%.

– The largest profit was $368 in March 2020.

– Worst loss was -$1,621 in March 2013.

– The median profit/loss was $100.

– The average profit/loss was $24.

Michael Rechenthin, Ph.D., aka “Dr. Data,” heads research and development at tastytrade and is the lead developer of the free backtesting software at tastytrade.com/backtest. @mrechenthin