Highly Liquid Media Stocks

Ripe & juicy trade ideas

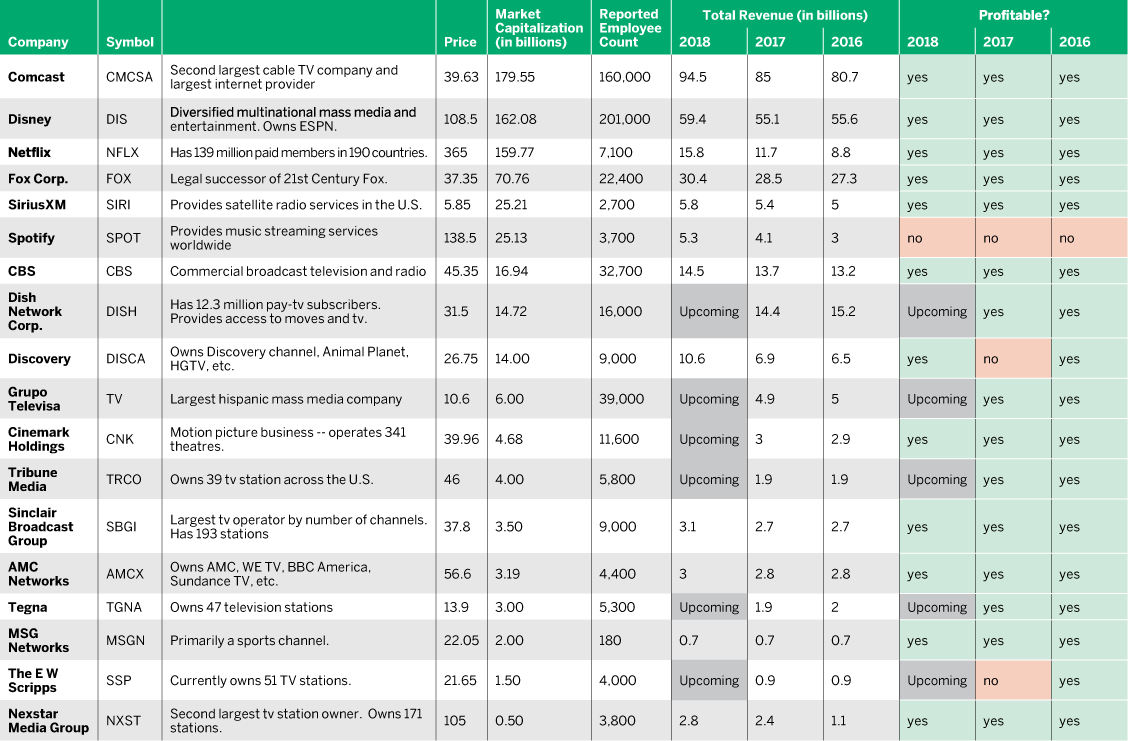

Technology, evolution and acquisitions are rearranging the geography of American media companies. Let’s catch up with the some of the changes by examining the numbers for market capitalization, profits and number of employees.

Technology, evolution and acquisitions are rearranging the geography of American media companies. Let’s catch up with the some of the changes by examining the numbers for market capitalization, profits and number of employees.

By the numbers

Investors can get to know companies by comparing market cap, profits and number of employees.

Sorted by market capitalization, three companies stand out – Comcast (CMCSA), Disney (DIS) and Netflix (NFLX). All have market capitalization of more than $160 billion. But market cap doesn’t tell the whole story of those companies. Disney rakes in four times as much revenue as Netflix and employs 28 times as many workers.

Meanwhile, Comcast is pulling down annual revenue of nearly $100 billion. Netflix and Spotify (SPOT) have both nearly doubled revenue over three years – but Netflix is profitable and Spotify has yet to turn a profit. That makes Spotify a more speculative trade – management still has yet to figure out a structure that works. Investors might want to avoid Spotify because there’s too much uncertainty.

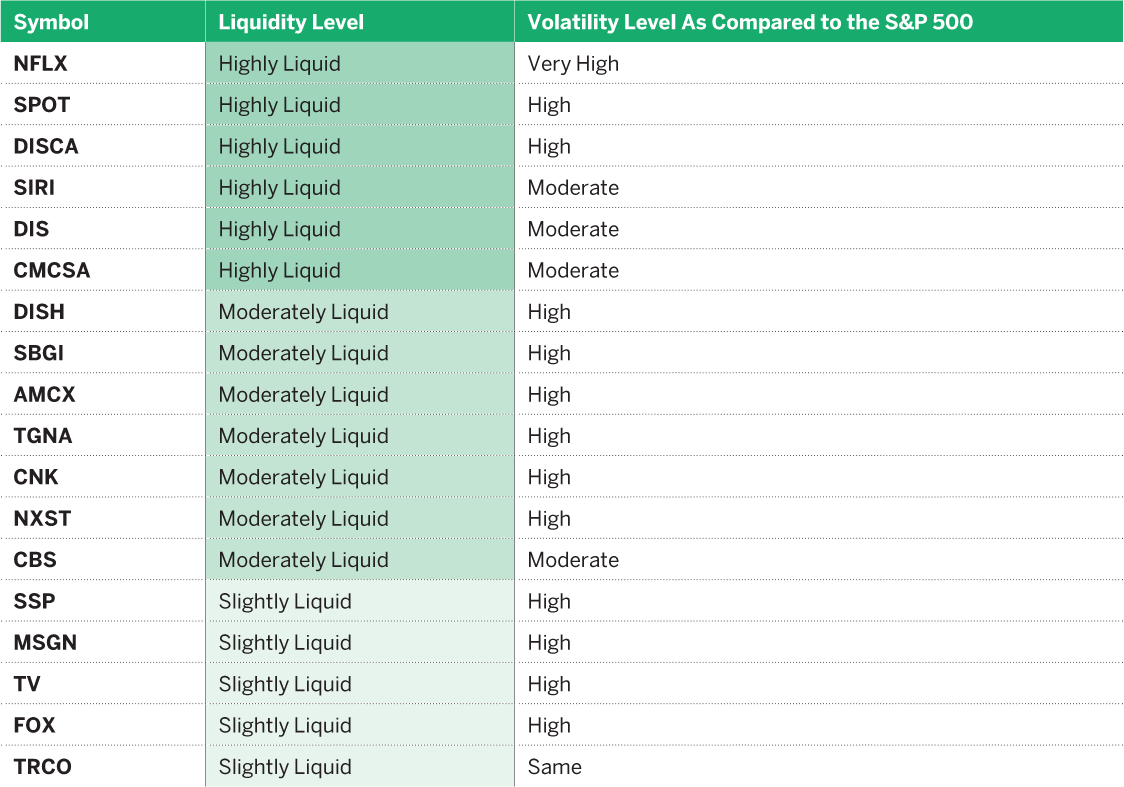

Lastly, what stocks have liquid option markets? Options, particularly sold short, can provide more opportunity for investors because they can theoretically get the direction wrong and still make money on the credit received.

In the list to the right, investors would do well to stick with the “highly liquid” stocks – Netflix, Spotify, Discovery Communications (DISCA), Sirius XM Holdings (SIRI), Disney and Comcast.

Liquid Refreshments

Stick with the highly liquid stocks.

Media Trade Ideas Using Options

Bearish NFLX (1:1) Short the first out-of-the-money call and long the 2nd out-of- the-money call. 50% probability of profit

Bullish DISCA Short the first out-of- the-money put, which will be below the market. With the credit received, a higher probability of success. The credit + maximum profit potential

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade.