Straddle Up

When you’re expecting a big price move but aren’t certain of the direction

Implied volatility is one of the most useful metrics to consider when looking at a stock’s movement. Symbols with higher implied volatility have higher expected movements, and higher expected movements translate into more expensive options prices.

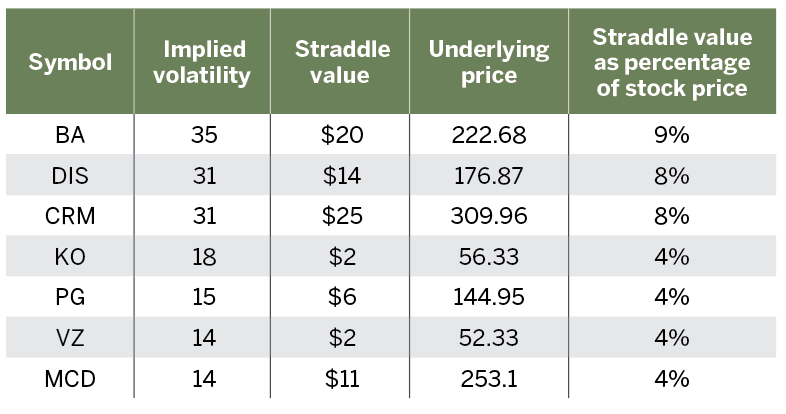

For a real-world example of the relationship between implied volatility and the cost of options, check out the table to the right. As a reminder, a straddle is an at-the-money call and put. The options in this example expire 1-1/2 months away.

The price of a straddle in Boeing (BA) is approximately 9% of the price of the company’s stock. Traders who think Boeing will move less than this would sell the straddle and capture the credit. Those who expect the price to move more than 9% would buy the straddle for a debit. Notice that as the implied volatility increases, so does the cost of the straddle as a percentage of the underlying costs.

Some major takeaways emerge. First, as the implied volatility increases, the value of the option increases. A stock with an implied volatility of 15 will have a straddle that costs roughly half as much as one with a value of 30.

Second, the market is pricing low movement in Coca-Cola (KO), Proctor & Gamble (PG), Verizon (VZ) and McDonald’s (MCD) as judged by the lower values of the straddles, and higher movement in Boeing, Disney (DIS) and Salesforce (CRM) as seen by the higher prices of the straddles as a percentage of the underlying prices.

As long as the market does not move up or down in price, the short straddle trader is perfectly fine. The optimum profitable scenario involves the erosion of both the time value and the intrinsic value of the put and call options.

The straddle

Traders can execute a neutral options strategy called a straddle by selling both a put option and a call option for the underlying security with the same strike price and the same expiration date.

Use a straddle when high volatility is combined with uncertainty in the price movement. It’s best to use a straddle with an option that has a long time to expiration.

Michael Rechenthin, Ph.D. (aka “Dr. Data”) heads research and development at tastytrade. @mrechenthin