Bitcoin’s Perfect Storm of Good Fortune

New exchanges could inundate the cryptocurrency with cash

Bitcoin, the world’s leading cryptocurrency, dodging regulatory problems and benefitting from a recent court ruling on exchange-traded funds.

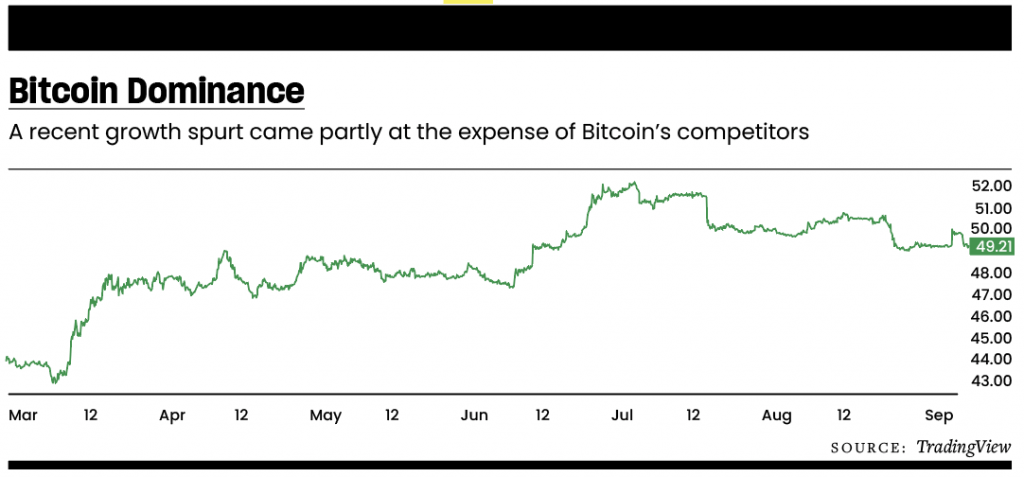

Moreover, the “Bitcoin dominance ratio” was above 47% by press time—meaning the cryptocurrency accounted for close to half of the $1.05 trillion market capitalization of all cryptocurrencies combined.

A recent growth spurt came partly at the expense of Bitcoin’s competitors. Investors view moving funds to Bitcoin (BTC) as a “flight to safety” because the Securities and Exchange Commission (SEC) has filed lawsuits against Binance and Coinbase.

The SEC accuses both of offering cryptocurrencies defined as securities while not operating as registered securities exchanges. Bitcoin remains “safe” from classification as a security and has therefore been outperforming “security ambiguous” coins.

The specter of SEC lawsuits aside, a lot has been going on with Bitcoin and the broader crypto market over the past few months. We’ll bring you up to speed.

Bitcoin spot ETFs

On Aug. 29, the U.S. Court of Appeals for the D.C. Circuit cleared a path for a spot Bitcoin ETF run by Grayscale Investments. The landmark ruling requires the SEC to reconsider the digital asset manager Grayscale’s application for a spot Bitcoin ETF.

Grayscale sued the SEC in 2022 when the agency rejected the firm’s bid for a spot Bitcoin ETF. Grayscale has attempted in vain to convert its GBTC “trust” into a spot Bitcoin ETF for a long time.

The ruling may be a watershed moment for other companies with pending spot Bitcoin applications, including BlackRock (BLK), Bitwise (BITW), VanEck ETF, WisdomTree (WT), Fidelity (FNF) and Invesco (IVZ).

On the tail of this news, Bitcoin rallied ~8%, closing near the $28,000 level on Aug. 29. But the optimism was short lived—Bitcoin has since retreated to just under $26,000.

EDX markets

Another catalyst for the recent Bitcoin surge relates to the June 20 launch of EDX markets, a custodial cryptocurrency exchange backed by the likes of Charles Schwab, (SCHW) Citadel Securities, Fidelity Digital Assets and other TradFi (traditional finance) giants.

EDX Markets currently offers only four digital assets:

• Bitcoin (BTC)

• Bitcoin Cash (BCH)

• Ether (ETH)

• Litecoin (LTC)

Why did EDX choose to provide liquidity for only four coins when other exchanges, such as Coinbase, offer hundreds of cryptocurrencies?

Because they’re playing it safe.

The launch of EDX Markets was announced just days after the SEC slapped the aforementioned lawsuits on Coinbase and Binance for offering unregistered securities to the public.

Of the four cryptos offered by EDX, only Ether could potentially be considered a security. But even SEC Chair Gary Gensler isn’t sure of Ether’s security status. He refused to answer when asked about it at a Congressional hearing.

EDX Markets may become TradFi’s gateway into cryptocurrency. Because the exchange will only offer four coins, the coins are well positioned for institutional adoption. Bitcoin Cash alone tripled in value in the days following the announcement.

Until there’s regulatory clarity—or a new crypto regulatory body—many expect Bitcoin’s relative outperformance of the broader crypto market to persist.

XRP ruling

On July 13, Ripple Labs, the team behind the crypto XRP, defeated the SEC in a landmark court case. The ruling stated that the sale of XRP to the public did not constitute a security offering. Immediately following the announcement, the broader crypto market rallied.

But Bitcoin did not perform as well as its peers on this news. Bitcoin dominance fell 2% immediately. And the court’s decision was positive news for the larger crypto market, akin to a tide that lifts all boats.

The recent optimism in the crypto world, coupled with easing inflation and bullish stock market sentiment, could position Bitcoin well for the rest of 2023. Barring unforeseen economic developments and forward progress with spot Bitcoin ETF applications, Bitcoin may soon become untethered to its sticky $25,000 to $30,000 price range and find a new home between $35,000 and $40,000.

Mike Martin, head of content for tastycrypto, has more than 15 years of experience in the investing and trading industry.

Subscribe for free at getluckbox.com.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.