Digging Gold

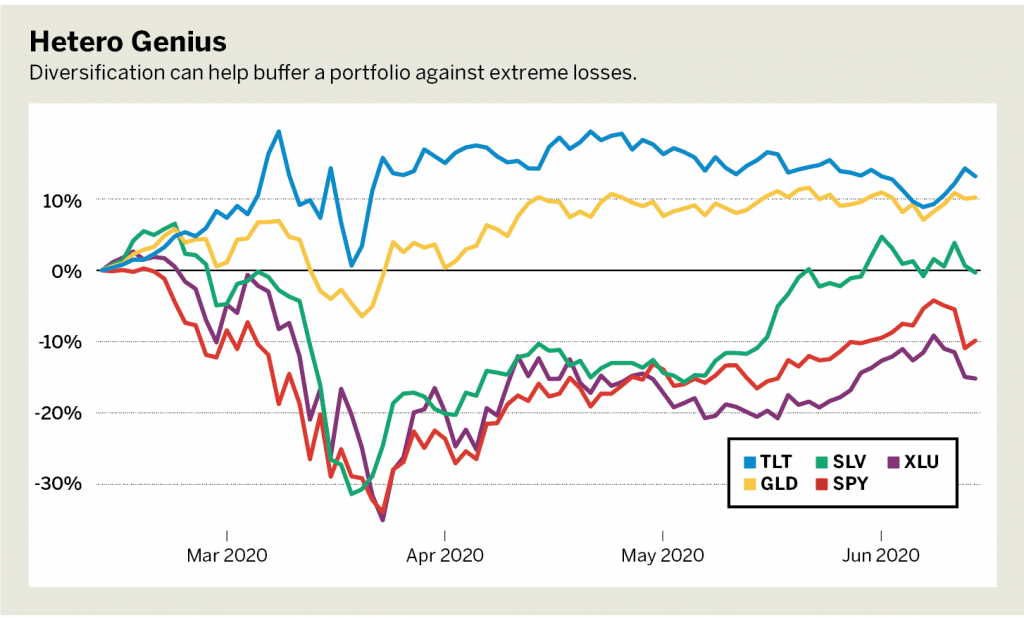

When the markets are in turmoil, money tends to flow out of stocks and into “safer” investments. The market’s definition of “safe” changes, but when stocks declined in March, money went into bonds and gold. The results? Let’s look at how diversification played out during the height of the turmoil.

Gold has a history of providing safety, and while precious metals no longer back currencies, the perception of their value remains powerful. (See “Hetero Genius,” below.)

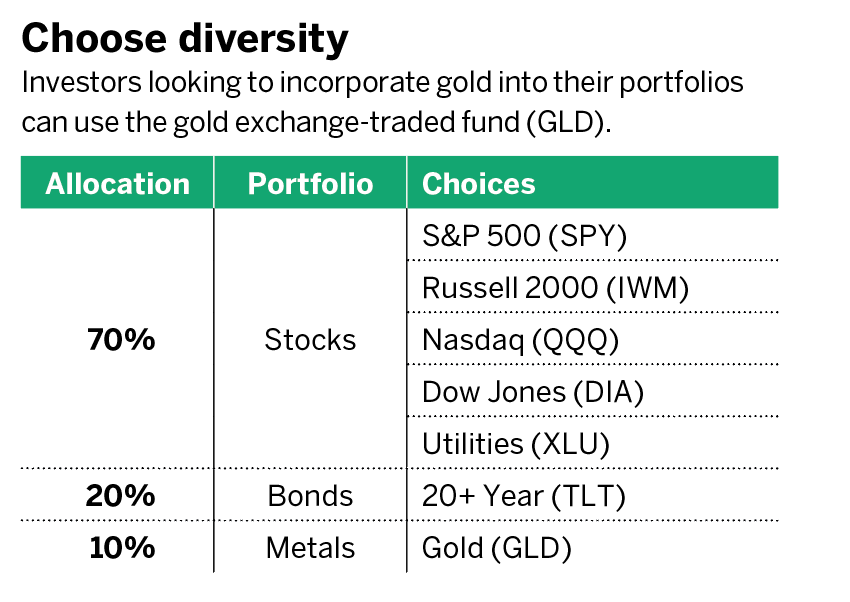

Traders looking to include gold in their portfolios can use the gold exchange-traded fund (ETF) GLD. Don’t confuse gold with “the poor person’s gold,” aka silver. Market crashes almost always see declines in silver, which normally has strong correlations with gold, but its correlation breaks apart when stocks decline. Even though silver doesn’t often carry the flight-to-safety title, it can be traded easily with the symbol SLV. (See “Choose diversity,” below.)

When stocks declined in March, bonds and Treasuries rose. The 20+ year bond ETF TLT increased by 20% when stocks declined by 20%. Rates came down as bonds went up.

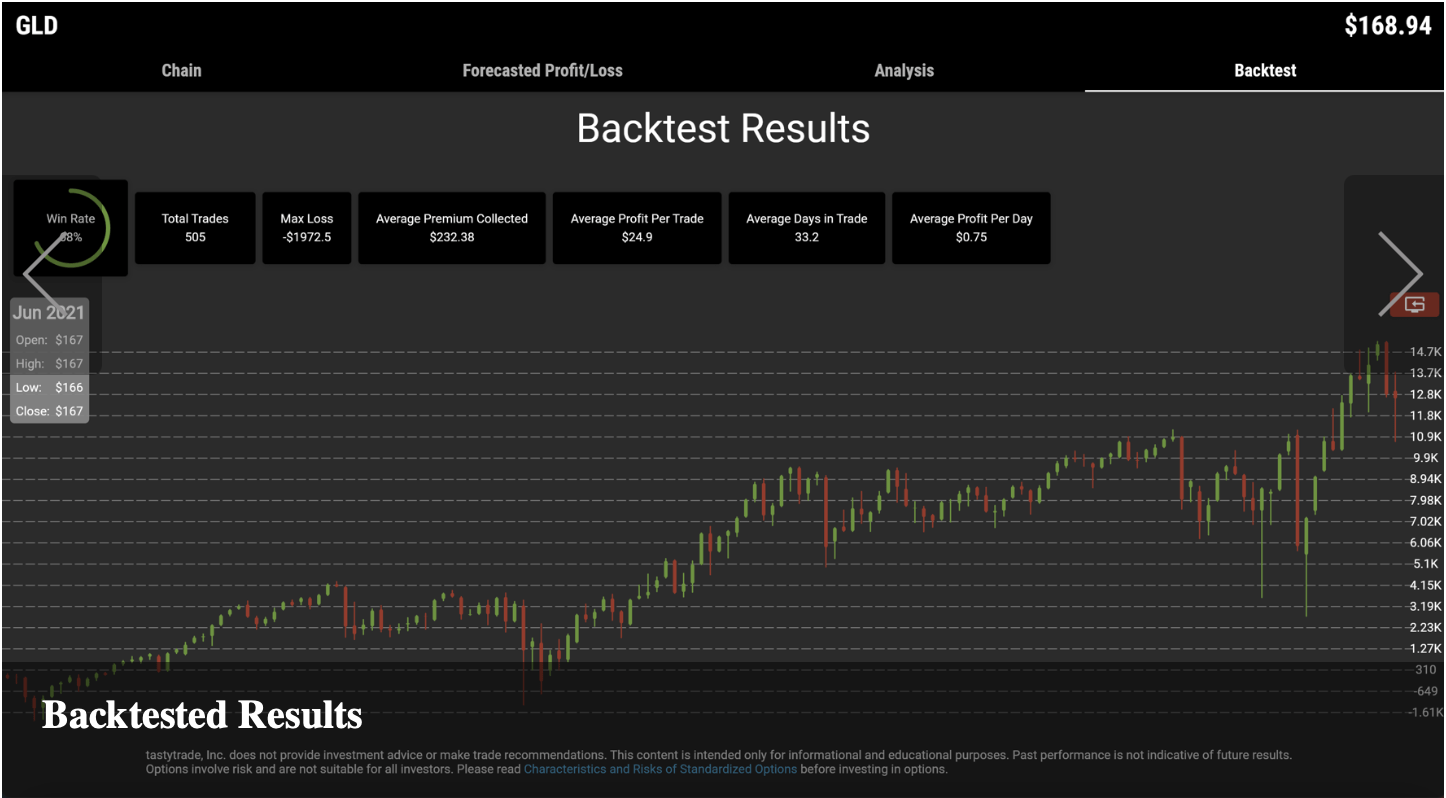

While most investors are long equities, most have little or no investment in bonds or gold. Diversification can help buffer a portfolio against extreme losses. As with any metal, don’t just let it wither away in the account. Make those shares earn their keep! Sell calls against every 100 shares held.

Consider the following portfolio: Long positions in stocks, bonds and metals (with covered calls) to help reduce volatility. Achieve this by purchasing 100 shares of each and then selling the second out-of-the-money call (i.e., the second strike above the current price).

Sign up for free cherry picks and market insights at info.tastytrade.com/cherry-picks

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin