A Nurse, a Lawyer and a Mail Carrier

Career choice can affect your financial future in unexpected ways

Debate over the value of higher education often centers on the relentless rise in tuition over the past few decades. But there’s also the issue of opportunity cost—the income that’s lost by entering the workforce four or more years later. The two factors can combine to produce massive debt for some college grads.

What’s usually missing from the discussion is how a degree affects lifetime investment potential. In July, Luckbox described a strategy called “dollar cost averaging” that can amass wealth over time. It calls for putting a relatively small portion of income into the market consistently. So, the question becomes how that would theoretically work out for someone with a high school diploma compared with a bachelor’s degree or graduate degree.

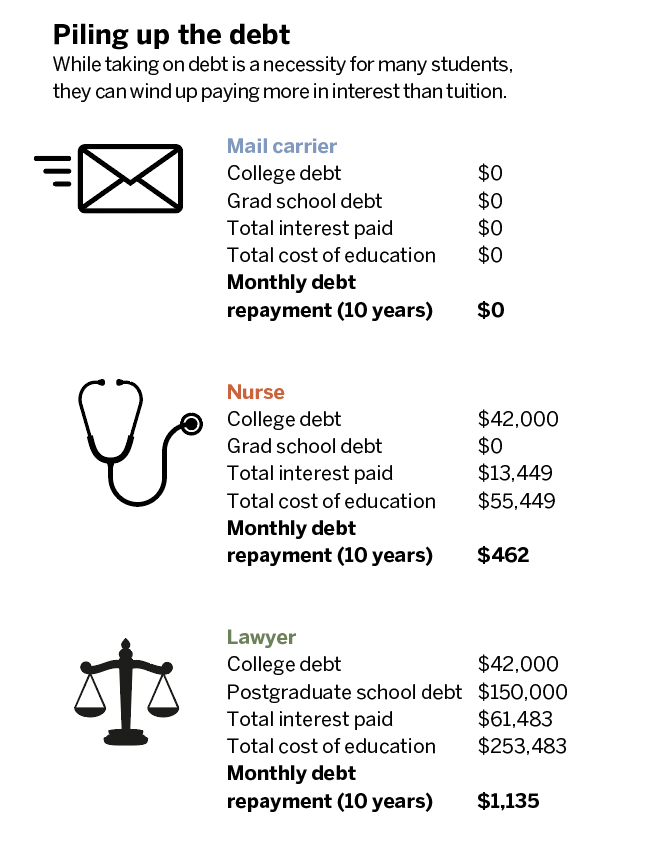

Consider the example of three professions: mail carrier, registered nurse and lawyer. The mail carrier doesn’t go to college, avoids taking on student loan debt and enters the workforce at age 18 but has the lowest earning potential of the three. The nurse goes to college for four years, relies on student loans and enters the workforce at age 22 but earns more than the mail carrier. The lawyer delays entering the workforce until age 25, with seven years of education and much larger student loan debt but the highest lifetime earnings potential.

The chart Long-term earnings shows Chicago area data from Glassdoor—a website that aggregates salary data—on how much each profession earns at various ages (in base pay). The graphic Piling up debt shows the cost of student loans for each profession and expected monthly payments for 10 years after graduating. The examples use a 5.8% interest rate, the national average according to the think tank New America, though some loans have higher rates.

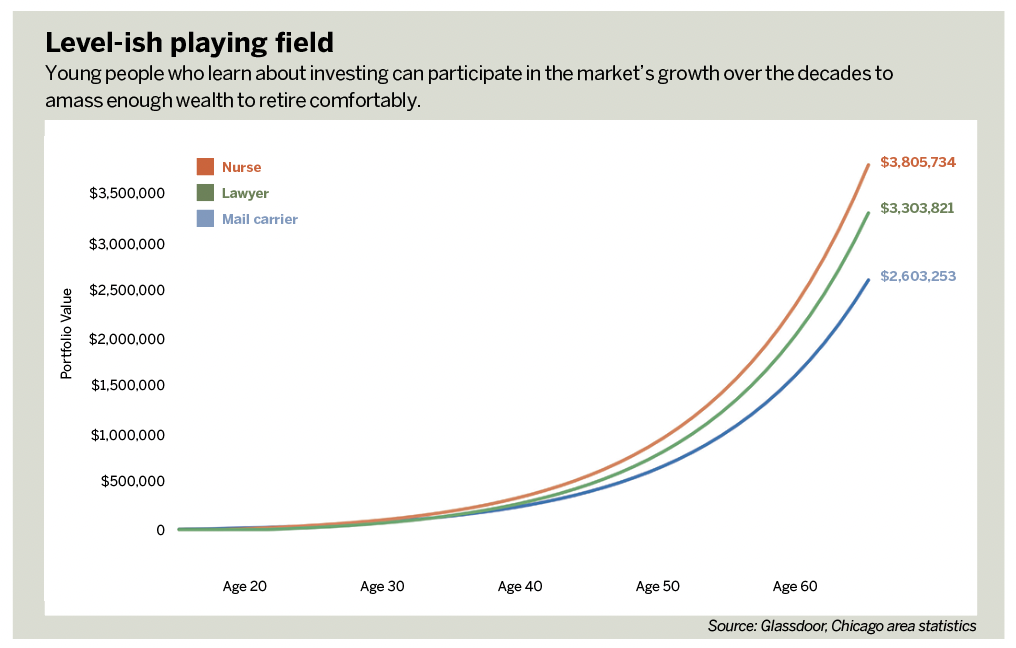

The graphic titled Level-ish playing field shows how much cash people in each profession could amass by sinking 6% of their gross monthly pay into a 401(k) plan or IRA account. The market has, on average, returned 10% per year over the past few decades and, while history does not necessarily repeat itself, experts on investing often cite that number as a reasonable estimate for long-term growth.

While the nurse takes the top spot among these three hypothetical professionals by the age of 65, neither the lawyer nor the mail carrier winds up empty-handed, each with projected multi-million-dollar retirement funds.

Perhaps the most important education anyone can receive is simple financial literacy.

A Pay Bonanza for Nurses

Travel nurses are earning up to $6,500 a week—more than four times as much as they did before the COVID-19 pandemic placed intense demands on the American healthcare system.

Several jobs offering that much pay for nurses willing to travel where they’re needed have appeared recently on Vivian Health, a marketplace for healthcare employment.

Admittedly, those paychecks qualify as outliers, but the gain in average remuneration has been staggering, too. Typical travel nursing pay increased from $1,706 a week in December 2019 to $3,290 today—meaning a travel nurse working 48 weeks a year could now gross $157,920.

Meanwhile, median annual pay for nurse anesthetists, nurse midwives and nurse practitioners—occupations that typically require a master’s degree—climbed to $123,780 last year, according to the U.S. Bureau of Labor Statistics.

For perspective on that $123,780 in annual pay for specialized nurses, consider the fact that median income was $127,990 for lawyers.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors.

@jamesblakeway