Retail Bargain Hunting

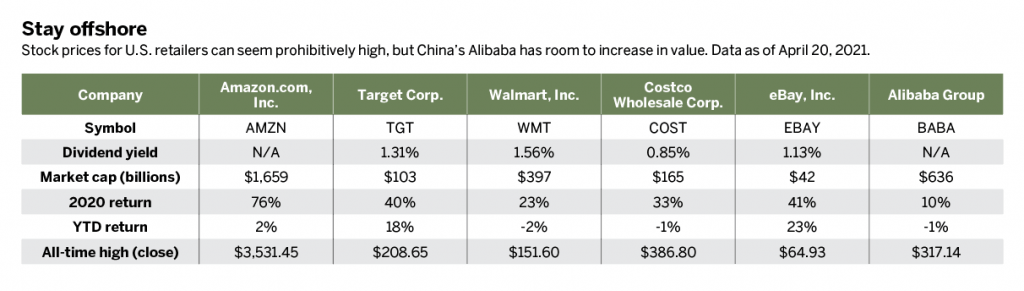

When America was asked to stay home in 2020, Amazon (AMZN) was there to keep consumers stocked up, in shape and entertained with everything from face masks and toilet paper to dumbbells and exercise bikes. After the brief pullback in February and March of 2020, which left virtually no stocks unscathed, Amazon shares roared back to new highs. The stock hit its all-time peak close, topping $3,530, in August.

Despite recent ebbs and flows, Amazon stands tall as the third-largest component in the S&P 500, a $1.6 trillion behemoth overshadowed by only Apple (AAPL) and Microsoft (MSFT). While Jeff Bezos’ wealth has become notorious, he’s not the only one to benefit from Amazon’s meteoric rise. A $10,000 investment in Amazon in January 2000 would be worth more than half a million dollars today.

While leadership, strategic moves and an unsatiated hunger for more led Bezos’ firm to its current standing, it wouldn’t have been possible without one key component: the American consumer. Americans earn some of the highest discretionary incomes in the world and also support their lavish spending habits with piles of credit card debt.

While Amazon captured enough of that spending to appear almost untouchable as the world’s largest retailer, it’s not without competitors that have their own advantages. Walmart (WMT), a familiar part of the scenery across the nation, has invested considerable amounts of money to compete with Amazon online. Walmart even launched Walmart+, a service to rival Amazon Prime with customer perks that include gas discounts.

Target (TGT) bolstered its online presence recently, often matching Amazon’s overnight or two-day shipping options. Both Walmart and Target grew in 2020 and 2021, hitting all-time highs in November and April, respectively. With 40% and 23% returns last year, Target and Walmart both beat the S&P 500’s 18% 2020 return despite being overshadowed by Amazon’s eye-watering 76% return.

While it may be tough for investors to justify purchasing any of these retail giants near record highs, the case may be stronger for Walmart or Target because they could see more foot traffic as COVID-19 restrictions continue to lift across the country. Walmart and Target both pay dividends yielding over 1.3% annually, but Amazon still does not pay a dividend.

The other guys

These three retail giants aren’t the only merchants competing for a share of America’s wallet. Besides the never-ending list of smaller retailers, some other large-cap stocks stand out for investors seeking retail portfolio exposure.

Costco (COST) saw impressive growth not only in the last year but over the last decade. However, Costco is also near record highs despite a pullback in the first quarter of this year. Investors may wish to look for a subsequent pullback in the stock price before considering adding it to their portfolios.

While many Americans write off eBay (EBAY) as an early 2000s internet fad, investors saw impressive gains in 2020 with a 40% return on the year. eBay shares experienced a steady decline from 2005 to 2011, but the last decade saw consistent growth in revenues because the site remains a top marketplace for vendors and customers around the world. While eBay does pay a 1.13% dividend, the stock still sits near all-time highs, like the others, meaning stock buyers may wish to simply add the stock to their watchlists for now.

Turning attention to the international scene, Alibaba (BABA), the Chinese online retailer, operates one of the world’s largest business-to-business networks while also owning several popular business-to-consumer and consumer-to-consumer sites.

Although Americans may be unfamiliar with Alibaba, it’s a household name in China, as are its subsidiaries TaoBao and AliExpress. Despite giving investors some headaches since its 2014 initial public offering, Alibaba is still up 145% since it was listed. Unlike major U.S. retailers, Alibaba may make a more attractive investment opportunity at current prices.

After crossing $310 in October, Alibaba retraced below $240 by mid-April, meaning investors may want to consider Alibaba for some potential upside returns in the

near future.

With these retail names hovering near all-time highs, buying stock can seem a precarious endeavor because of fears of an impending correction. All of the aforementioned stocks are accompanied by liquid options markets. That means traders willing to purchase retail firms at lower prices may look to sell puts. Those who want to own shares now but think the upside potential is limited may look to sell call options against long stock positions.

Retailing ETFs

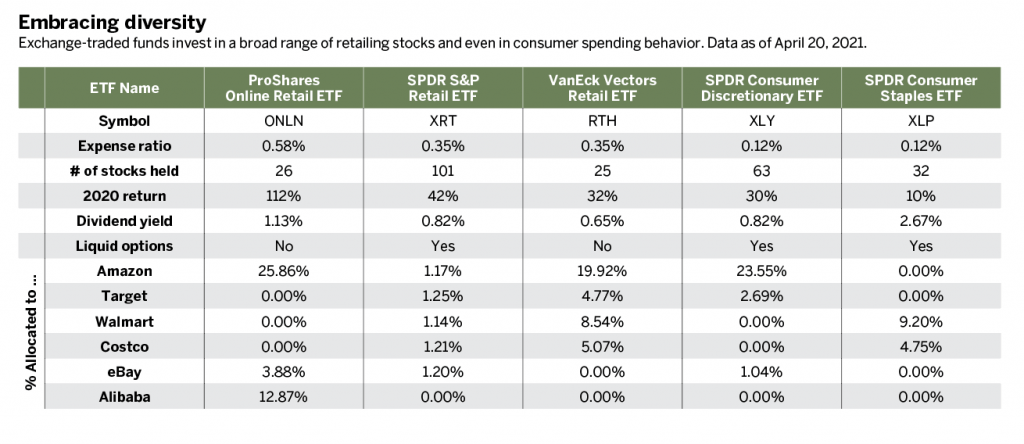

Investors interested in long-term, diversified opportunities in the retail sector are well-served by the exchange-traded fund (ETF) industry. For investors looking to gain exposure to Amazon, Target and Walmart, the VanEck Vectors Retail ETF (RTH) holds all three firms in their top 10 holdings, with Amazon as No. 1. Those looking for more exposure to online-only retailers may consider the ProShares Online Retail ETF (ONLN), which holds Amazon, Alibaba and eBay as its top three holdings. Other top online retailers held by the ProShares fund include Etsy (ETSY), Wayfair (W) and Overstock.com (OSTK). Traders in the market for a diverse, well-balanced fund may be interested in the SPDR S&P Retail ETF (XRT). This fund differs from the SPDR sector ETFs because it does not hold stocks according to their S&P 500 Index weighting.

Instead, the 101 stocks are held in a more balanced ratio, with no single stock currently totaling more than 1.32% of the portfolio. The SPDR Retail ETF remains popular with options traders because of wide and deep options markets with varying expirations. The VanEck and ProShares funds do not exhibit the same high options liquidity as the SPDR Retail fund.

Outside the retailing sector, investors can choose from among funds that offer exposure to general consumer spending habits. SPDR funds offer both a Consumer Discretionary (XLY) and Consumer Staples (XLP) fund. The former holds Amazon, Target and eBay stock, while the latter incorporates both Walmart and Costco. All five ETFs charge fairly low expense ratios, and only the ProShares Online Retail fund comes in above 50 basis points, at 0.58%.

Investors looking for a dividend-paying ETF with retail exposure may be best-suited for the SPDR Consumer Staples fund, with a 2.67% annual yield. For options traders, the three SPDR funds are reliable for liquid

options markets.

With retail stocks and ETFs, as with any smart purchase, investors should always do a little window shopping, possibly read some online reviews and, as always, do their due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway