High-IQ ETFs

The American public has favored mutual funds for decades and by the end of 2019 had placed $21.3 trillion in them, often through 401(k) retirement plans. Luckily for investors, the growth in the mutual fund industry led to more competition, prompting fund managers to refine strategy and lower fees to stay competitive.

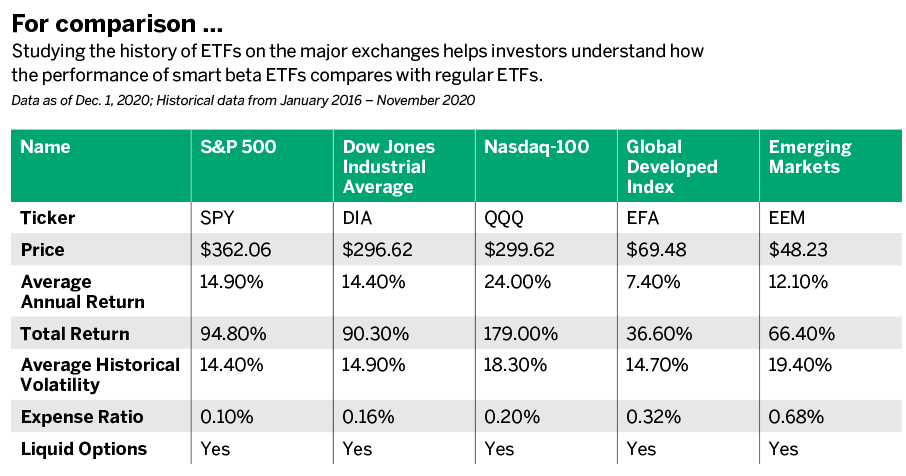

But more recently, ETFs saw increasing numbers and became more popular among investors and traders who want to step outside of their 401(k) plans. ETFs tend to ditch the fund manager and simply track an underlying index. For example, the SPDR S&P 500 ETF (SPY) tracks the S&P 500 index.

That means lower overall fund expenses as firms don’t pay for managers and analysts. Last year, investment in ETFs worldwide totaled $6.3 trillion with 70% of those assets trading in the United States. The growth of ETFs also forced financial firms to add diversity and invent new products to entice investors, including the advent of smart beta ETFs.

Smart beta ETFs trade on exchanges like any other ETF, but the difference lies in the portfolio construction. These funds act as a hybrid of an index- or sector-tracking ETF and a traditionally managed mutual fund. That’s typically achieved by sticking with an underlying index and then applying a rule or set of rules governing which stocks should be purchased for the ETF.

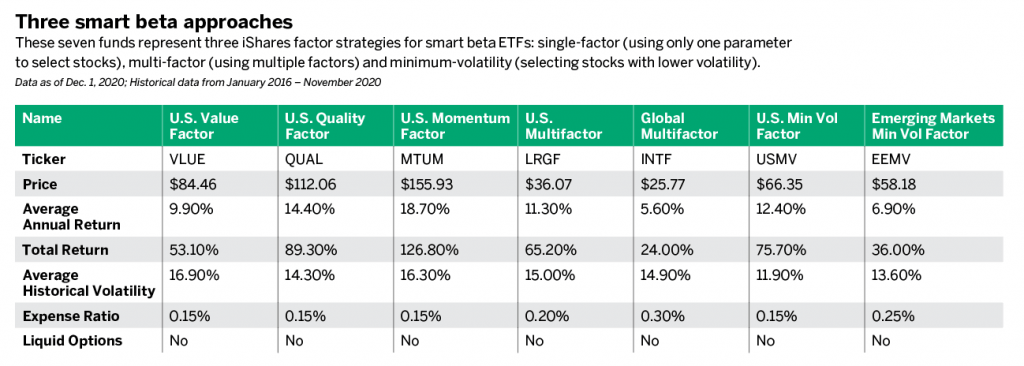

Those rules, or factors, vary across smart beta ETFs and are imposed to add traditional investment principals to the fund construction. While there’s a plethora of smart beta ETFs out there, let’s focus on a sample of those provided by iShares, one of the nation’s top ETF companies. (See “Three smart beta approaches,” below).

Get smart

The seven funds in the table total near $85 billion in assets and illustrate a variety of factor strategies by iShares, a subsidiary of BlackRock. Three types of smart beta ETFs are represented here: single-factor (using only one parameter to select stocks), multi-factor (using multiple factors to select stocks) and minimum-volatility (selecting stocks that exhibit lower volatility).

The single-factor ETFs focused on companies that seemed undervalued (VLUE), companies with quality financial health (QUAL) and companies that were showing upward momentum (MTUM). Both the value and quality funds underperformed the S&P 500 ETF, which is typically considered the benchmark of the U.S. stock market.

The momentum fund did manage to outperform the S&P 500 in both average annual and total returns the past five years. However, this performance paled compared with the Nasdaq-100 ETF, typically considered the choice for more aggressive index investing. The momentum fund failed to keep pace with the Nasdaq in each positive return year and lost 1.67% in 2018, compared with a loss of 0.13% for the Nasdaq.

Consider next the multifactor smart beta ETFs. Both the MSCI USA multifactor (LRGF) and MSCI international multifactor (INTF) ETFs focus on portfolios of stocks that show potential relating to quality, value, size and momentum. The USA multifactor ETF can once again be compared with the major U.S. stock indexes, the S&P 500 and the Dow Jones Industrial Average (DIA).

Think of a smart beta exchange-traded fund

as a hybrid of an index- or sector-tracking ETF and a traditionally managed mutual fund.

The multifactor ETF lagged behind the stock indexes. What stands out is that the returns were not lower with lower volatility. The multifactor ETF exhibited a slightly higher volatility than either the S&P 500 or Dow Jones ETF, and it did so with a higher expense ratio. That means investors who held the multifactor U.S. ETF saw larger fluctuations in their portfolio and paid higher fees to do so—while seeing lower returns.

The international multifactor ETF presents a similar story when compared with the iShares MSCI International ETF (EFA). Both ETFs focus on global stocks in developed nations. While the smart beta ETF has marginally lower fees, two basis points, the performance once again lagged behind the standard ETF. While the 36.6% total return for the international ETF is far below the U.S. indexes, it still beat the smart beta fund by over 12%.

The minimum volatility funds appear to be where iShares smart beta tactics shine brightest. As the name suggests, the goal is simply to stick with the chosen index but lower the overall volatility by emphasizing stocks that are less volatile. Both the U.S. minimum volatility (USMV) and emerging markets minimum volatility (EEMV) funds succeeded in providing a lower average volatility compared with their index counterparts.

However, the caveat is a substantially lower return over the past five years. Surprisingly, the emerging markets minimum volatility fund offered an expense ratio at 43 basis points below the standard emerging markets ETF (EEM). Though, again, that wasn’t worth the 30% difference in returns. There’s definitely some merit to the minimum volatility funds, especially for older, more risk-averse investors, because they maintained lower volatility compared with the standard index funds.

Smart choice

Most investors who debate whether to invest in smart beta funds will likely do so in an IRA or personal margin account with far more flexibility and choices than the average 401(k) plan. That flexibility includes the opportunity to sell options, or option spreads against ETFs, and potentially lower risk while enhancing returns.

Unfortunately, that’s not the case with the smart beta ETFs. There are no liquid options markets in any of these analyzed funds, adding to the list of reasons investors may wish to stick with index and sector ETFs.

Those index and sector ETFs may not be “smart” ETFs, but they certainly aren’t dumb investment choices. Regardless of investing goals and risk tolerance, there’s likely an ETF for every investor. Be smarter than the average investor, find what works for you and, as always, do your due diligence.

Evaluate any portfolio with Quiet Foundation

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.@jamesblakeway

Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report are based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com.