Crypto 101: Enroll in the Asset Class

Traders may remember 2011 as a nothing year for the S&P 500. The stock index opened in January at 1,257.62 and closed the year at 1,257.60. Only small circles of tech gurus were mining and trading bitcoin, a relatively unknown asset back then. The next year saw bitcoin finally rally above $1 per coin, peaking at more than $15 in the summer before closing the year back below the $5 mark.

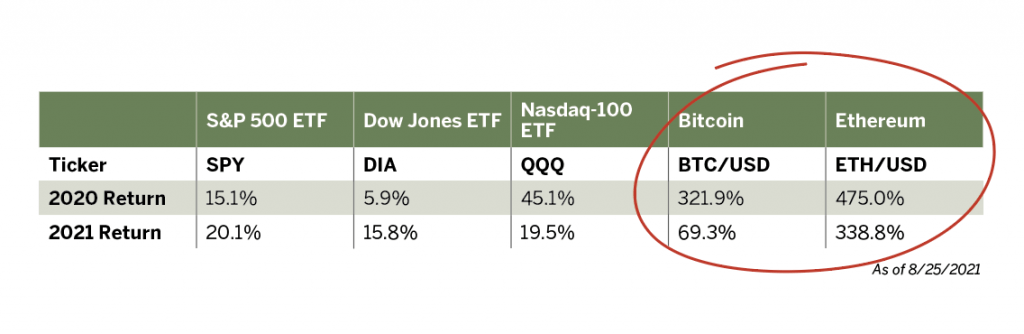

From the close of 2011 until July of this year, the S&P 500 rallied 250%. Bitcoin, on the other hand, returned 884,000%. That explains why every new investor wants to learn about and trade bitcoin, and usually doesn’t care much about the seemingly mundane S&P.

Bitcoin’s meteoric rise also explains at least some of the interest and buzz in the likes of dogecoin and other cheaper cryptocurrencies in 2021. New traders, empowered by easy-to-use investing apps and with pockets lined by stimulus cash, plowed money into various cryptocurrencies hoping they were on the ground floor of the next bitcoin or ethereum.

Traders, traditional asset managers and firms building financial products all view cryptocurrencies as an emerging opportunity. They use cryptocurrencies as a new asset class for diversification and use the volatile market for speculative trading.

Still, it’s worth noting that cryptocurrencies failed a key test this summer. Before that, many advocates claimed they were the perfect inflation-hedging asset. But as troubling inflation numbers were published, bitcoin and ethereum fell, driven by talk of crypto regulation in the United States and China, as well as concerns about the environmental impact of crypto mining.

Crypto access

For individual investors, there’s no shortage of places to access and trade cryptocurrencies, as well as emerging products that allow indirect access in traditional brokerage or IRA accounts.

Grayscale Investments is capitalizing on the crypto craze by offering cryptocurrency trust products that investors can buy or sell much like stock or exchange-traded funds. Their two largest products are the Bitcoin Trust (GBTC) and Ethereum Trust (ETHE). While both crypto trusts trade on the over-the-counter markets, they exhibit high daily volume, with millions of shares trading each day. However, both products have two very distinct drawbacks.

First, cryptocurrency has a general disconnect with traditional financial markets. Bitcoin and ethereum trade 24 hours a day, 365 days a year, while the trusts trade only during standard market hours.

That creates an issue for anyone looking to trade the trust products actively. They can’t react instantaneously to any overnight or weekend movement in bitcoin and ethereum, leaving them susceptible to aggressive price moves when the stock market reopens.

The second pitfall comes with the cost associated with these trusts. The bitcoin and ethereum trusts currently charge 2% and 2.5% in annual fees, respectively. It’s easy to forget a 2% fee in a year like 2020 when bitcoin returned 300%. But if bitcoin stabilizes with 5% to 10% annual returns, those fees will dramatically reduce the benefits of using the trust products. Those looking to hold cryptocurrencies longer-term via these trust products should keep the fees in mind.

Despite the growing interest in cryptocurrencies, choices remain limited for active and derivative traders. The inability to short bitcoin or ethereum starves traders of bearish opportunities. One possibility for long, short and options trades is the bitcoin futures product offered by the CME Group. However, each contract controls five bitcoins, with a hefty margin requirement, putting it out-of-reach for most retail traders.

Given the lack of traditional exchange-listed crypto derivatives, some traders are getting creative with their crypto speculation and hedging. They’re navigating back to the equity world and using stocks that operate cryptocurrency businesses.

Riot Blockchain (RIOT) stands out as a popular proxy product for bitcoin. RIOT specializes in cryptocurrency mining, operating the largest bitcoin mine in North America. Much like gold mining stocks fluctuating with the price of gold, RIOT often rallies and falls with the price of bitcoin.

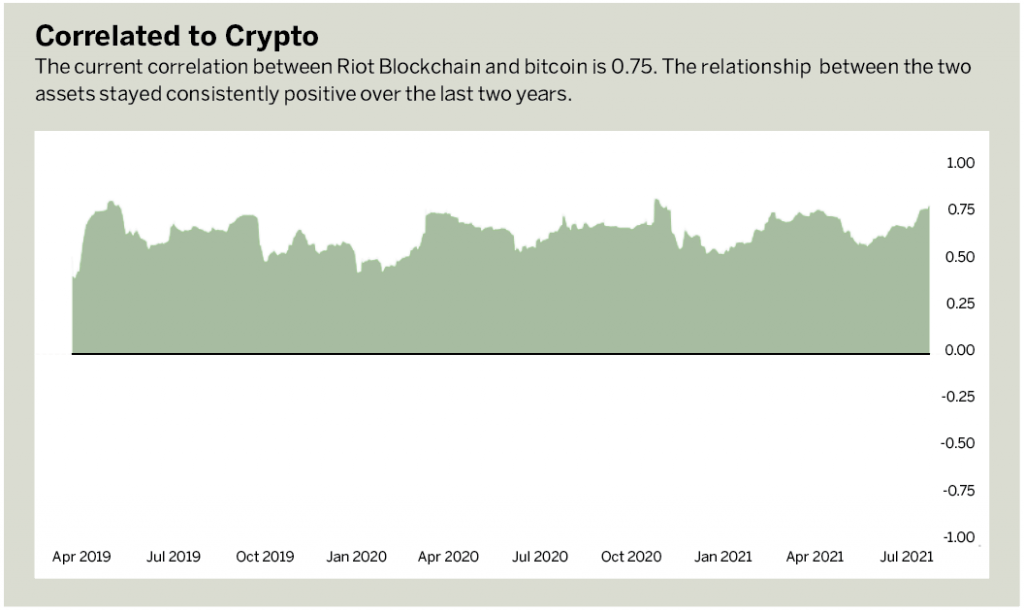

The current correlation between RIOT and bitcoin is 0.75, meaning that on any given day it’s likely but not certain that both assets will move in the same direction. Looking back over the last two years, the correlation between the two assets stayed consistently positive. (See “Correlated to Crypto,” below).

With the higher correlation, options traders sometimes look to hedge long bitcoin holdings with short positions in RIOT, such as short calls or short call spreads. Others may use RIOT as a long bitcoin alternative, selling puts and put spreads for a higher probability trade or buying calls for a speculative lower probability bet.

Traders using RIOT stock or options in place of bitcoin should be wary that the correlation relationship could break down at any time. For example, a broad stock market sell-off could drag down RIOT stock regardless of price action in bitcoin.

Crypto exchanges

While some investors look for proxies to the cryptocurrencies, others seek broader investments for the expansion of the cryptocurrency sector. Coinbase (COIN), one of the largest cryptocurrency exchanges, stands out as a prominent name.

That’s perhaps because of its infamous post-IPO nosedive in April and May. While COIN may still be overvalued at a $64 billion market cap, its two-sided price action and liquid options markets are compelling for active traders.

Around the world, investors and traders alike are waiting eagerly for the cryptocurrency market to offer further access as well as alternative products. In many ways, it feels like as though this could be the beginning of a new asset class.

As firms navigate the upcoming cryptocurrency regulation that seems likely to occur, financial innovators will find a way to offer new cryptocurrency funds and derivatives, further democratizing access to these dynamic assets.

Regardless of investing timeframe or chosen financial products, traders and investors should remain cognizant of the ever-changing new financial frontier of cryptocurrencies and, as always, do their due

diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway