Petroleum Perseveres

While debate continues on the transition from fossil fuels to green energy, the nation will rely on oil and gas for the foreseeable future

In April 20, 2020, the seemingly unthinkable happened: Crude oil prices fell below zero. More accurately, the May 2020 WTI crude oil futures went negative, touching a low price of -$40.32 per barrel.

This freakish anomaly for crude oil came after a combination of steady declines and sharp drops as the world came to grips with the COVID-19 pandemic. Americans were disappointed to learn they weren’t being paid to fill up their gas guzzlers, but crude oil prices slowly turned around.

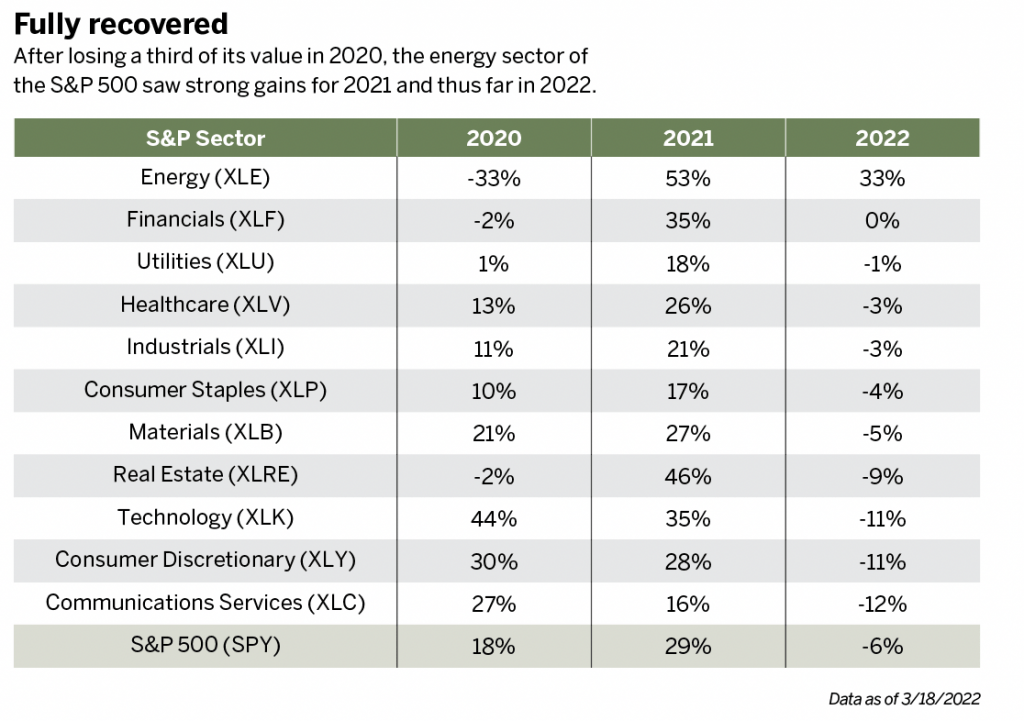

Starting 2020 at $61, crude oil managed to recover somewhat by the end of the year, closing December at $48, a decline of 21% for the futures. Despite the substantial recovery in crude oil prices, the impact on oil and gas stocks in 2020 made the energy sector the worst performer of that year (see Fully recovered). Exxon Mobil (XOM), the largest energy company in the S&P 500, ended 2020 down 36%, at one point seeing a loss of 55%.

Longer-term investors in the energy sector licked their wounds and saw a much-needed rally in 2021. XLE, the SPDR S&P 500 energy sector ETF, gained 53% in 2021, making it the best performing sector in the index that year. The same is true, thus far, for 2022 as energy is once again the top sector in the S&P 500.

In fact, energy is the only sector with a positive return. That’s because of the fallout from Vladimir Putin’s invasion of Ukraine. Most stocks are down in 2022 on fears related to the war, the global supply crunch and the Federal Reserve’s plans to raise interest rates throughout the year. The invasion of Ukraine spiked oil prices at the beginning of March after a consistent climb in January and February. That pushed stocks like ExxonMobil even higher. Exxon reached an all-time high of $91.51 on March 8.

While debate continues on the transition from fossil fuels to green energy, the nation appears likely to rely on oil and gas for the foreseeable future. In the meantime, stocks in the petroleum industry generated some healthy returns over the past year and a half. Many of those stocks are now at their highs, alongside the price of oil, and investors might hesitate to buy in at these lofty prices.

However, if oil prices retreat to $60 or $70 per barrel, investors may anticipate another rally in oil. But what if investors don’t want to invest in just one stock (not knowing which to pick) and definitely don’t want to buy an oil future?

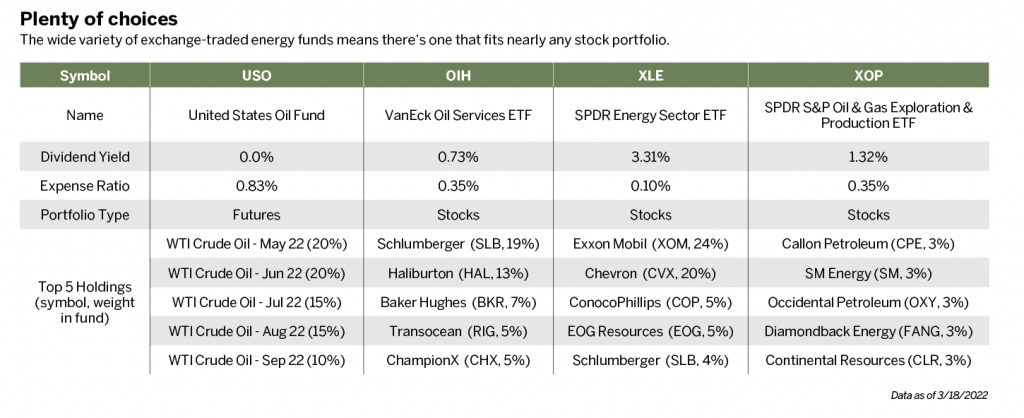

As usual, there’s an exchange-traded fund (ETF) for that. As mentioned earlier, specific sector ETFs are available, such as the S&P 500 Energy Sector ETF that holds all the energy stocks in the S&P Index. As shown in the graphic (see Plenty of choices), ExxonMobil is the largest holding in the Energy Sector ETF.

Investors seeking alternatives to the SPDR energy sector fund may prefer the SPDR S&P Oil and Gas Exploration and Production ETF (XOP). That fund may attract investors because of the lower weighting of its top components—no single stock makes up more than 3% of the portfolio. However, it does have a lower dividend yield and higher expense ratio than the broad energy sector fund.

A third option, the VanEck Oil Services ETF (OIH), holds a slightly different mix of stocks in its top components compared with the other two. Note that the three funds have a large amount of crossover with their holdings. Additionally, all three funds exhibit current correlations with one another above 0.75, meaning they often move in the same direction.

A fourth ETF worth mentioning is the United States Oil Fund (USO). This fund differs from the others in that its portfolio is built from futures contracts, not shares of stocks. The managers of this oil fund buy futures contracts for a variety of months, as indicated in the table.

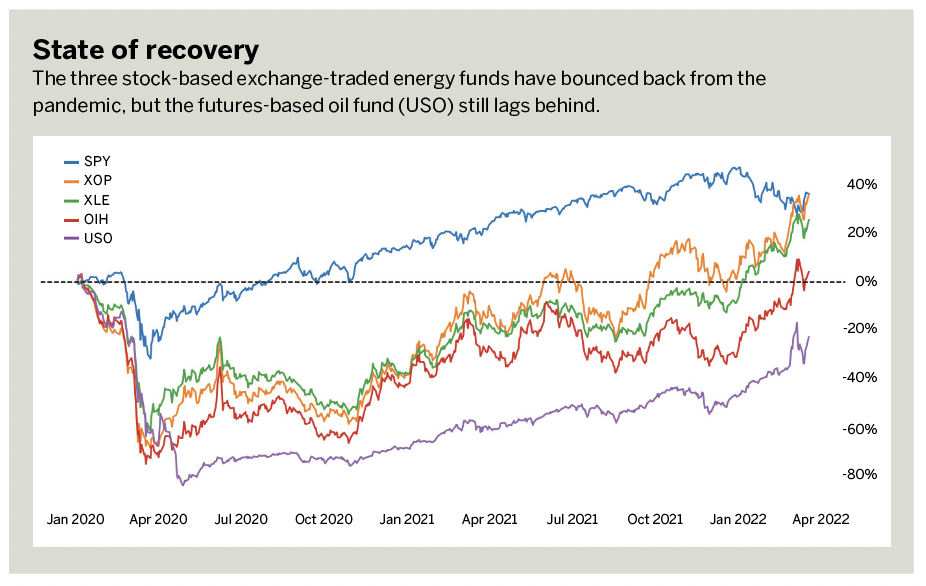

That gives investors a more direct avenue for oil exposure, but it comes with a stern caveat. The U.S. Oil Fund is prone to an issue known as “drag,” whereby the price can seemingly decay over time.

It occurs when the fund managers must roll their futures positions forward before they expire. They sell the expiring futures and buy futures that expire later. Because the later-dated futures are cheaper than front-month futures, this phenomenon isn’t happening now. However, it will return if the oil market shifts.

Depending on investors’ goals, an energy ETF will probably fit into their portfolios, assuming they want the exposure. Energy will continue to exhibit volatility throughout 2022. Investors should stay vigilant. Before jumping into any energy asset, they should always do their due diligence.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors. @Jamesblakeway