How Gold Fits

Investors often tout gold as a strategy during market declines. It sounds ideal because a precious metal like gold should withstand shocks to the economic cycle, right?

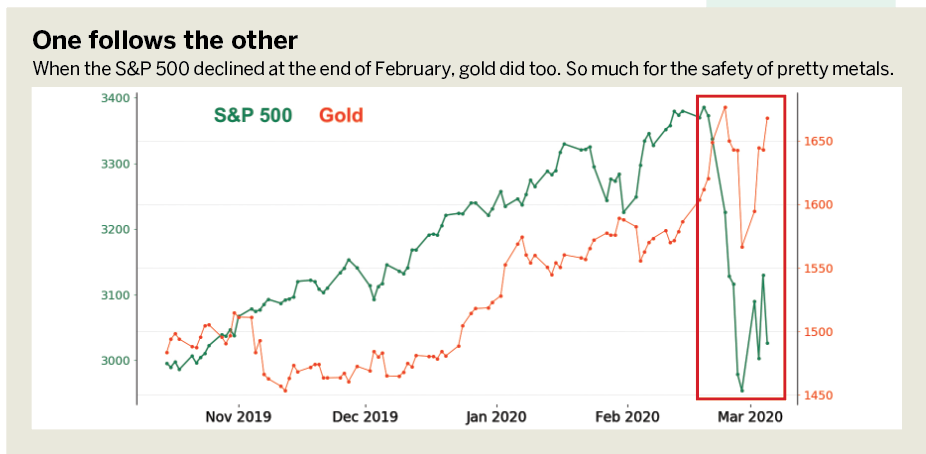

Well, not always. Think about the decline of the S&P 500 at the end of February. The market dropped and so did gold. Yes, it did provide some diversification to a portfolio because it didn’t drop as much, but it still didn’t increase as much as many would have expected. (See “One follows the other,” below.)

During the past 20 years, gold increased only 57% of the weeks when the S&P 500 saw a decline. And that average move in gold during the declines was a negligible 0.3%. Think of gold then as capital preservation instead of capital appreciation. In other words, you won’t “knock it out of the park” with gold.

The second thing to remember is the volatility of gold. It’s less volatile than stocks but still more volatile than many might expect. On a typical day, gold moves between -1.1% and +1.1%. As a comparison, the S&P 500 moves -1.2% to 1.2% per day. Gold isn’t as “safe” then as many would like to think.

Still, gold does have a place in many portfolios. But first, ditch the late-night commercials touting commemorative gold coins and bars. The spread between the bid and offer is huge—and where would you store $10,000 worth of gold coins?

Instead, check out the SPDR Gold Trust (GLD), an exchange-traded fund. Investors trade GLD shares worth more than $1.2 billion every day. Each share is backed by 1/10th of an ounce of gold in a vault in New York. Or check out the iShares Gold Trust (IAU). It trades less, but the markets can be extremely tight—each share is backed by 1/100th of an ounce of gold. That makes it attractive for those with smaller accounts.

Keep gold positions small—don’t develop a “chicken little complex” and begin believing the sky is falling—that would set up a portfolio for underperformance. Over time, gold tends to underperform the S&P 500 dramatically. Instead, use covered calls in gold.

For example, consider buying 100 shares of GLD at 150 and selling the at-the-money 150 call in June for $450. That lowers the breakeven and increases the probability that the position will help provide protection while adding some cashflow to the account.

Sign up for free cherry picks and market insights at

info.tastytrade.com/cherry-picks

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin