Reassessing Options in a Down Market

In drawdowns as when the Nasdaq, Dow Jones and S&P 500 recently found their way down 10%, 7%

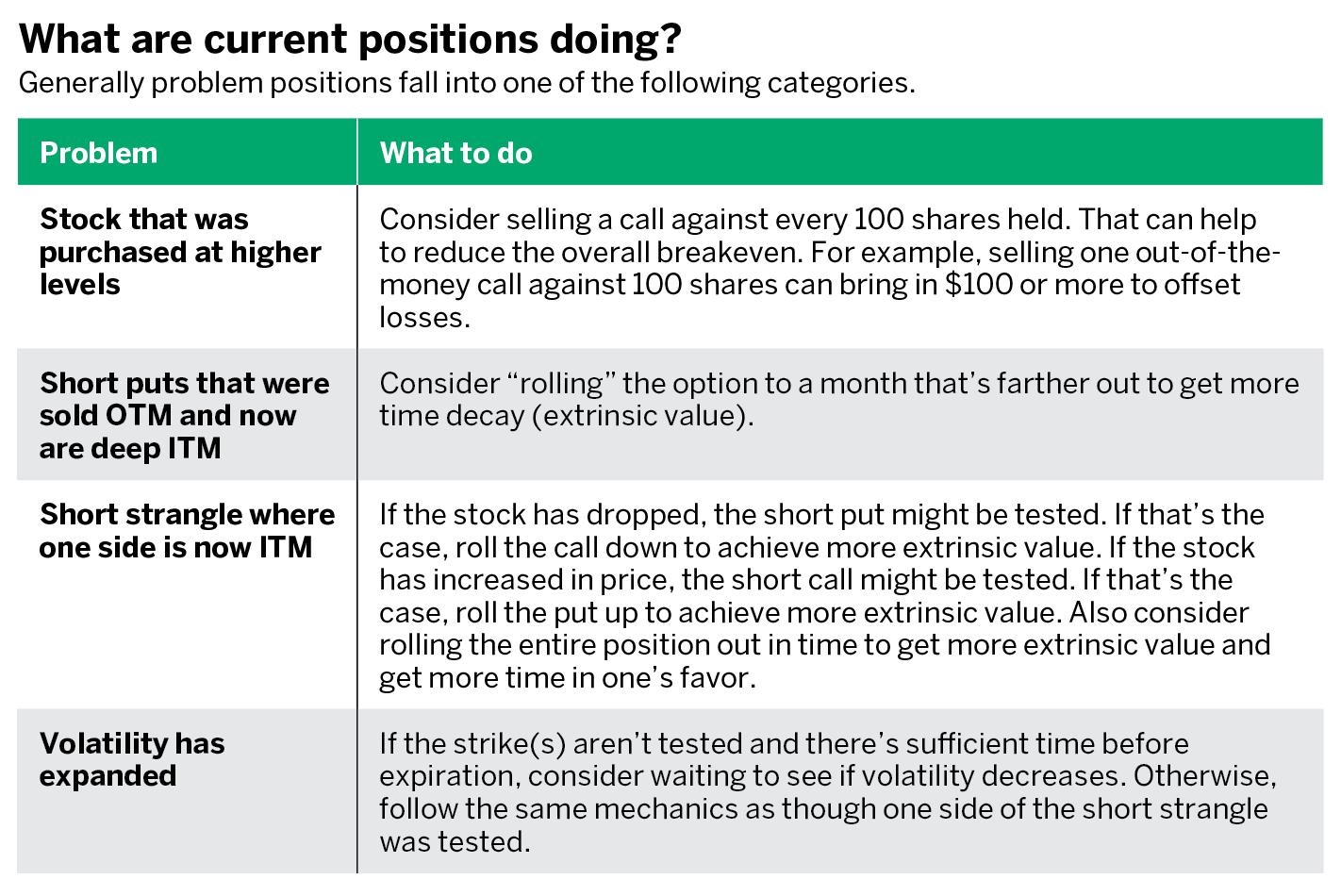

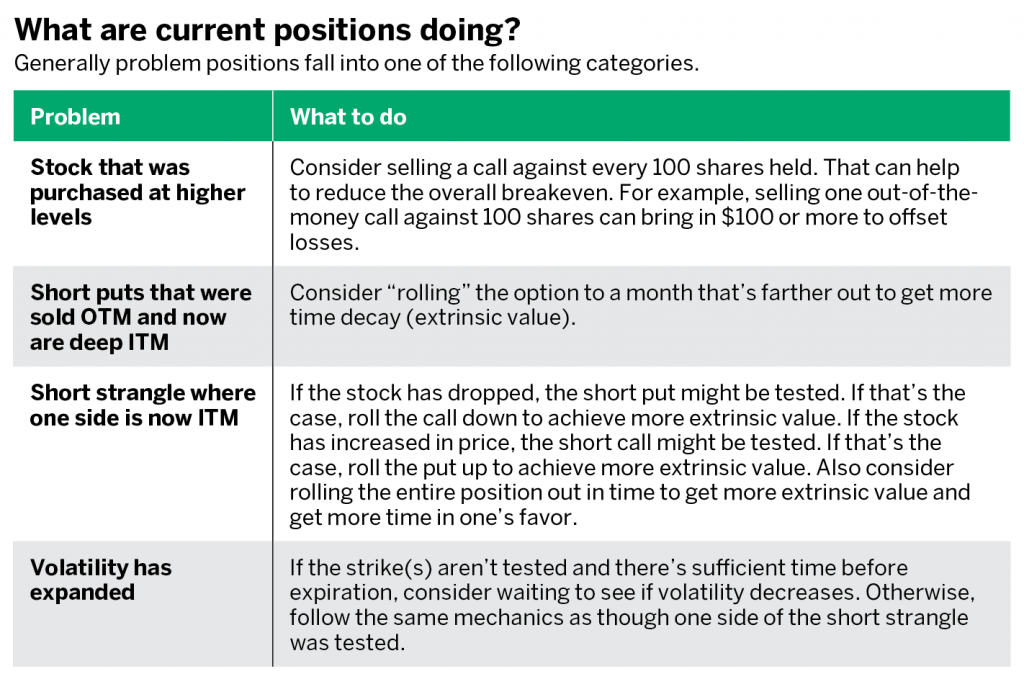

Generally, problem positions fall into one of the categories in “What are current positions doing?” (below).

When assessing compromised options positions, consider how deep the short option is in-the-money (ITM). Is it $1 or $25 ITM? The deeper ITM the option is, the less time decay will be built into the option. The position will generally have a higher probability of being assigned—which is not a huge deal—but being assigned stock does negate the reason why options are so powerful. Options have time decay—and if one has been assigned stock, time decay is no longer working in one’s favor. So as a general rule, keep those short options rolled.

Where does opportunity exist?

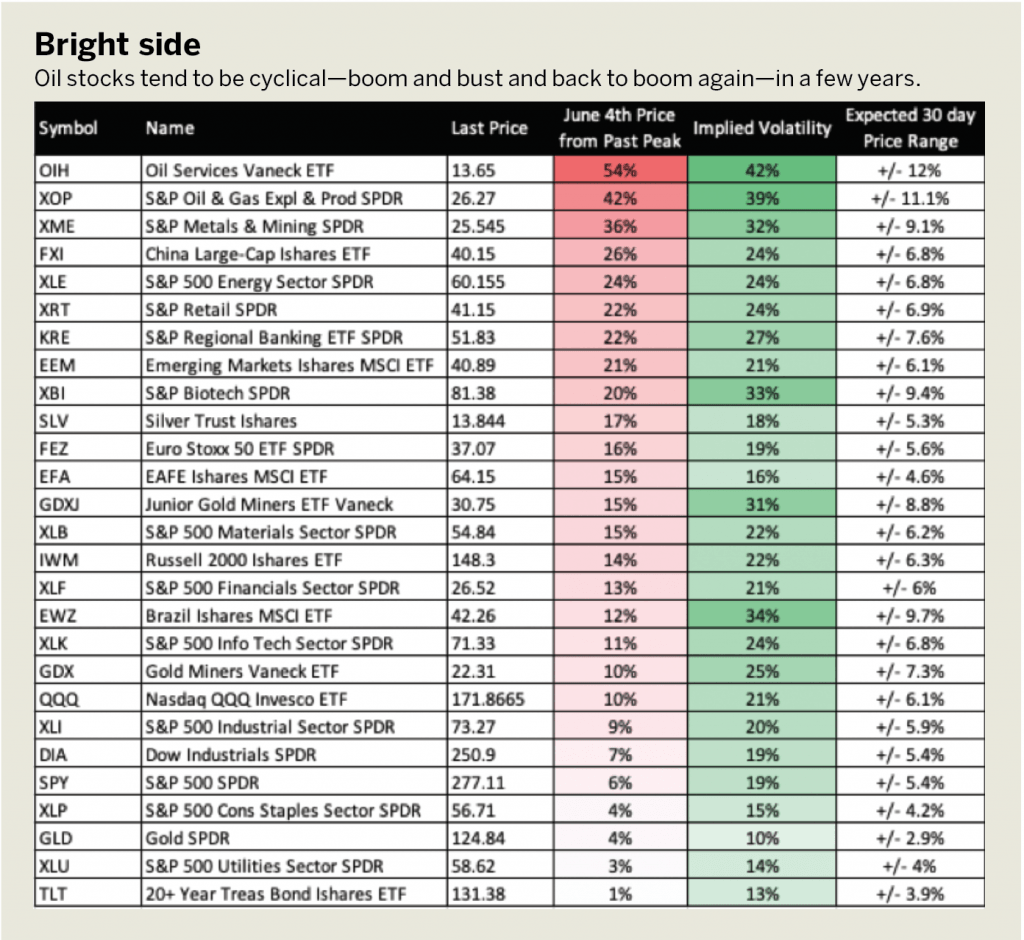

When looking for additional opportunity, focus on market sectors that have been “beat up” with high levels of volatility. Not only can an investor buy things for less than they were selling for previously, but the higher volatility means options are selling at a premium. That can provide a theoretical edge.

In “Bright side,” right,you can see that sector exchange-traded funds (ETFs) have been hit especially hard. VanEck Vectors Oil Services ETF (OIH) is down 54% from its highs and SPDR S&P Oil & Gas Exploration & Production (XOP) is down 42%. Two reasons for this downturn: Oil is down 28% from last year’s peak, and the overall market is down, which often causes investors to punish, especially hard, the underperforming sectors.

The bright side is oil stocks tend to be cyclical—boom and bust—rinse and repeat—back to boom again in a few years. With option implied volatility so high in this sector (meaning traders have “bid up” the insurance for these stocks) a trader looking to take a bullish stance can get paid to enter a long position when stocks are at huge discounts in price.

Consider selling an out-of-the-money (OTM) put in OIH. If the stock is at 14, the first OTM put would be 13. Because the stock would have to fall further than 13 minus the credit received from the put, this is a relatively high probability trade. Another interesting trade is the Metals and Mining ETF (XME). This ETF can be had for 36% of a discount from peaks made last year. Consider buying 100 shares and then selling an ATM call against the stock. The call has the potential to lower the breakeven by several percentage points. Not a bad way to start a bullish stance!

To sign up for free cherry picks and daily market insights, visit tastytrade.com

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade.