Shorter-Duration CDs Offer Higher-Yield Opportunity

With the Federal Reserve increasing the overnight interest rate, shorter-duration treasuries have increased in yield. That “flattening of the yield curve” means three-month CDs now have yields comparable to considerably longer CDs.

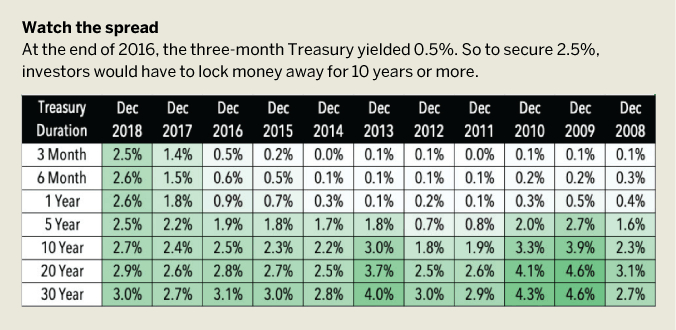

That’s unusual – generally, longer-term CDs have considerably higher yields than short- er-duration CDs. For example, the annualized yield on a three-month Treasury is currently 2.5% while a 10-year is 2.7%. Historically, that spread (the difference between the long- and short-terms) is larger. The present situation tilts the favor to the purchaser of shorter-term CDs (see “Watch the spread,” below).

Look at the end of 2016, when a three-month Treasury yielded 0.5%. To get 2.5%, investors would have to lock money away for 10 years or more. Now they can earn an annualized return of 2.5% and lock money up for only three months. That’s a big advantage for anyone looking to park money for only a short time.

Covered Call in Utilities

When using covered calls in utilities you get the advantage of reduced theoretical volatility from the overall market, and you receive additional cash flow potential.

Utility stocks account for less than 5% of the S&P 500. That means many investors are underexposed to that relatively stable sector of the economy and might gain from the added diversification of utilities.

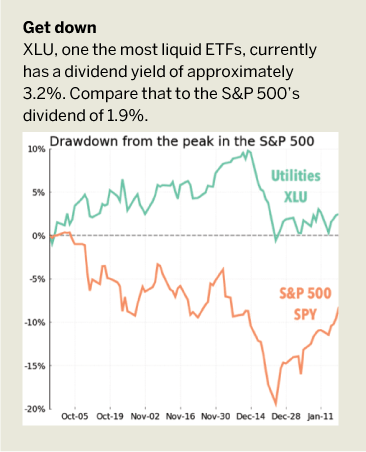

XLU, one of the most liquid ETFs, includes 27 stocks and currently has a dividend yield of approximately 3.2%. Compare that to the S&P 500’s dividend of 1.9%. An additional advantage is that drawdowns are typically less severe than with many of the equity indices. From September to December 2018, when the S&P 500 lost nearly 20% of its value, utilities were in the green during much of that time. (See “Get down,” right)

One choice is simply buying the ETF and receiving the dividends as cash payments. The other choice is to buy 100 shares and sell out-of-the-money covered calls using the monthly expiration.

The second approach has the potential to increase cash flow, reduce the largest drawdown and increase the overall stability of the stock by decreasing the cost-basis of the position.

Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade