Three Roads to China

Some stocks offer more exposure in Chinese markets than their names suggest. Here’s a sampling of opportunites.

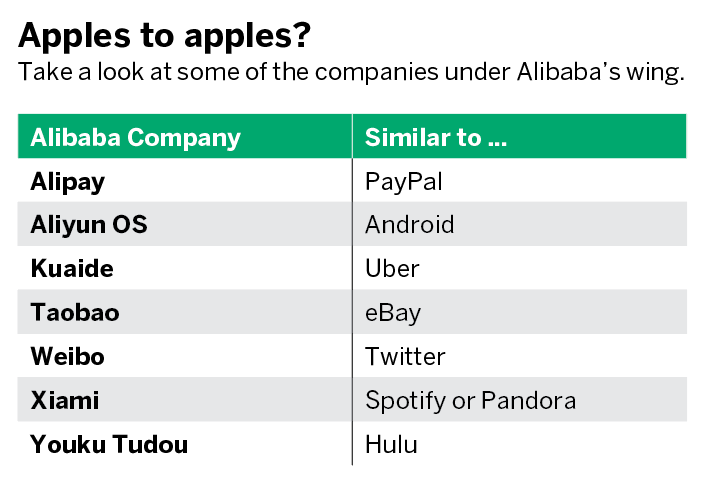

Alibaba

A Chinese holding company with a range of products and companies, Alibaba (BABA) invests mostly in independent firms that expose investors to only small amounts of industry risk. Takae a look at some of the companies under the wing of Alibaba in the table “Apples to apples?” below.

Here’s a slightly bullish trade that uses a short put in Alibaba. Because it’s a short option, it benefits from the decay of time—in effect, the investor will be “paid” to enter the trade through risking money.

Trade idea: Sell one put in Alibaba below the current price of 205. As of Jan. 29, the price of the April 200 put is $8.00. That means the seller will be paid $800 to enter this trade.

Caterpillar

Investors don’t realize most Dow Jones stocks are largely international. A great example is Caterpillar (CAT)—59% of its sales come from outside of the United States and nearly 25% come from the Asia-Pacific region. International sales have declined, but that perhaps explains why the stock is off nearly $40 from its highs.

Trade idea: Investors who’d like to take some risk could consider selling the 130 put in May. That’s a couple months away and will pay $530.

Starbucks

Starbucks (SBUX) operates 4,100 stores in China, the company’s second-largest market outside the U.S. While Chinese people aren’t known to be coffee drinkers (they often prefer tea), that’s changing and means a lot of potential for Starbucks.

Trade idea: Based on a neutral to slightly bullish position, short the 82.5 put and 95 call in April. That brings in approximately $210 worth of credit with lots of room to be wrong.