Time to Short Bitcoin? Check These 3 Signals

Given bitcoin’s high volatility, how do investors know whether an upswing marks the peak of the market or just a “local top” before another leg up?

Thanks to the transparency of bitcoin’s blockchain, analysts can see changes in spending behaviors, money entering and leaving exchanges, gains and losses among bitcoin wallets, and other information about what people do with bitcoin.

Certain patterns emerge when bitcoin nears its market cycle tops, just before bear markets begin. Three metrics—Puell Multiple, MVRV Z-score and HODL Waves—can help savvy investors see the momentum shift before everybody else does.

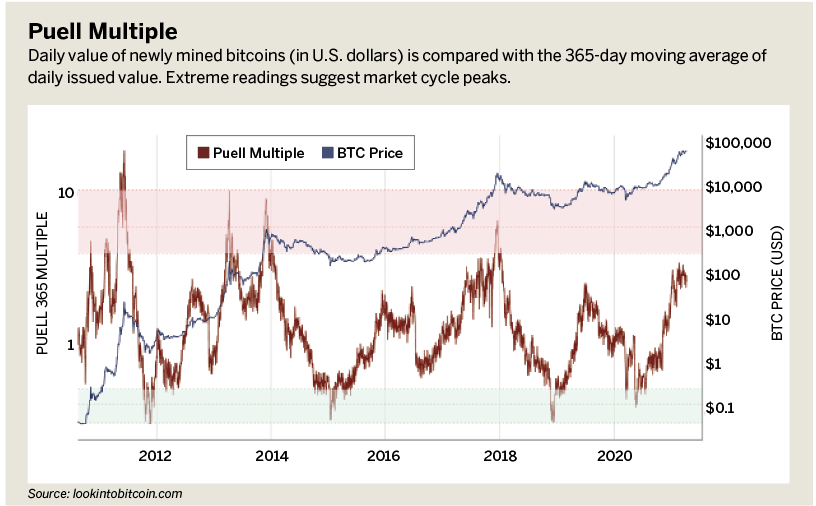

The Puell Multiple

The Puell Multiple compares the price of a newly mined bitcoin with the average market value of all mined bitcoins over a given period of time.

When the Puell Multiple gets high, miners tend to reduce their holdings. Some feel compelled to sell for local currency that they can invest in their operations, while others simply want to realize immediate profits.

Invariably, bitcoin bull markets end when the Puell Multiple hits extreme levels.

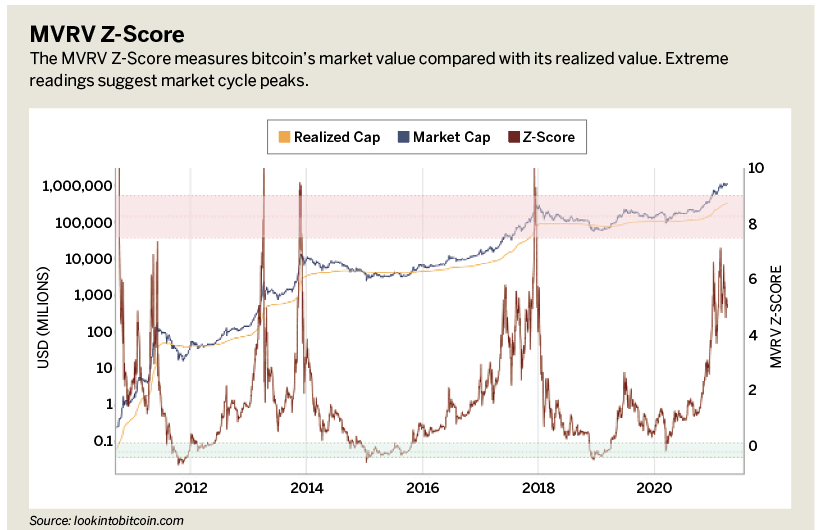

The MVRV Z-Score

MVRV Z-score measures the difference between bitcoin’s present price and the average price people paid for it. When the score gets high, people convert bitcoin into other things.

Maybe they want to cash out their new fortune. Perhaps they fear the market will crash.

For whatever reason, they tend to sell en masse. Every bitcoin bull market has ended with the MVRV Z-score at extreme levels.

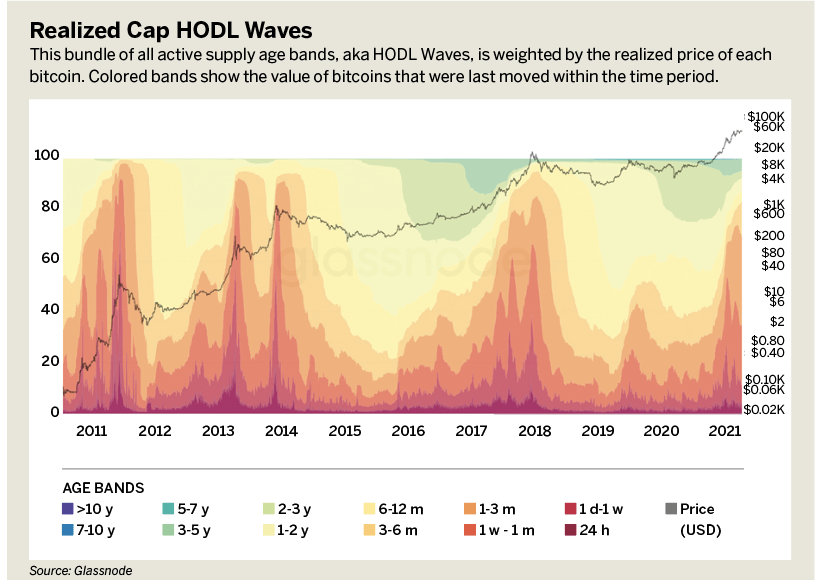

HODL Waves

While the Puell Multiple and MVRV Z-score can reliably signal market peaks, HODL Waves offer clues about how close or far those market peaks might be. These waves measure strength and conviction among people who have bitcoin but don’t use it. They’re known as “HODLers” in crypto-speak and as “diamond hands” on Reddit.

Historically, bitcoin peaks when at least 80% of its market value falls into the hands of short-term HODLers. These people tend to buy less often, purchase smaller amounts and sell more quickly than long-term HODLers.

One measure of HODLing—called Realized Cap HODL Waves—splits HODLers into bands that represent time frames, as shown on the chart.

The top bands represent the value of bitcoin in the hands of long-term HODLers, while the bottom bands represent the value of bitcoin in the hands of short-term HODLers.

While bitcoin’s price ebbs and flows, HODL Waves show clear spikes in short-term HODLers shortly before large corrections. Bitcoin’s bull markets end soon after those spikes go above 80%.

Behavior as data

MVRV Z-score and the Puell Multiple both measure human behaviors and impute all of the movements of bitcoin from all entities. When they both hit their peaks at the same time, bitcoin hits its peak, too.

At the same time, HODL Waves confirm the strong hands have sold nearly all of their bitcoin to people with weak hands who will eagerly sell the price drops or when prices go too high, too fast.

As a result, bitcoins flood the market and overwhelm buyers.

That’s happened only four times in bitcoin’s history: June 2011, April 2013, November 2013 and December 2017. Each time, bitcoin’s price dropped at least 67% in the month afterward, leading to one bear market that lasted six months and three bear markets that lasted longer than two years.

For an asset where big crashes are the norm and every boom seems to go parabolic, this data tells investors when to exit or accumulate.

With 1,000% returns seemingly mundane over the course of a full bull market and 80% losses standard for each bear market, even small advantages can mean the difference between a big loss and a massive windfall.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto is Easy newsletter at cryptoiseasy.substack.com. His second book, Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency, reached No. 2 on Amazon. @mkhelfman