When Airlines Stocks Resume Flight

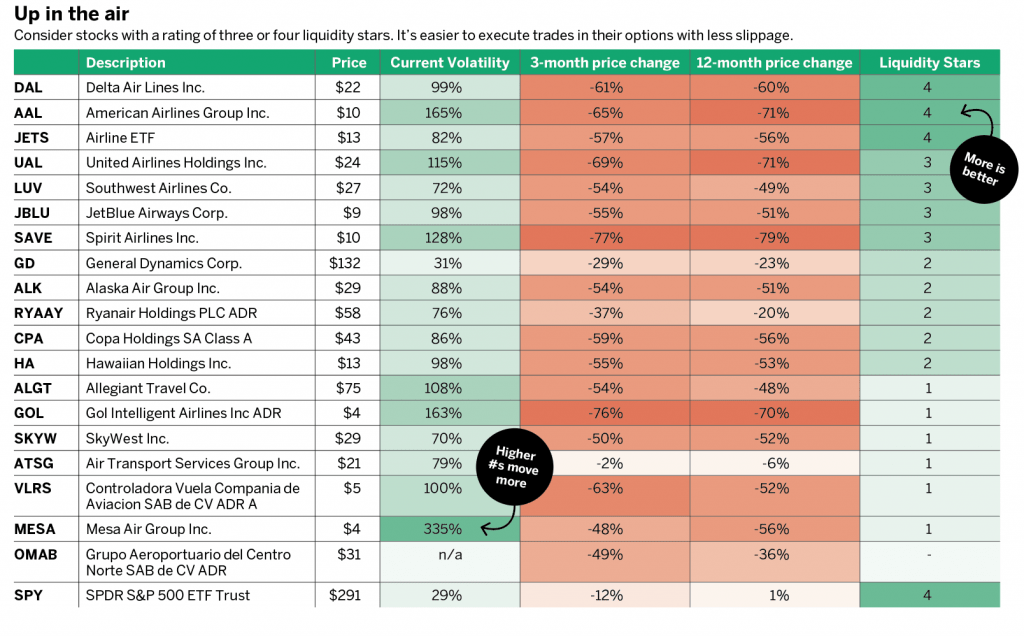

Because of coronavirus fears, the only seats filled these days are the ones in front of TVs. With very few people traveling, airline stock prices have declined an average of 50% during the past few months, prompting long-term investing maven Warren Buffet to make the unusual announcement that he was exiting his positions in the sector.

The decline has caused implied volatility in those stocks’ options to skyrocket. But high volatility can mean more opportunity.

Below are two trade ideas.

American Airlines (AAL) plunged 65% in the past three months and has a volatility of 165%. With volatility that high, traders can sell a naked put (a bullish strategy) in mid-July at 50% below the current stock price and receive a credit and max profit that could generate a return on capital of nearly 10% real-return on money in the next few weeks.

JETS is an airline exchange-traded fund (ETF). Because it’s an ETF, it’s a diversified portfolio and carries less risk than an individual airline stock but much more than the S&P 500. JETS has a volatility of 82%, versus the 29% of the S&P 500. Consider a covered call, another bullish strategy, which is buying 100 shares of JETS and selling a slightly out-of-the-money call. At those levels, the call can help protect against the downside risk of the stock falling by 9%. That means the price of JETS can decline by 9% and traders could still make money.

Sign up for free Cherry Picks and market insight at info.tastytrade.com/cherry-picks

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin