Strap in. Here’s 3 Reasons Market Volatility Will Remain Elevated Through Autumn.

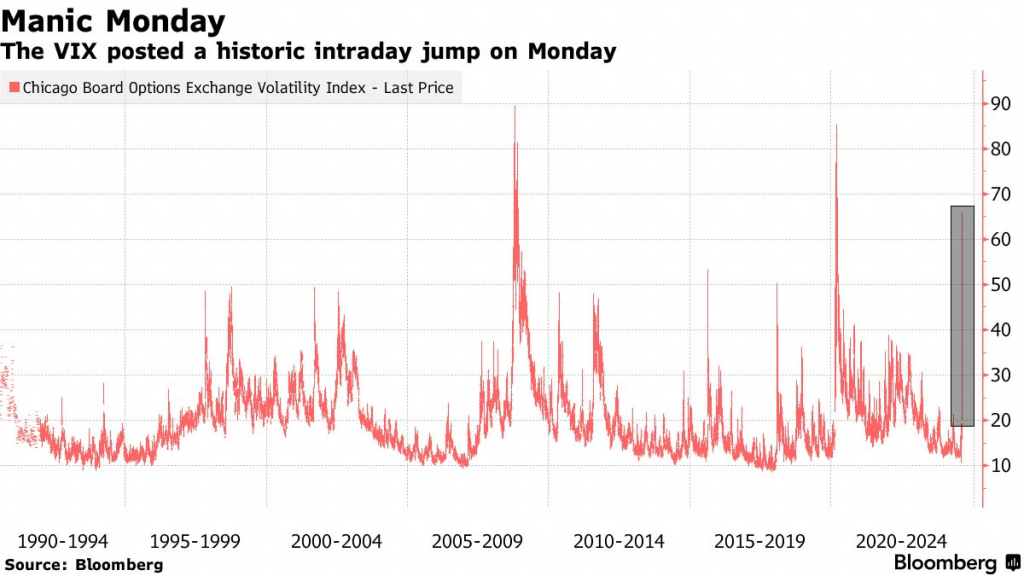

It wasn’t just a decline in prices in the last couple of days. Volatility reached its highest intraday level since 2020, but still closed below 40.

- On Aug. 5, stocks dropped sharply and market volatility surged, pushing the CBOE Volatility Index (VIX) to an intraday high of 65.

- Despite the spike, the VIX retraced, and ultimately closed below 40—a key level of long-term resistance.

- With autumn approaching and geopolitical risks rising, elevated levels of market volatility are expected to persist.

- Active investors should closely monitor 5,119 in the S&P 500, which served as a critical level of support on Aug. 5.

The financial markets cycle between complacency, panic and somewhere in between. And for most of 2024, investors have been highly complacent.

However, this narrative shifted abruptly in early August. Exhibit A, the stock market’s best-known gauge of risk—the CBOE Volatility Index (VIX)—spiked sharply on Aug. 5, signaling “fear” (e.g. anxiety) had returned to the financial markets.

However, the VIX had already been trending higher before the latest correction.

Anxiety started creeping back into the financial markets after President Joe Biden removed himself from the 2024 presidential race on July 21. Since then, the stock market has been exhibiting higher magnitude moves in both directions, foreshadowing a potential pullback.

Indeed, the market started moving south on Aug. 1, followed by sharp corrections on Aug. 2 and Aug. 5. Over those three trading days, the S&P 500 dropped by 336 points, or 6%, while the tech-heavy Nasdaq Composite fell by 8%.

All told, the S&P 500 is down about 8.5% since it peaked in mid-July, while the Nasdaq Composite is down closer to 13%.

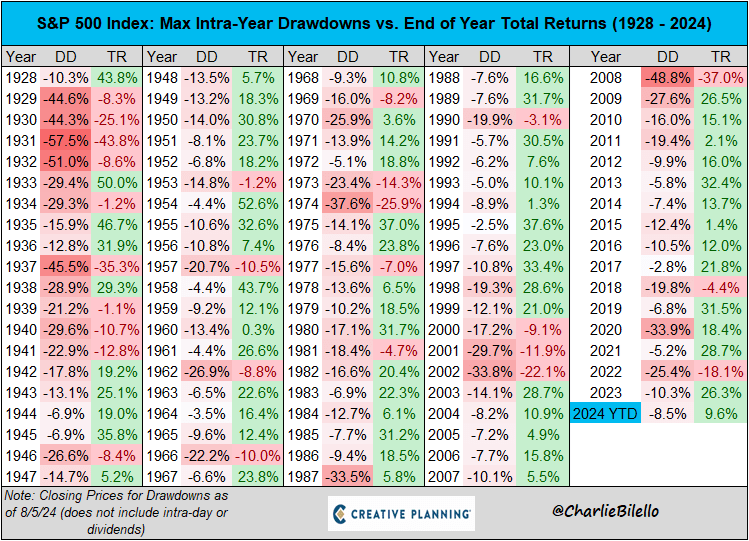

These are significant pullbacks, but they are likely best described as “normal.” The stock markets never move straight up. They always exhibit some degree of volatility, rising some days and falling on others. But they have consistently exhibited an upward bias over the long term.

Along those lines, the chart below details the maximum drawdown in the S&P 500 each year going back to 1928. As the data shows, drawdowns are relatively common, even during years when the return was ultimately positive.

Key support levels to monitor in the S&P 500

The big question now is where the major indices will bottom. While it’s difficult to answer with high confidence, there are clear levels of support that could represent the “bottom” of the current pullback. In the markets, support refers to a price where a downtrend might pause because of a strong concentration of buying interest.

The S&P 500 has already bounced off a key level of support. That occurred Aug. 5, when the S&P notched an intraday low of 5,119 before closing closer to 5,186. This 5,119 level represents nearly a 10% decline from the S&P 500’s recent all-time high of 5,670, and historically, 10% declines are fairly common.

The next major level of support in the S&P 500 is 4,970, representing the index’s most recent low in April. After that, a 20% correction would bring the index to about 4,500. Below 4,500, the next major level of support is roughly 4,100, where the current bull run started last autumn.

For now, the critical levels to watch are 5,119 and 4,970. If the market breaks through the latter, the VIX might finally close above 40, something it hasn’t done since 2020, when the world was grappling with the COVID-19 pandemic.

The VIX spiked above 60, but closed below 40

Beyond the support levels in the S&P 500, active investors can monitor the VIX for additional insight into risk sentiment on Wall Street.

On Aug. 5, the VIX spiked to 65, the highest level since 2020. However, the VIX didn’t close at that level and, instead, settled around 38.5. That’s significant because 40 has served as a strong level of resistance for the VIX in recent years. The VIX hasn’t closed above 40 since 2020, and over the years, 40 has become a hard ceiling, holding strong once again on Aug. 5.

The way the VIX retraced into the close may suggest a near-term stock market rebound is in the cards. And whether the VIX can finally close above 40 in 2024 is yet to be seen, although it does seem increasingly likely.

Three reasons volatility appears likely to persist

At the top of the list of reasons why volatility may remain high is the fact that September and October are usually the most volatile months on the year. The other stark reality is that this is an election year in the United States, and shifting expectations for the outcome will more than likely inject added volatility into the financial markets.

Another critical consideration is the risk of a major geopolitical event.

On Aug. 5, U.S. government sources indicated Iran could retaliate against Israel in the near future. While that outcome isn’t inevitable, U.S. Secretary of State Anthony Blinken reportedly told his G7 counterparts an attack might be imminent. However, we don’t know the details of the potential attack.

This understandably has the world on edge because any escalation of the ongoing conflict in the Middle East could have dramatic consequences. Plus, Russia’s war against Ukraine is still raging in Eastern Europe.

Together, these three considerations—the onset of autumn, the forthcoming U.S. elections and rising geopolitical uncertainty—indicate elevated volatility in the financial markets is likely to persist.

For passive market participants, that may be a cause for concern. But for active investors, the potential for increased volatility may be more welcome. Opportunities in the financial markets tend to multiply during volatile periods, and that’s likely to be the case in 2024, as well.

However, active investors should analyze their own risk appetites and assess whether prevailing market conditions are conducive to their strategic approach, market outlook and risk tolerance. For more insight on the 2024 financial markets, readers can tune into the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.