After Surge in EV Sales, China is Now the World’s Top Exporter of Vehicles

With electric vehicle (EV) sales surging globally, China has quietly become the world’s top exporter of passenger vehicles

- Due to surging sales of electric vehicles (EVs), China has quietly become the world’s top exporter of new passenger vehicles.

- The European Commission recently launched an inquiry into Chinese EV exports, investigating whether government subsidies have provided an unfair competitive advantage.

- The investigation is expected to result in increased tariffs on Chinese EV imports to Europe. The U.S. already imposes a 27.5% tariff on Chinese vehicle imports.

For roughly 140 years, the internal combustion engine has been the standard in passenger vehicles.

It all began back in 1886 when Karl Benz first started commercially producing motor vehicles featuring these engines. However, based on recent data, sales of vehicles featuring internal combustion engines peaked back in 2017 at 86 million units.

These days, electric vehicles (EVs) are the new rage. Unlike traditional vehicles—which are powered by the combustion of fuel—EVs are powered by batteries. But this technological revolution isn’t just transforming how vehicles are powered, it’s also shaking up who’s making them.

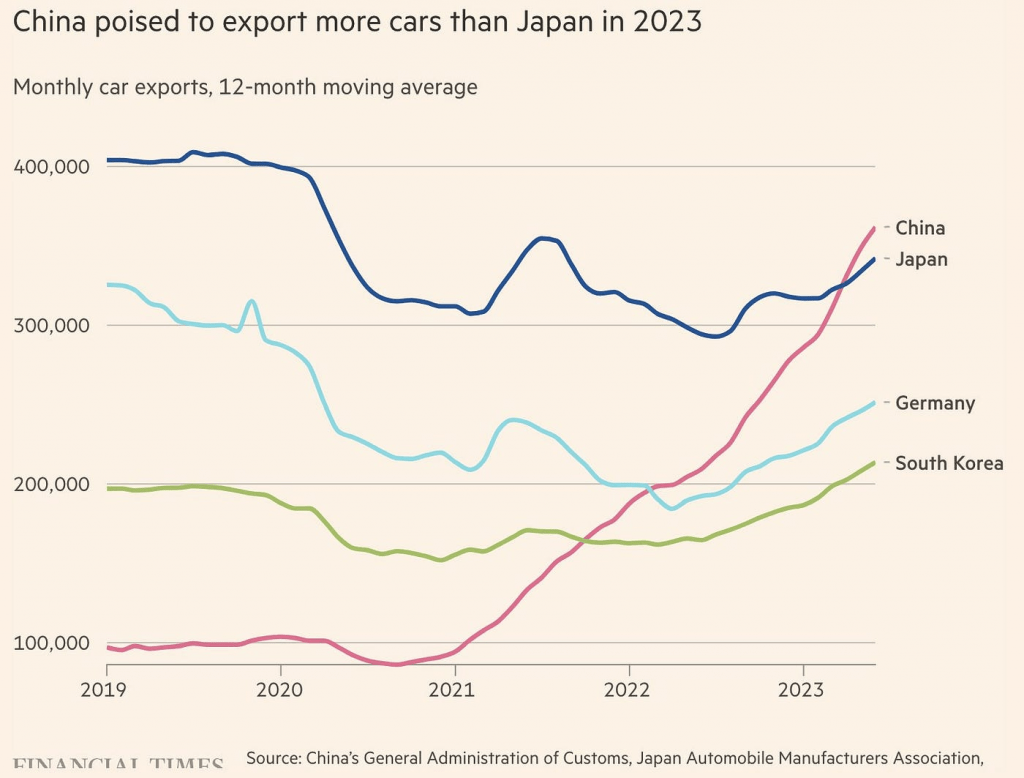

According to data collected in the first half of 2023, China is now the world’s largest exporter of vehicles. And most of China’s recent export growth has been attributable to so-called new energy vehicles (NEVs), which includes EVs.

International trade data shows that China exported just over 1 million vehicles in Q1, which was roughly 50,000 units more than Japan.

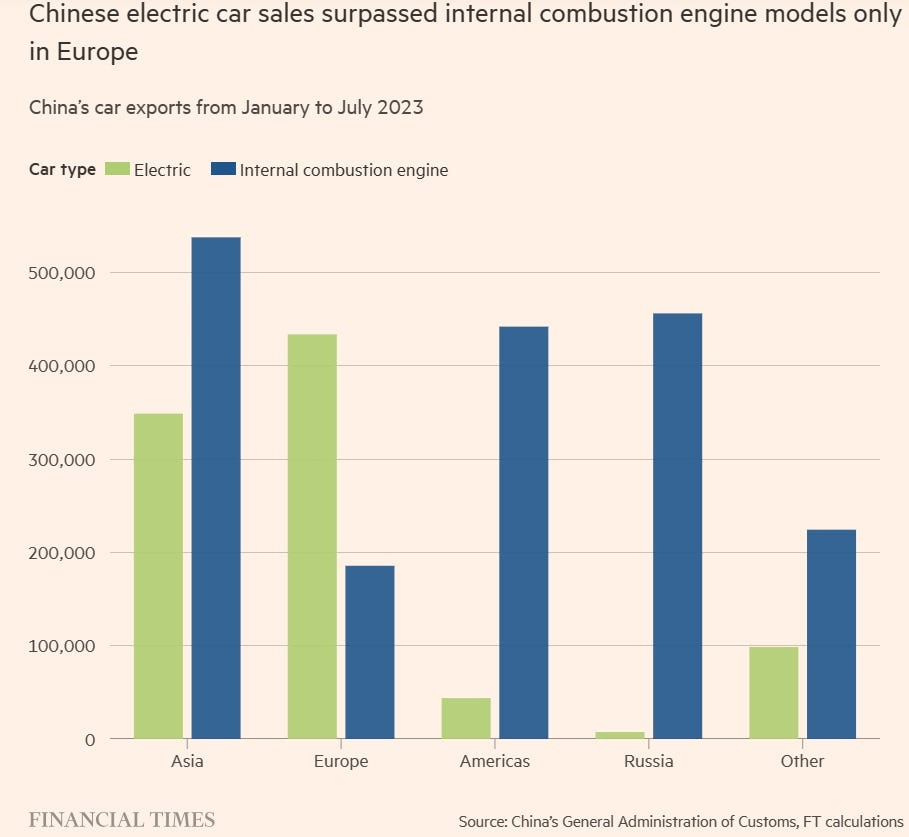

During the first seven months of 2023, China exported a total of 2.8 million vehicles, of which 1.8 million were gas-powered.

Based on those figures, China is forecasted to export about 4.8 million total vehicles during 2023. And some projections suggest that figure could jump to 9 million by 2030—pushing China’s total global market share to 30% from 16% in 2022.

In 2023, the surge in Chinese exports is attributable to increased demand from Europe. As a result of the war in Ukraine, Russia’s vehicle imports from the West have fallen off a cliff, and it’s been leaning on China to fill the gap.

As a result, the Geely Coolray crossover, a gas-powered vehicle, is now one of the most popular new cars in Russia, selling at an average price of about $14,000. In western Europe, however, consumers clearly prefer Chinese EVs over gas-powered vehicles.

As illustrated below, Europe has become the first region to import more EVs from China than gas-powered vehicles.

Surging demand for Chinese EVs appears to stem from technological advances in the Chinese market. But on top of that, Chinese EVs also tend to be less expensive than EVs produced in Europe, Japan and the United States.

Speaking to these competitive advantages, the chairman and founder of the Chinese EV manufacturer BYD Wang Chuanfu recently told analysts, “the Chinese EV industry is three to five years ahead of foreign legacy automakers in terms of technology and scale, and as much as 10 years ahead in terms of cost advantage.”

Independent research conducted by UBS appears to corroborate some of those assertions. Teaming up with an engineering team, UBS analysts took apart one of BYD’s most popular EVs—the Seal—and concluded that it probably cost 35% less to manufacture as compared to a similar EV produced by a European manufacturer.

Considering the relatively low wages paid for labor in China, there’s no doubt a competitive advantage for Chinese car manufacturers when it comes to manufacturing costs. However, that’s where yin (e.g. “shady side”) comes into play for the burgeoning EV industry in China.

Chinese EV Sector Landscape

China enjoys lower labor costs as compared to many of the other key regions where EVs are produced, including Japan, Europe and the U.S.

However, many experts have argued that government subsidies also play a big role in the Chinese automotive industry. And many competing EV manufacturers headquartered outside of China view those subsidies as anti-competitive and illegal.

As a result, auto manufacturers in Europe and the United States have been pressing lawmakers to crack down on imports of Chinese EVs.

In the U.S., such protections are already largely in place. Back in 2018, at the outset of the now infamous U.S.-China trade war, former President Donald Trump slapped a 27.5% tariff on vehicle imports from China. As a result, Chinese EVs haven’t managed to penetrate the American market, as they have in Europe.

However, based on recent developments, the European Union may be following suit with similar tariffs in the near future. On Oct. 4, the European Commission launched a formal anti-subsidy investigation into the imports of battery electric vehicles (BEVs) from China.

According to the official press release, the investigation “will first determine whether BEV value chains in China benefit from illegal subsidization and whether this subsidization causes or threatens to cause economic injury to EU BEV producers.” Furthermore, based on the findings of the investigation “the Commission will establish whether it is in the EU’s interest to remedy the effects of the unfair trade practices found by imposing anti-subsidy duties on imports of battery electric vehicles from China.”

Based on an analysis conducted by Politico, any provisional tariffs stemming from the investigation will need to be imposed within nine months of the start of the investigation. Moreover, any “definitive” tariffs would need to be imposed by early November of 2024.

Past investigations of this sort have resulted in tariffs ranging from 10-20%, which would be considerably less than the tariff currently imposed by the U.S. of 27.5%.

Leaders in China have already expressed their disappointment with the European investigation, and have threatened retaliatory measures if the tariffs are ultimately put in place.

A report by The New York Times recently highlighted how the Chinese EV manufacturer Nio (NIO) currently loses on average about $35,000 per vehicle that it produces. That’s based on the company’s Q2 earnings report, which revealed the company had lost roughly $835 million for the quarter.

On the other end of the spectrum is China’s largest producer of EVs—BYD (BYDDF)—which recently announced that it expects to book roughly $1.3 billion in profit during Q3.

BYD isn’t just the largest producer of EVs in China, it’s also one of the top two manufacturers in the world, along with Tesla (TSLA). And current projections suggest that BYD will become the world’s largest BEV manufacturer by the end of this year.

In addition to BYD, some of the other large vehicle manufacturers in China are listed below (sorted by total annual production, largest to smallest, along with year-to-date stock return, where applicable):

- SAIC Motor

- Geely Auto (GELYF), -26%

- BYD (BYDDF), +21%

- Changan

- Chery Motor

- Great Wall Motor (GWLLF), -4%

- Dongfeng (DNFGF), -28%

- GAC Auto (GNZUF), -29%

- BAIC Motor(BMCLF), +5%

- FAW Group

- JAC Motors

- Hozon Auto

- Li Auto (LI), +52%

- Nio (NIO), -21%

- Xpeng (XPEV), +32%

- Leapmotor

- AITO

Of the companies listed above, startups like AITO, Li Auto, Hozon, Leapmotor and Xpeng are focused primarily on BEVs, much like BYD and NIO. But of those seven companies, only BYD, Li Auto, Nio and Xpeng are publicly traded in the U.S.

It should be noted that some of China’s legacy vehicle manufacturers are also breaking into the EV space, and count among the world’s top 20 by the number of vehicles produced annually.

A total of ten Chinese companies are included in that list, including BYD, Geely, GAC, SAIC, Chery, Changan, Dongfeng, and Hozon. However, several of the aforementioned Chinese EV startups are on the cusp of breaking into the world’s top 20, including Li Auto, Leapmotor, Nio and Xpeng.

Chinese EV Sector Faces Significant Headwinds

The big question going forward is where all those Chinese EVs will be sold. Demand for EVs is highest in China, Western Europe and Northern America. And the two latter regions aren’t looking like fertile ground for Chinese EV manufacturers, due to the aforementioned tariff issue.

Chinese producers could attempt to skirt those tariffs by building factories in Europe and North America, but that would increase the average cost of production. In July, SAIC announced that it was considering building a production facility in Europe, but thus far, others haven’t followed suit.

Moreover, EV sales in China have declined in recent months alongside the slowing Chinese economy. As highlighted below, softening conditions in the Chinese EV market have also contributed to corrections in the lithium, cobalt and nickel markets—the latter of which are all key materials used to produce EV batteries.

All told, the aforementioned information suggests that further price appreciation in the stocks of Chinese vehicle producers could hinge on a turnaround in the Chinese economy, or better yet, the broader world economy.

Alternatively, a surprise decision by the European Commission to maintain moderate tariffs on Chinese EVs, as opposed to the 10%-20% tariff that’s currently under consideration, could represent a key catalyst for Chinese EV stocks, like BYD, Li Auto, Nio and Xpeng.

Importantly, shares of Tesla have also corrected by about 30% since peaking in mid-July. Tesla reported weaker than expected earnings during the week of Oct. 16, which is undoubtedly a net negative for the broader EV sector, as well.

All told, that means the headwinds for Chinese EV stocks will likely be stiffer than the tailwinds during the remainder of this year, and probably into early 2024, as well.

Barring a big turnaround in the global economy, there are probably better places to deploy capital for the time being, especially considering that bonds have historically outperformed stocks during previous economic contractions.

To follow everything moving the markets, including the bond markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.