From Engineer to Options Trader: How Gary Foster Achieved Trading Success

Meet an Iowa business owner who transitioned from John Deere engineer to consistent options trader specializing in covered calls on ETFs

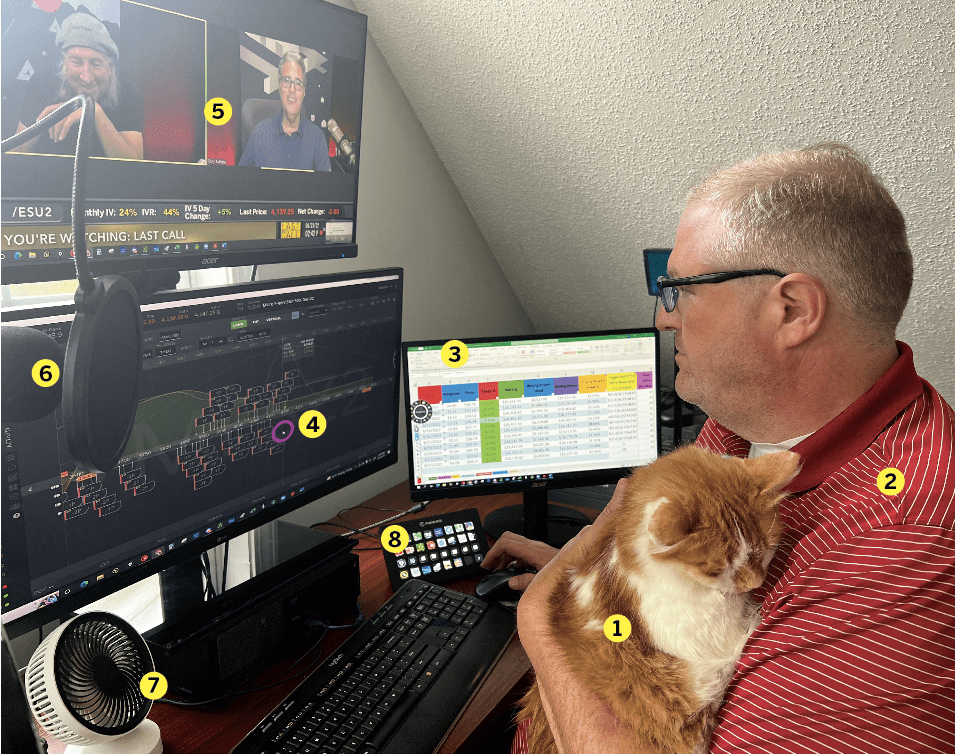

- Gary Foster, 39

- Cedar Falls, Iowa

- Years trading: 18

Gary Foster, a former engineer for John Deere with a background in CNC machining, has teamed up with his wife to operate Moment in Thyme Catering.

In the video below, you can see what he says about his approach to trading.

How did you start trading?

To make money, of course! I was going to trade futures, live in a Chicago penthouse and be worth millions. On my very first live cattle trade I lost $250 on a calendar spread. From then on I realized this may take some practice. My dad and I had a few interesting books that got us into it, and I’ve been hooked ever since.

Favorite trading strategy?

Covered call by far. When I want to stay small, I’ll do the ZEBRA or PMCC but the bulk of my position is in covered calls.

Which financial instruments do you most frequently trade?

Exchange-traded funds (ETFs), such as: IWM, TLT and SPY. I’ve been active in futures, as well, like /MES. Crypto? Not so much. I prefer markets with active options so that I can be more strategic.

Tell us about your success with trading.

I spent a couple years losing small amounts, like $2,000 to $3 ,000 per year trading with different strategies and learning what not to do. Now, I’ve been very consistent in bringing in monthly or quarterly returns. I’m up about 12% for the year in realized gains (after commissions and fees), so these aren’t huge earth-shattering returns but I’m consistent and I’m in control of what I can control, and I like that.

What was your worst trading moment?

I’ve managed to keep position sizes small, so I don’t have any large horror stories. However, one thing that drives me crazy is when I close a losing trade and then watch the underlying move in the direction I wanted—that’s the worst feeling. But staying small with these “take a shot” trades is key to my sanity.

Check out all the previous rising stars here.

Yesenia Duran — not an alien, not a zombie; just an editor.