Crypto Riche

1.7 million new millionaires and 56 new billionaires emerged in America in 2020.

Here’s a glimpse of the crypto class.

Aparody Twitter account called @justsaysinmice flags clickbait health articles with headlines like, “Scientists Find Link Between Video Games and Sexual Prowess.” But researchers discovered that trend only in mice. The same nudge and wink apply to the spate of breathless headlines proclaiming the explosion of investors becoming crypto millionaires overnight. Just say “on paper.”

As many as 100,000 people have $1 million or more stashed in bitcoin wallets, according to the cryptocurrency data-tracking firm bitinfocharts. That’s up from just 25,000 bitcoin millionaires three months ago. A year ago, only 15,000 people possessed millionaire bitcoin accounts.

Those are approximate counts because analysts gathered the data in February, but bitcoin has undeniably become a major player in the field of alternative assets. Its market cap is approaching $2 trillion, and it accounts for half of the money invested in cryptocurrency.

But don’t get the impression that bitcoin has the cryptocurrency scene all to itself. More than 9,000 cryptocurrencies have crowded into the field, according to the CoinMarketCap website. Some were created in the hope of mass adoption and others came into being as the punchlines of jokes.

Because this issue of Luckbox is dedicated to all things crypto, it seems appropriate to delve into the world of crypto millionaires. Are they the new nouveau riche? If you’re hoping for MTV Cribs-style videos of palatial estates, Learjets and more beluga caviar than you can shake a fur coat at, prepare to be underwhelmed. Crypto millionaires are as enigmatic as the blockchain, but several inherent traits have emerged.

First, luck. Just right place, right time luck. This is pure market timing. The second trait: All crypto millionaires are zealots. Fanatical and unwavering in their belief that crypto is superior to gold, fiat money and their ex-wives. And finally, when crypto millionaires have funds, as jaredx3 writes on the r/bitcoin subreddit, “most of us take profits into bitcoin, not out of it.”

But let’s start at the top.

The first bitcoin billionaire

Sam Bankman-Fried is a 29-year-old crypto billionaire several times over. Sixteen times, if you believe the latest Forbes magazine estimate. According to the Yahoo Finance site, “many of Bankman-Fried’s digital assets are illiquid, of speculative value and just plain weird—his sudden prosperity appears to constitute one of the fastest accumulations of self-made wealth in history.” Bankman-Fried started the Hong Kong-based cryptocurrency futures exchange FTX in 2019.

Yes, that FTX, the one with its name sewn onto MLB uniforms and attached to a new stadium in Miami. The one that Tom Brady touts.

Journalist Roger Parloff described the enterprise this way for Yahoo:“Last month, FTX—of which Bankman-Fried owns nearly 60%—completed an industry-record $900 million fundraising at an $18 billion valuation. That valuation was 18 times higher than it had been 17 months earlier, at FTX’s first-round fundraising in

February 2020.”

Like most crypto millionaires and billionaires, Bankman-Fried believes in redeploying profits, either into charity or back into crypto ventures. A disciple of “effective altruism,” Bankman-Fried views work merely as a vehicle for funding his altruism.

His mother, Barbara Fried, had this to say: “If you’re earning money for personal consumption, there is a very steep, declining marginal utility of income. After your fifth Porsche, do you really need a sixth?

But if you’re earning money to give it away to charity, there’s no diminishing marginal utility to money.” Which explains why, despite his billionaire status, Bankman-Fried lives in a modest Hong Kong apartment with roommates.

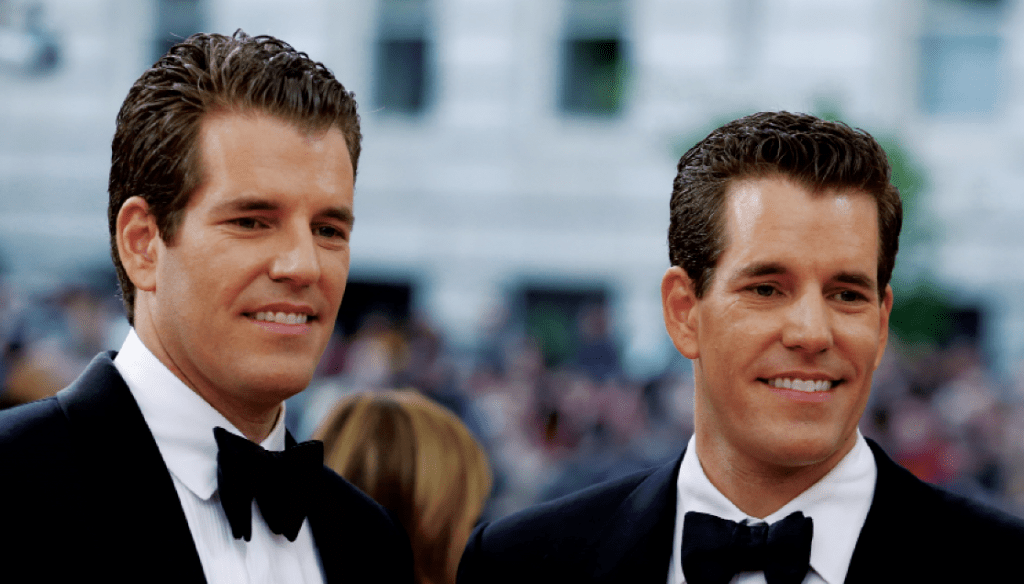

The O.G. bitcoin kings

Tyler and Cameron Winklevoss became infamous because of the way screenwriter and playwright Aaron Sorkin portrayed them in The Social Network, a 2010 film about Facebook. The twins came off as giant brutes hellbent on destroying Mark Zuckerberg. But when they tried to use their Facebook settlement to become venture capitalists, no one wanted their money (insert sad trombone sound) so they pivoted into becoming the Kings of Crypto.

The dynamic duo doubled down and started the cryptocurrency exchange Gemini in 2014 and later founded Block-Fi. Through their personal accounts and various business ventures, the Winklevii have claimed to manage or own 1% of all the bitcoins in circulation, an estimated 180,000 coins.

Today, Gemini offers trading and support for more than 30 cryptocurrencies and is one of the largest crypto exchanges in the world. In March of this year, Block-Fi raised $350 million at a $3 billion valuation. Combined, it’s estimated that the Winklevii’s net worth is close to $6 billion.

The baby-faced bitcoin millionaire

Erik Finnman has become famous as the “youngest bitcoin millionaire,” and his life story provides fodder for screenplays. Using $1,000 he got from his Nana, he started investing in bitcoin in 2011 when it was $12! He dropped out of high school at age 15 and made a deal with his parents—if he became a millionaire by the age of 18, then he didn’t have to go to college. Get Timothee Chalamet’s agent on the line—he’s perfect to play this

kid Finnman!

But cryptocurrency didn’t actually make Finnman’s fortune. He liquidated his “Nana coins” for $100,000 when bitcoin hit $1,200 and used part of the money to start a video education service called Botangle. He used the rest to take some fancy trips and to finance a meet-and-greet with Reddit co-founder Alexis Ohanian. Finally, the travel Insta-porn I was

searching for.

In another scenario worthy of a Hollywood movie, Finnman sold Botangle in 2015 and the buyer offered him either $100,000 in cash or 300 bitcoins, which at the time were trading for around $200 a coin. Because of his zealous belief in bitcoin, he chose

the coins.

Asked how he learned about bitcoin he tells this story: “I was in Washington, D.C., at the Jefferson Memorial. My brother brought me to this protest, and some people got arrested for dancing—like Footloose. Some guy had a bitcoin shirt on. We were in the middle of running from the police, and I asked him what it was. He was like, ‘It’s going to end Wall Street, bro,’ and ran off. That was how I found out about bitcoin. I researched it as soon as I got back and just really saw how great it would be—saw

its future.”

Um, can we see if Matt Damon is available to play bitcoin T-shirt guy? Now in his early 20s, Finnman is thinking beyond crypto, making investments in venture funding, a cell phone and other endeavors.

The holy-crap-I’m-glad-this-had-a-happy-ending crypto guy

Chances are you’ve heard this story: Someone’s brother’s cousin’s roommate’s sister’s boyfriend hit the crypto jackpot. This lucky crypto urban legend is Dan Conway. His first-person account of how he came into his crypto millions literally caused my heart rate alert to chime on my Apple Watch.

As he wrote in Hustle magazineabout his visit to a bank branch to withdraw funds:“My voice sped up as I said it: $100k. This represented my family’s entire life savings. It was money my wife and I planned to use to pay for our three kids’ college tuition, our eventual retirement and emergency expenses. I was a middle-aged guy with a family who had never been on the cutting edge of anything. But I was about to bet everything I had on an unproven virtual currency called ethereum.”

Conway wrote about how unhappy he’d been in his corporate job and mused about his addictive personality. “A part of me recognized these thoughts as destructive mania,” he confessed. “My addictive personality had landed me in trouble before—first with alcohol, then with harder drugs. My 12-step sponsor wasn’t going to pat me on the back and say, ‘Go buy that bitcoin, Dan! Sounds like a fantastic plan!’”

This is where I started yelling at my computer. By December of 2016, Conway’s $100,000 investment was worth only $40,000. So what does he do? Get even more zealous!

“Though I was $60k in the hole, my confidence in ethereum was stronger than ever … and it was now at a bargain-basement-level price,” Conway wrote. “So, I decided to double down. That winter, I borrowed $200k on my home and used it to buy more ETH. I now owned 26,750 ETH total, at an average buy-in of $11.21 per coin. And I was $300k in the hole.”

This is where I punted my computer into Lake Michigan. But in 2017, things turned around for ethereum, and in a span of four months Conway’s investment was worth $6 million.

“On Jan. 3, 2018, ethereum hit $900; three days later, it passed $1k. Then, over the course of two hours, I sold 11k ETH, the majority of my remaining stack, for $10m,” Conway reported.

Even Conway realizes the role that luck played in his success story. “I banked everything I had on relatively unproven technology and got out at the right time,” he wrote. “For every story like mine, there are hundreds of others about people who lost it all. I know that could’ve easily been me.”

Crypto isn’t bound by something as strong as the immutable laws of physics. No, it’s more like the Muskian laws of the Wild West. To the uninitiated, it seems crazy to mortgage your house, cash in your 401(k) plan and risk your kids’ tuition to obtain an asset that fluctuates on the musings of a man who tweets “dank memes,” sold all of his belongings and has more baby mama drama than an episode of Maury.

And there are very real concerns about cryptocurrency—like access and security, environmental effects and the ever-increasing risk of a Janet Yellen smackdown in crypto town. Enthusiasm is great when you’re investing, but be careful that it doesn’t border on zealousness. No one knows what the future holds for crypto, but putting stock in Horatio Alger-like tales of rags-to-crypto can be dangerous. Engage in the crypto market, but do it with your eyes wide open. For the love of all things Shiba, don’t drain your savings.

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan