The Pawn Trade

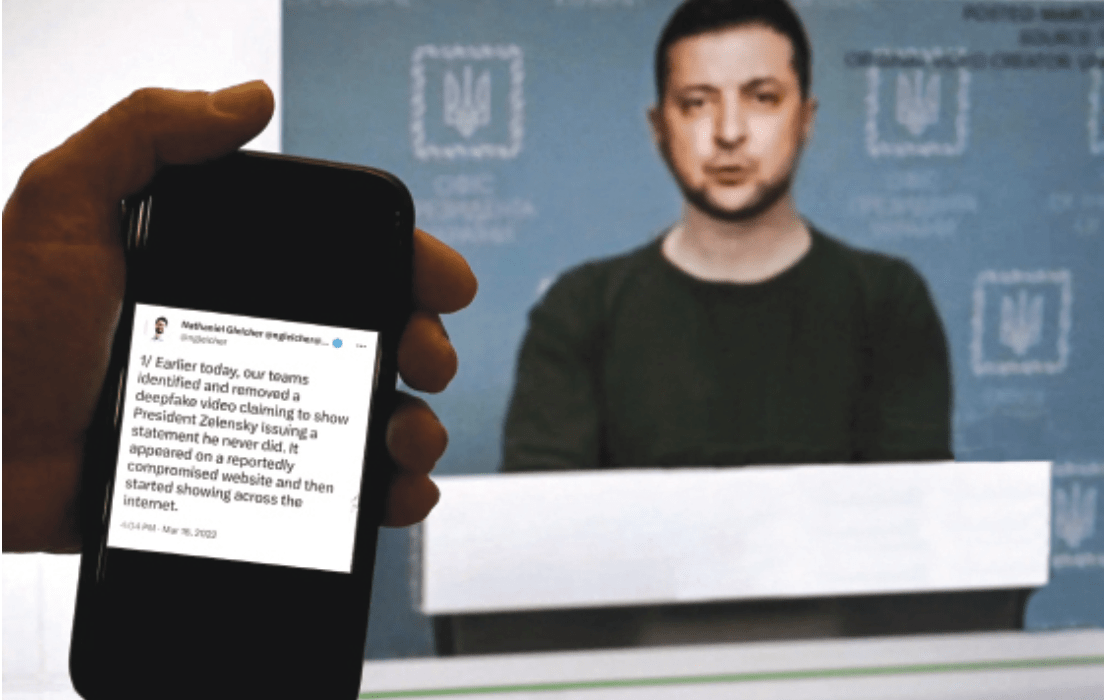

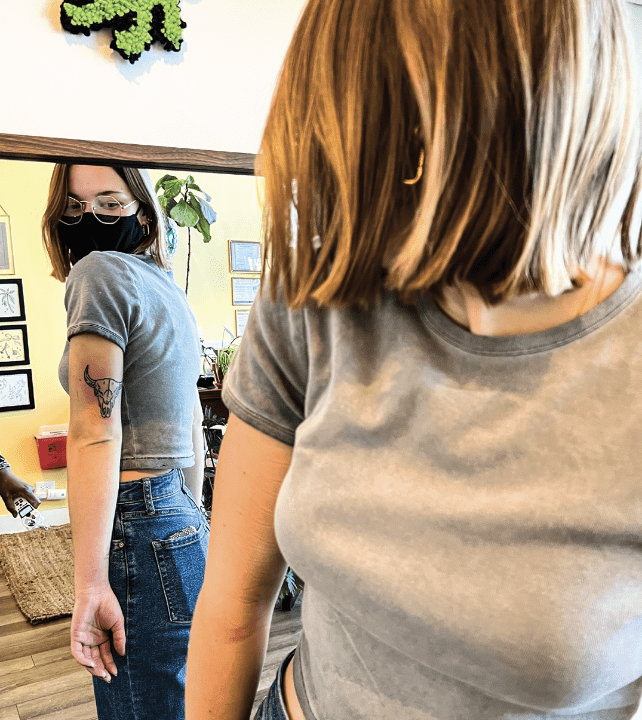

Do rich people pawn stuff? California-based Ideal Luxury offers clients private consultations in an office that looks more like an Edward Jones than an EZ Loan.

Orange County, California: Home to smog, pristine beaches, housewives botoxed to within an inch of their life…and pawnshops?

I hadn’t been to a pawnshop since I was 15 years old and in the market for a used acoustic guitar so I could become the Black Jewel. (Does that make me onyx?) Anyhoo, all of my knowledge of pawnshops comes from the reality series Pawn Stars.

But this issue of Luckbox is all about trading and bartering, so we decided to interview the nation’s premier luxury pawnbroker. Our objectives included learning about the upscale pawn market, discovering how to get luxury goods for less and finding out whether rich people really pawn stuff.

Lux pawn

In his book Pawnonomics, author Stephen Krupnik details the 5,000-year history of the pawnbroking industry and makes the tongue-in-cheek claim that pawnbroking is the second oldest profession. But that joke may have a basis in fact—depending upon your experience, you might walk out of a pawnshop feeling like you got screwed.

“Every year, some 30 million Americans frequent the country’s 11.8k pawnshops in the hopes of securing a loan in exchange for collateral,” writes Zachary Crockett for The Hustle, a website created to debunk nearly everything. Pawnshop loans, purchases and sales add up to $6 billion dollars per year, he notes.

But dollars and cents alone can’t explain the whole pawnshop “experience” of neon signs, buzzing doors, and a man with a cigar protruding from his mouth saying, “Best I can do is…”

Yet, California entrepreneur Mark Schechter suspected there was a better way. To spend time with his family, he went into the jewelry and loan business with his father in 2008. At first, their store was a traditional pawnshop, and Schechter found himself working even more hours than at his old corporate job.

“I had a good friend whose wife is Panamanian,” he said. “Yeah, in Panama [pawn] is totally different. You go sit in someone’s office with a cup of coffee and discuss your private business behind closed doors. It’s done privately—not publicly.”

That seed of an idea germinated, and in 2013 Schechter launched Ideal Luxury in Tustin, California. The American luxury pawn concierge was born.

Ideal Luxury provides clients private consultations in an office that looks more like an Edward Jones than an EZ Loan. He offers loans, consignment and a retail arm of the business.

Industry trends

Some 7.4% of all U.S. households have visited a pawnshop, according to the National Pawnbrokers Association. That figure jumps to 40% among lower-income earners.

The average pawn loan is just $150, but even that amount can be significant to someone in dire financial need. During the pandemic, Schechter quickly pivoted to meeting the needs of high-end customers who wanted to buy tangible assets.

“We saw our retail sales go nuts when COVID first hit,” he recalls. “We had a streak, and I want to say it was almost two straight months where every week we had a retail sale that was five figures or greater.”

Watches became his favorite tangible asset during the pandemic, and Ideal Luxury offers timepieces only from companies like Rolex, Patek Philippe and Audemars Piguet.

Now, as the economic climate shifts, Schechter is seeing changes in his business. “You’ve got to add some zeros” to the end of the loans his clients now need, he says.

“Our loans might have been 20% of our business because we’re a quality play, not a quantity play,” Schechter says of the days before the pandemic. “I would say right now on the lending side it’s probably closer to 40%,” with an increasing number of loans sought for luxury purses, watches and jewelry.

So, what’s next for Ideal Luxury?

“We’ve pulled back on what we take in and how much we offer,” Schechter acknowledges. “It’s gone from a seller’s market to a buyer’s market. So, before I would take what I could get, but I can only buy so many watches and diamonds in the next 30 days. I’ve got to make sure that what I’m buying is something that I don’t mind owning for a long time if things get really bad.”

He sees that trend lasting until the end of Q4 2023.

First-world problems

I assume rich people dive into their rooms full of money á la Scrooge McDuck. So, I asked Schechter for examples of how his clientele use the loan part of his business.

In California, pawnshops’ monthly interest rates are around 3% for loans under $2,500. Over that amount, rates are “negotiable.”

Schechter’s clientele qualify as “asset rich and cash poor” and use his loans to bridge a liquidity crisis, he says. He tells me of a young real estate agent out to make a name for herself. She closed her first deal but her commission check wouldn’t hit her account for another six to eight weeks. But she had a Birkin handbag her mom gave her for graduation. She used a loan on the bag to live on until her check cleared. (I think I got a Panda Express gift card when I graduated.)

Ideal Luxury’s loans also help entrepreneurs—sometimes a lot. “I always say we’re not saving lives,” Schechter continues, “but I’ve had someone that had to make a COBRA (health insurance) payment. Within two hours they’re going to lose their health insurance.”

On the consignment side of the business, Schechter offers the tale of a man who brought in a bag of jewelry and a wristwatch without straps. A competing broker had offered the man $10,000 for the watch, but Schechter wanted to do some digging, and the client agreed.

It turns out the watch, a rare, sought-after Rolex, had a value of $50,000. Ideal Luxury takes 25% on consignment, so the customer walked away with nearly four times as much cash. Schechter’s industry knowledge paid off.

Expected value

Bougie-adjacent shoppers find really good deals at pawnshops. Curious about this trend, I visited the premier pawnshop in Chicagoland. (Narrator: “It was not premier. It was in a sad strip mall next to Papa John’s.”)

The jewelry in the pawnshop’s case looked appropriate—for an out-of-the-way Service Merchandise in 1984. Luxury offerings included a sad-looking cream-and-white Louis Vuitton Neverfull tote. A mint green Gucci clutch looked out of place next to a gun rack.

I then toured the Ideal Luxury site for comparison and was blown away by the high-quality luxury goods and competitive prices. Unlike sites like Tradesy and Poshmark, Schechter takes in only pristine goods and then uploads their unretouched, unedited photos to the site.

He once acquired a $2 million Harry Winston ring for such a good price he was able to sell it to a happy customer for less than a million.

A fetching pink diamond in a gorgeous setting caught my eye on the site. A widow sold it to Schechter so she could buy property.

One client bought a Rolex watch at a considerable discount and said it “will get me out of jail anywhere in the world.” Um, you do you, buddy.

I hope never to need a luxury concierge, but if I ever do I’d want one that lists core values on its website—the way Ideal Luxury does.

The pawn industry is under threat because legislators want to wrap pawn loans in the same blanket as “predatory payday loans”—even though the owners reclaim most of the goods offered up for pawn.

Schechter is confident and charismatic, and he remarks more than once to Luckbox that “I’m not of the business—I’m in the business.” But he’s changing the way the pawn business works and for the better. So, if you’re a large bearded man, I’m a ring size 6 and I love the color pink.

Vonetta Logan, a writer and comedian, appears daily on the tastylive network. @vonettalogan