How A Press Release Becomes A Post

“Fake news” entered our lexicon in 2017. Often, the tainted term can seem ambiguous – its meaning tortured to fit a particular political perspective.

But fake news doesn’t always concern government. Far too many pieces of fake financial news are bouncing around in the media these days.

Much of the financial fakery resides online. Digital news platforms struggle daily to attract eyeballs that build traffic and sell advertisements. Two factors influence digital traffic – the quantity and the quality of content posted on the site. That’s why many website owners stay on the lookout for more content to post. To simplify matters, some prefer turnkey content that’s free of charge and ready to publish.

Financial public relations firms understand that hunger for content. In fact, some now exist mainly to fill that void. They represent untold numbers of mutual fund managers, investment advisers and financial newsletter writers longing for electronic “ink” that will increase their visibility and thus help them sell more of whatever they are promoting.

What follows is a factual account of a fake financial news “sting.”

On Dec. 19, 2018, the major U.S. equity indices dropped sharply, each closing lower for the third consecutive day as investors remained wary of the Federal Reserve Bank’s widely expected fourth rate hike of the year. During the previous two trading sessions, the Dow lost more than 1,000 points and the S&P 500 made its lowest close in 14 months.

In the aftermath of that downturn, a personalized email arrived in the luckbox inbox at 7:30 a.m. Eastern Standard Time from a California-based public relations firm. The writer got to the point in the second paragraph. That’s where Gerry Frigon, chief investment officer of Taylor Frigon Capital Management, commented on the return of the “hissy fit.”

Sixteen, bulleted, quotable talking points followed. The first three of which, read…

- We have discussed many times over the last decade or so how the market’s reactions to scary headlines and prognostications of gloom can be described as a “hissy fit.”

- It’s like the reaction of the spoiled child who is told they can’t have any more candy. Stomp out of the room in a huff and whine and complain for hours as if that is going to make a difference.

- Worse yet, and certainly the root cause of “spoiled child syndrome,” the parent gives in and lets the child have what they want only to find the child finds something else to be “pissy” about.

Pure drivel…utterly useless commentary. Good luck with that, Gerry. A PR firm should have little chance of grabbing exposure with this nonsense. No reputable financial news outlet would seem likely to publish such valueless blather. But what happened next? Watch how noise becomes signal, as this PR becomes a post…

Enter ValueWalk, the self-described “news site responsible for breaking worldwide news on business, value investing, politics, technology and science.” At 10:27 a.m. EST, the site posted a story titled, ZIRP: The Return of the Hissy Fit, a nearly verbatim regurgitation of Frigon’s cut-rate clickbait. In less than three hours, prattle finds a platform.

The financial PR firm scored a placement for its client. The firm boasts on its website of having secured hundreds of articles for clients in the Financial Times, WIRED, Tech Crunch, MIT Technology Review, and The Economist. The company also uses the site to tout itself as “a reliable and trusted source among journalists.”

The ValueWalk website, which boasts traffic of five million visitors per month, gets a free story to post to attract more readers.

Taylor Frigon, the mind-numbing, hissy-fit spotter and investment manager of the barely breathing ($12 million in assets) and inexplicitly expensive (1.45% fee) Taylor Frigon Core Growth (TFCGX) mutual fund lives to see another day with hope that imbecilic insights may incent some fund inflows.

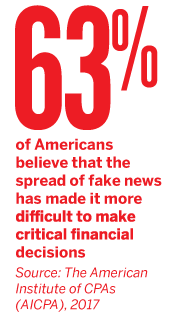

Unfortunately, this happens every day. The result is that many Americans are either poorly informed, or, underinformed. According to a 2018 AICPA/Harris Poll, 28% of Americans involved in investment decisions never study investment strategies or search for potential investment opportunities.

At luckbox, the editors are convinced that the proliferation of financial media noise, fake signals, misinformation and investors’ lack of research is what causes 32% of Americans to make poorly conceived, high-risk investments.