July Earnings Season: Will Double Volatility Double the Fun?

Americans love the Fourth of July’s fireworks, warm weather and celebratory beverages. But this time, an ominous feeling has taken hold.

The pandemic has made large gatherings dangerous, and the financial markets remain extremely volatile.

Stocks staged an epic rally in April, May and June that saw many return to their previous highs or even establish new highs. Normally, that would have been a relief.

But uneasiness hasn’t subsided because market volatility has remained stubbornly high in June and July, especially compared with the relative complacency of summer trading in years past.

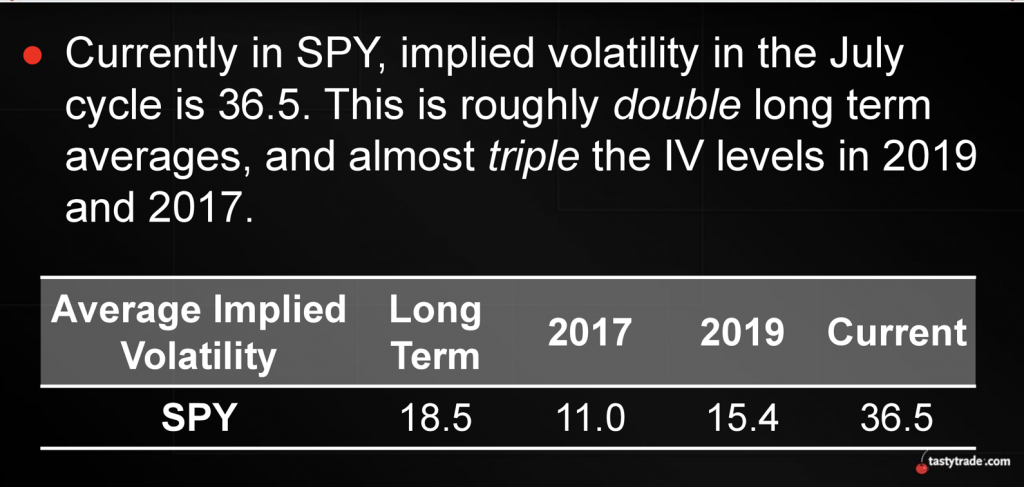

In fact, implied volatility for the July expiration cycle is about twice as high as the historical average for that period, according to tastytrade research.

“Expiration cycle” refers to the monthly expiration of standard, exchange-traded options that normally expire on the third Friday of the month. The July expiration cycle in 2020 stretches from June 20 through July 17.

When comparing the 2020 July expiration cycle with 2017 and 2019, the contrast really hits home—the 2020 July expiration cycle has been about three times as volatile as 2017 and 2019, as highlighted in the graphic below.

The data above shows why investors may feel unsettled about the current trading environment.

While 2017 was the least volatile year in market history, 2020 is now in the running for the most volatile year ever.

During the first half of 2020 the S&P 500 experienced 26 trading days when the index moved by more than 3%. One has to go back to 2008 to find a higher number of such moves—42 days to be exact. Based on the current pace, the market will eclipse that number (42) in the fourth quarter.

Adding to the suspense, public companies begin reporting second-quarter earnings in mid-July, a “season” that can also push volatility higher. Unofficially, JPMorgan (JPM) is expected to kick off Q2 earnings season on July 14.

Projections for Q2 look miserable, with total average earnings for the S&P 500 expected to decline by a jaw-dropping 45%. And while the epic hit to profitability in Q2 has already been built into expectations, the earnings reports themselves will undoubtedly provide further clarity on profitability for the remainder of 2020 and beyond.

That information should provide traders with insight into the potential economic recovery in the United States and abroad. Currently, the stock market is pricing in a sharp V-shaped recovery in the earnings potential of public companies.

However, data released during the upcoming earnings season could cast doubt upon that V-shaped recovery,and spark additional volatility in the global financial markets through at least the third and fourth quarters—and perhaps beyond.

Analysts project negative earnings and negative revenue growth in 2020 but a quick reversion back into positive territory in 2021—that’s the supposed “V”—as shown below.

But it’s difficult to assign a high-degree of confidence to third and fourth quarter earnings projections, much less beyond. That uncertainty helps explain why volatility remains high and why the VIX is still above 30 despite the recent rally.

The remainder of 2020 could offer plenty of fresh trading opportunities. However, before taking on new exposures, traders should realize that risks are elevated.

In terms of the Q2 earnings calendar, projected (i.e. not confirmed) earnings dates for some of the most anticipated upcoming announcements include:

- 7/15 Intel (INTC)

- 7/16 Microsoft (MSFT)

- 7/16 Netflix (NFLX)

- 7/22 Facebook (FB)

- 7/22 Tesla (TSLA)

- 7/23 Alphabet (GOOGL)

- 7/23 Amazon (AMZN)

- 7/28 Apple (AAPL)

To learn more about the mid-summer volatility landscape, readers may want to review a new installment of Tasty Extras on the tastytrade financial network.

More detailed information relating to earnings season and associated trading strategies can be found here.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.