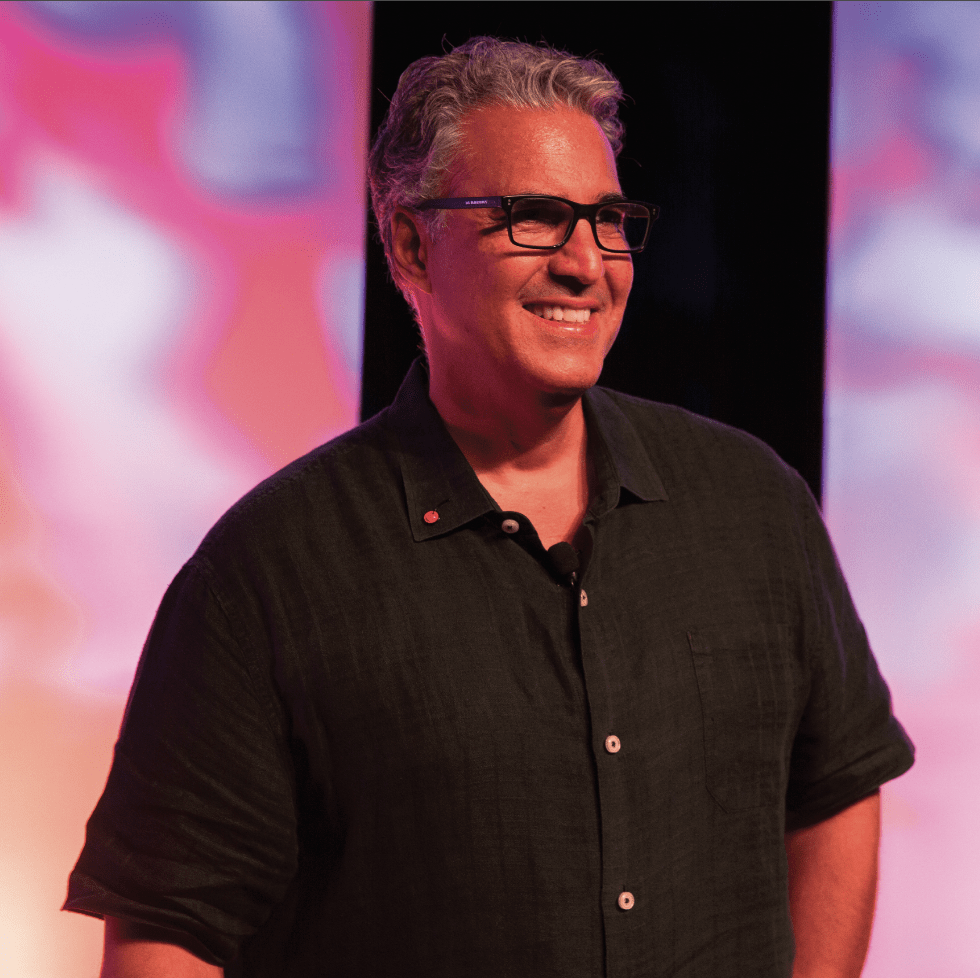

The Master Trader & Educator

“Those who can’t do, teach” is a truncation of a line from Man and Superman, a 1905 George Bernard Shaw play. It’s a maxim that’s often true in the world of options trading, where hucksters pose as teachers to peddle pointless newsletters or charge fees for dubious advice. Yet, one altruistic educator offers true wisdom to options traders struggling to negotiate the markets—and he doesn’t charge a cent for it.

Meet Tony Battista.

Tony “The Bat” Battista has been “in it to win it” since his early days on the streets of Brooklyn.

The legendary trader, skillful educator and valued co-host to Tom Sosnoff on the tastylive financial network, recently sat down with Luckbox to reflect on how he taught himself to trade and why he helps others write their own rags to riches stories.

The only child of a single mother who tried to keep him on a straight and narrow path, Battista learned much later in life that he was one of five children from his father. As a child, he thought his dad was on a very long car-buying trip, but he was actually serving time in Lewisburg State Penitentiary for bookmaking.

Battista chose not to follow in his father’s loan-shark footsteps. Instead, in 1980 at the age of 18, he packed up his mother’s Dodge Diplomat, shoved his last $300 into his pocket and pointed the car westward toward Chicago and the new Chicago Board Options Exchange (CBOE).

“I always thought when I left Brooklyn, New York, to come to Chicago, that I would stay in Chicago for a couple of years, make a fortune and then move right back to my same neighborhood in Brooklyn,” Battista said. “But you quickly learn once you get a taste of a good life here, what you had there was good only because your bubble was so small.”

Thanks to his cousin, he landed a job as a runner on the floor of the CBOE making $600 a month, which barely covered his daily commuter train ticket and the rent for his studio apartment in suburban Highwood.

“I was broke,” Battista remembered.

Side hustle

A man of the side hustle—such as selling discounted Jordache and Sasson designer jeans out of his trunk as a New York livery driver—Battista set up a legit sideline in Chicago that connected him to some of the most influential CBOE players.

Forty years ago, floor traders made their marks on trading sheets—actual pieces of paper, not computer screens. Trades happened fast and the handwriting was often sloppy, so the heavy hitters liked to come into the office on Saturday morning, collect their trading sheets, check the math and have their work done before starting fresh on Monday morning.

Battista witnessed this and decided to head into the office on a Saturday morning, too, and pitched a courier service for traders. Suddenly, everyone wanted it and he was collecting $700 a weekend delivering sheets.

“When I started, I didn’t realize I was going to meet all the market makers,” he said. They invited him into their luxurious homes, where he met their kids, enjoyed their pools and became their friend.

One of those market makers, Kenny Weiss, offered Battista a sweetheart deal he couldn’t refuse—a free office and desk, plus a network of market makers to show him the way. He joined Brandt & Associates, and Harry Brandt, one of the first to buy a CBOE seat, offered Battista 50% of the cost of a seat so he could also buy his way in. Battista put in a bid of $260,000 and the day the market crashed in 1987, he won that seat and began trading as an independent.

“It was one of the best purchases of my entire life,” he said, adding that the seat eventually led to making millions of dollars. “When they say it’s better to be lucky than good, it’s true. But you’ve got to put yourself in the right position.”

So, Battista set about doing exactly that.

“In the ‘87 crash, I made a million dollars in a day by being right,” he said. “I was louder and faster than most and traded a good amount of volume—I took a lot of small wins.”

Battista was 23 years old making $1,000 a day working for himself, and he didn’t know what to do with the money after he bought a condo. A friend convinced him and others to invest in one of Chicago’s soon-to-be-hottest nightclubs, Cairo, and he did, spending the next six years enjoying the club life and trading on the side. But he eventually returned to trading full time, even dabbled at the Chicago Board of Trade, until computers became mainstream tools for investing.

He finally left trading in 2005 after 22 years of never having a losing year and started his own business, which didn’t work out. Battista eventually landed on air first at thinkorswim, and then tastytrade—which is now named tastylive.

Sosnoff chimes in

Tom Sosnoff said Battista turned him down three times before joining his team at the former thinkorswim brokerage firm.

“We’ve been friends for close to 40 years—we met playing baseball together,” Sosnoff said, remembering their Saturday afternoon games in Chicago. The two traded in the pit together, maintaining their friendship for years.

“I brought him on for our education team and thought he’d be really good, and he was,” Sosnoff said. “He was very personable, he loved teaching, he loved being in front of a crowd of people. Then we built tasty and I asked if he wanted to come over to join.”

Although Sosnoff jokes that Battista is annoying and feels he deserves “some kind of combat pay” for spending so much time with his sidekick, he admits they’re able to play off each other on the air to create a nice balance for viewers. After 18 years of working together, “You can tell the friendship is genuine,” he said.

Between two traders

Comedian Vonetta Logan often plays point guard between Tom and Tony on the tastylive morning show.

“Tony’s very confident, boisterous, gregarious, very charismatic and very loud. He’s also great at improvisation,” she said, adding he is not only the true archetype of a trader, but also a true teacher.

“He’s hands down, one of the best teachers we have,” she said. “He really wants you to understand things because it makes him happy. He has an innate joy about trading and that shines through in the way he tries to teach and explain things to people.”

Logan admires Battista’s backstory: He’s a kid who didn’t go to college but made a move with so little and created life-changing generational wealth for his family.

Logan commends Battista for overcoming a tough childhood to be the father he is to his children.

“He works with his son here and that relationship is phenomenal,” Logan said. “They really are two peas in a pod.”

The Bat’s son

When Tony recruited his son Nick Battista to work at tastylive seven years ago, Nick had no idea what was in store for him.

“My first week here, I was told, ‘Next week, you’ll start a show with your dad live on air,’” remembers Nick, now 32. But he didn’t mind being thrown right into it. The two are close.

“I always wanted to be like my dad,” Nick said. “He’s the best—he’s cool, good looking, successful, checks all the boxes and a good role model to have growing up and into my adult life.”

His dad coached Nick’s sports teams when he was growing up—baseball, basketball and football. But his family’s story was much different than others in the posh Chicago suburb of Glencoe.

“My dad was a trader who didn’t have a college education, didn’t come from a lot of money, and my dad came from a family of gangsters,” Nick said. “It’s the opposite of what I grew up around. It definitely made him cooler. He was this rugged outlier in the town, a rich, successful, loud, talkative, good looking, tall guy—he had it all.”

Proud to say he was the first Battista to graduate from college, Nick studied economics and business at the University of Kansas. He said learning how to trade options was heavily influenced by his dad who is now less of a risk taker than he is.

Gauging today’s market

“We always talk about how volatility brings opportunity and that’s how we trade,” Nick said. “Higher volatility means that there’s more risk and more reward out there. Being engaged in these markets is super important and for a younger audience, not being afraid of the risk is really, really important.”

He explained that over long periods of time, markets tend to go up and to the right on the charts, and if investors have a disposable income to trade with and they’re in it for the long term, now is a great time to make an investment.

“The risk reward skews heavily in our favor—that’s how younger people should look at this opportunity,” Nick said.

“If you missed the last two years, you kind of got a mulligan,” he said. “You should definitely be taking risks right now because this market is paying you to take risks. Why wouldn’t you be buying right now?”

Sosnoff said today’s market isn’t much different from other markets and advises investors to get active.

“It’s never a good time to be passive—it’s never a time to be out for us,” Sosnoff said. “Now is an interesting time because there’s a lot of opportunity all over the place in lots of different areas of finance, but no different than any other time.”

Battista agrees it’s always better to be an active investor.

“I’m not a math guy and I have no formal education,” said Battista, who spent only a few weeks in college studying criminal justice before discovering academics was not in his future. Instead, he studied strategies in the market and the bell curve.

This is what he recommends to investors in the coming year.

“Stay within the ranges,” Battista recommended. “Make a lot of little investments. If you hear complex spread it should always perk up your ears. If someone describes something as complex, more than likely, they are trying to keep you out of their game.”

He recognized that 70% of the time, a stock falls within its expected range, and 30% of moves will be outside of that range—that’s the math that drives probabilistic investment choices.

“Now is the perfect time to be an active investor,” Battista said of the market. “Stay small,” he recommends, “because the time you think you know something, you don’t.”

So, what’s next for The Bat?

“I’m not done yet,” he says with a sly, toothy smile.

Click here to read THE JOURNEYMAN: THE PATH TO A 153,000% RETURN.