NFT Craze Has Faded, But Broader Collectibles Market is Roaring

The NFT craze elevated the profile of digital assets and invigorated the broader collectibles market

- Despite the pullback in prices of non-fungible tokens (NFTs), interest in digital assets has helped reinvigorate the broader collectibles market.

- Several categories of traditional collectibles have already set records in 2024, including a $6 million vintage comic book.

- With prices steadily rising, collectibles have been gaining traction as an “alternative” asset class.

The bullish wave sweeping the financial markets has found a new frontier: collectibles. Once the domain of hobbyists and niche enthusiasts, this vibrant sector is now attracting serious attention from investors.

From the elegance of fine art and the nostalgia of comic books to the allure of vintage cars and the attraction of baseball cards, the world of collectibles is as diverse as it is fascinating. It also includes timeless treasures like antiques, stamps and rare coins. Recent trends indicate a widening reach, with the markets growing in both value and interest as more investors seek to diversify their portfolios with these “alternative” assets.

Last year, the value of the collectibles market was estimated at $495 billion. To put this into perspective, the market capitalization of the global cryptocurrency market stands at around $2.3 trillion.

Traditionally viewed as a cottage industry driven by the passion of dedicated enthusiasts, the collectibles market is now experiencing a transformative shift. With valuations for many collectibles soaring, Kiplinger recently noted that collectibles “have morphed into an increasingly solid asset class in their own right.”

Digital collectibles helped reinvigorate the broader collectibles market

One catalyst for this growth has been the rise of digital assets. While cryptocurrencies themselves are not typically classified as collectibles, other digital assets, such as non-fungible tokens (NFTs) and “limited edition” cryptocurrencies, have found a place in the collectibles market.

The NFT craze, which gained significant momentum during the COVID-19 pandemic, not only elevated the profile of digital assets, but also invigorated the broader collectibles market. The crossover between these realms became evident with the sale of Beeple’s Everydays—The First 5000 Days NFT, which fetched an astounding $69 million at a Christie’s auction in March 2021.

Before October 2020, Beeple (aka Mike Winkelmann) reportedly hadn’t sold a print of his digital art for more than $100. NFTs, akin to other digital images, exist on a blockchain, which verifies ownership and memorializes the image as a collectible work of art.

Somewhat unexpectedly, the NFT trend has fallen to the wayside for the time being, with the sector seeing some noticeable declines in valuation. But the physical collectibles market has been moving in the opposite direction, steadily gaining value and momentum.

Prices have been soaring for traditional collectibles

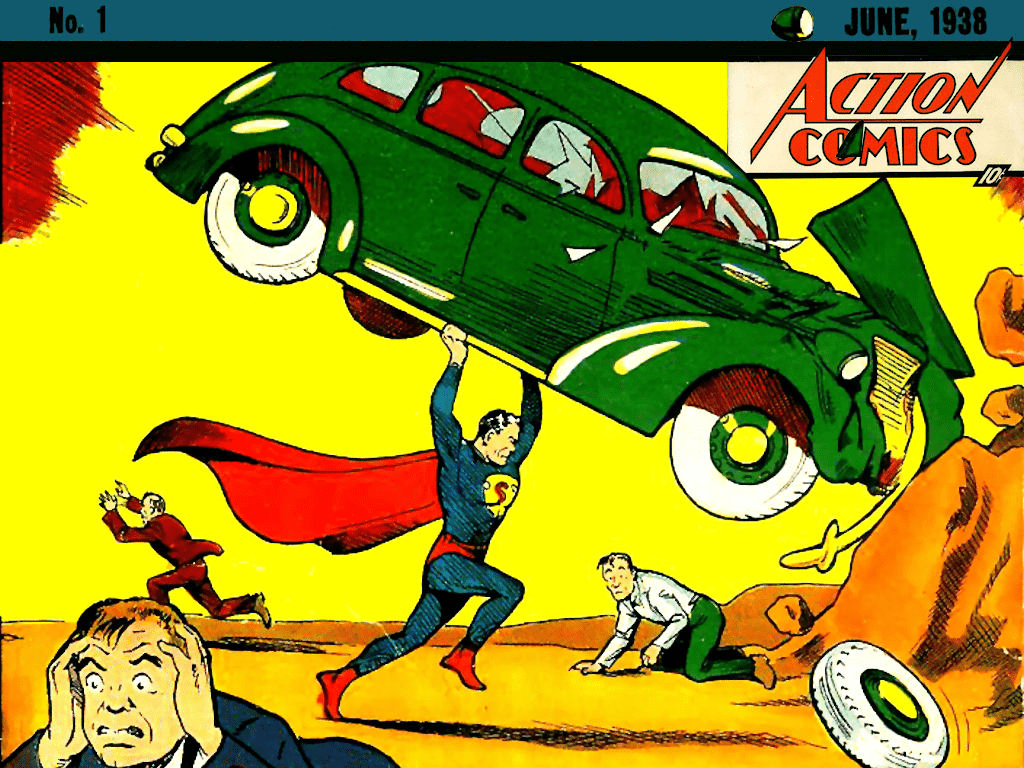

The traditional collectibles market received a significant boost this spring when a single comic book sold at auction for a record-breaking $6 million. The comic in question, Action Comics No. 1 from 1938, is an icon marking the first appearance of Superman.

Often hailed as “the most important comic ever published,” it is fitting that Action Comics No. 1 now holds the auction record. Of the 200,000 copies originally printed by National Allied Publications (now DC Comics), only an estimated 100 still exist and their condition varies.

The previous record holder was Superman No. 1, which sold for $5.3 million in 2022.

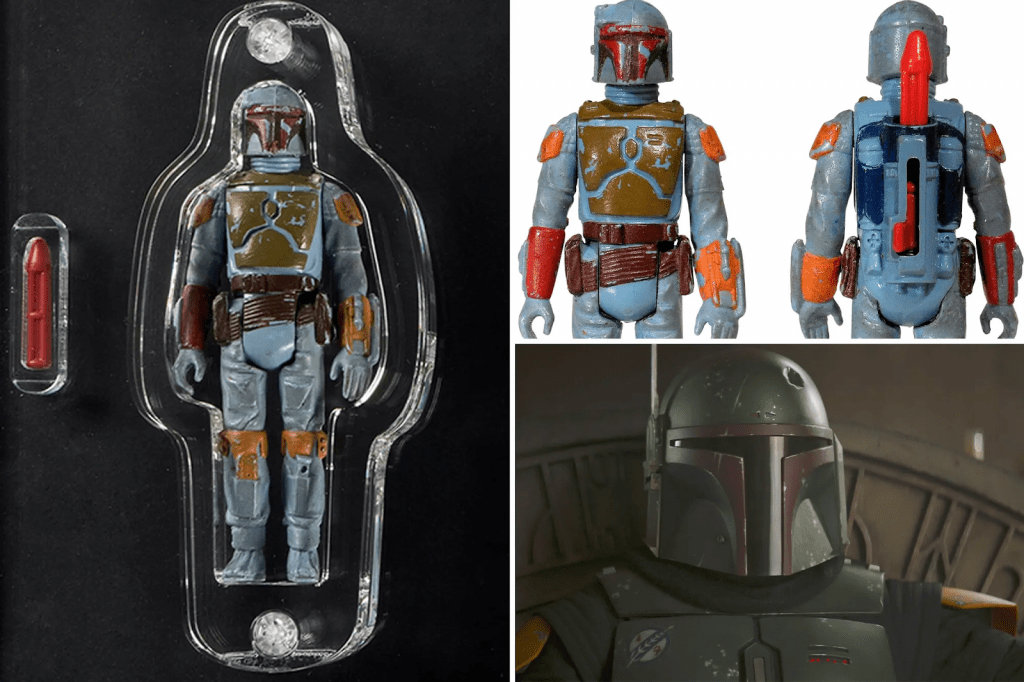

The collectibles market has other record-breaking sales in 2024, with the sale of a vintage toy nearly doubling the previous record. The action figure in question is a representation of the famed Star Wars character Boba Fett, which was never officially released to the public.

Known as “Rocket Fett,” the figure sold recently at auction for $525,000, surpassing the previous record holder by $225,000. The previous record was set by a Barbie that sold in 2010 for about $300,000.

Rocket Fett was available exclusively through a mail-away promotion sponsored by the American toy maker Kenner. Consumers could mail in proof of purchase for four Star Wars action figures to receive this unique version of Fett, featuring a rocket launcher on his back.

Boba Fett has gained increased attention in recent years, thanks to the popularity of the widely acclaimed The Mandalorian series and the closely associated The Book of Boba Fett.

A new record in sports collectibles

Beyond the vintage toy market, other collectibles records are poised to be shattered in 2024. In the sports memorabilia niche, many expect the jersey that Babe Ruth was wearing when he famously “called his shot” in Game Three of the 1932 World Series to become the most valuable item ever sold at auction when it hits the block this autumn.

The current record holder in that category is a jersey of Michael Jordan wore in Game One of the 1998 NBA Finals, which sold for $10.1 million. Ruth’s jersey is expected to surpass that figure and even beat the overall sports collectibles record currently held by a 1952 Topps card featuring Mickey Mantle, which sold for $12.6 million in 2022.

Just a few months ago, a guitar once owned by John Lennon sold for $2.86 million, nearly three times the pre-auction estimate. Lennon used the guitar, a Framus “Hootenanny,” during the Help! recording sessions in 1965.

Video game-related collectibles have also been gaining value. A sealed copy of the original Legend of Zelda video game was auctioned for $288,000 earlier this year. That followed the record-setting sale of an unopened copy of Nintendo’s original Super Mario Bros., which sold for $2 million in 2021. Back in the 1980s, those same game cartridges sold for around $30 new.

Parting shots

The fact that the collectibles market continues to set records in 2024 is a testament to the recent strength of this alternative investment niche. While upper echelon of the market makes headlines, the broader collectibles universe is also gaining traction.

One of the most exciting aspects of this market is its dynamic nature. As time passes, trends shift, igniting prices in sometimes lesser-known niches. The passage of time also brings new merchandise into the spotlight as aging often increases its value and desirability.

The data indicates growth in the collectibles market will remain robust, further solidifying its place in the broader investment universe.

As with any potential investment, however, those considering collectibles should proceed with caution. As noted recently by Forbes, “there’s zero guarantee that you’ll recoup your initial investment or that you’ll be able to sell [a collectible] in the future for more than it’s currently worth.” That said, guarantees aren’t easy to come by in other asset classes, either.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.