Solar Stocks Plummet Amid High Interest Rates

Elevated interest rates are impacting solar companies' profit and triggering a broad-based selloff in the sector.

In 2022, the solar sector was one of the few bright spots in the stock market. For example, the Invesco Solar ETF (TAN) rose by roughly 17% last year.

However, performance in the solar heavyweights was even more impressive, with Enphase Energy (ENPH) and First Solar (FSLR) rallying by 45% and 71% in 2022.

Unfortunately, optimism in the solar sector has not carried over into 2023. Based on recent Q1 earnings reports, it appears elevated interest rates and other recessionary pressures have finally hit the solar industry.

After Enphase released its quarterly earnings report on April 25, the stock dropped by more than 25%. Enphase reported in-line revenue and earnings figures for Q1, but guided down expectations for the rest of 2023.

With a market capitalization of $21 billion, Enphase is one of the largest solar players in the world, so its disappointing outlook triggered broad-based selling across the sector.

At one point during the first quarter of 2023, the Invesco Solar ETF was up as much as 15%, but is now trading down 5% on the year. The bleeding has been even worse in some of the single stocks in the sector.

For example, since peaking last December at nearly $320/share, Enphase has now corrected by about 50%, and is currently trading at about $155/share.

Shares in First Solar have held up better than Enphase, but First Solae has corrected to a greater extent than Invesco. First Solar currently trades for about $180/share—17% lower than its 52-week high.

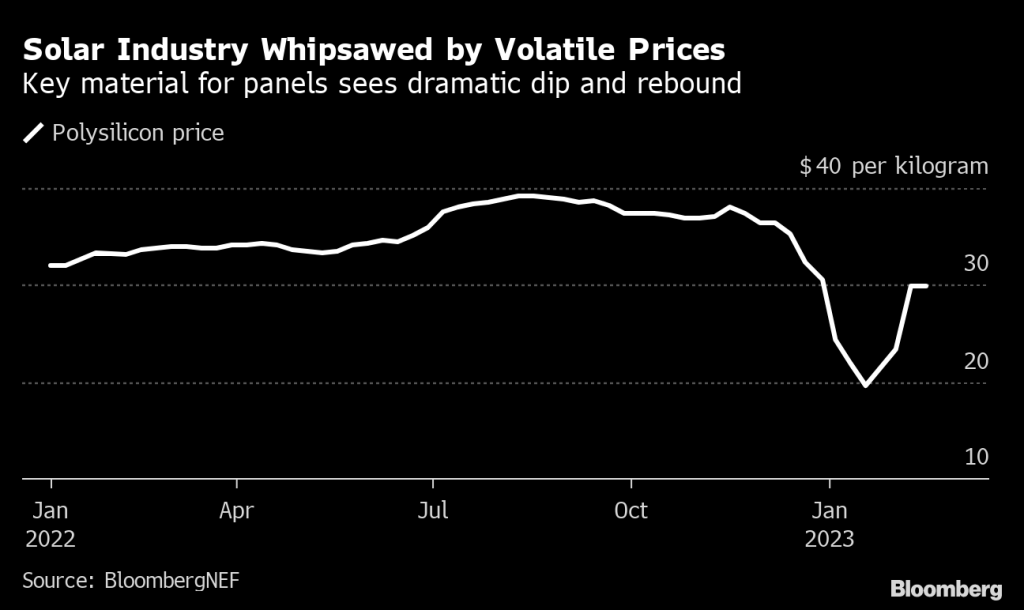

As illustrated below, one of the biggest problems in the solar sector in 2023 has been a spike in the cost of raw materials.

Headwinds in the solar sector

Looking beyond the increased cost of raw materials, higher interest rates are also starting to negatively impact the earnings potential of the solar industry.

Purchases of solar panels are often financed, which means higher interest rates translate to higher costs for solar installers and end users. And because Enphase focuses heavily on residential customers, the company’s earnings are closely tied to the health of the American consumer.

Consumer confidence in the U.S. has been weak for some time now. To wit, the Michigan Consumer Sentiment Index (MSCI) hasn’t registered above 75 since July of 2021, which means consumer sentiment in the U.S. has been below average for 22 consecutive months.

One big complication of higher interest rates is that the addition of extra financing costs makes residential solar projects more expensive as compared to powering a home with a traditional energy source.

Research conducted by Bank of America analyst Julien Dumoulin-Smith revealed that an 8.5% annual financing rate basically equates to a solar bill of $130-$140 per month for the average home in Florida, Texas or Arizona. However, those same consumers could expect to pay between $100-$120 a month for a traditional electricity bill, and possibly even less, considering the sharp correction in natural gas prices.

Moreover, the consumer solar industry took a hit this year as a result of some policy changes at the state level. The state of California, for example, recently changed the rules by which residential rooftop customers get reimbursed for selling excess energy back to the grid.

The most important change was the amount of the reimbursement, which is now only 20%-30% of the previous figure. California represents the largest market for residential rooftop solar, and the recent policy changes have created added uncertainty in a market that was already experiencing a slowdown in demand.

Considering all of the above, it’s no great surprise that Enphase—and other solar companies that serve residential consumers—have experienced a pullback in their associated valuations.

U.S. government support of renewables

For the time being, demand from commercial customers remains relatively robust in the solar industry, which helps explain why First Solar hasn’t corrected to the same degree as Enphase.

First Solar focuses on solar farms and solar plants, like those operated by utility companies. And because these capital-intensive projects have longer lead times, they are less sensitive to short-term shifts in the underlying economy.

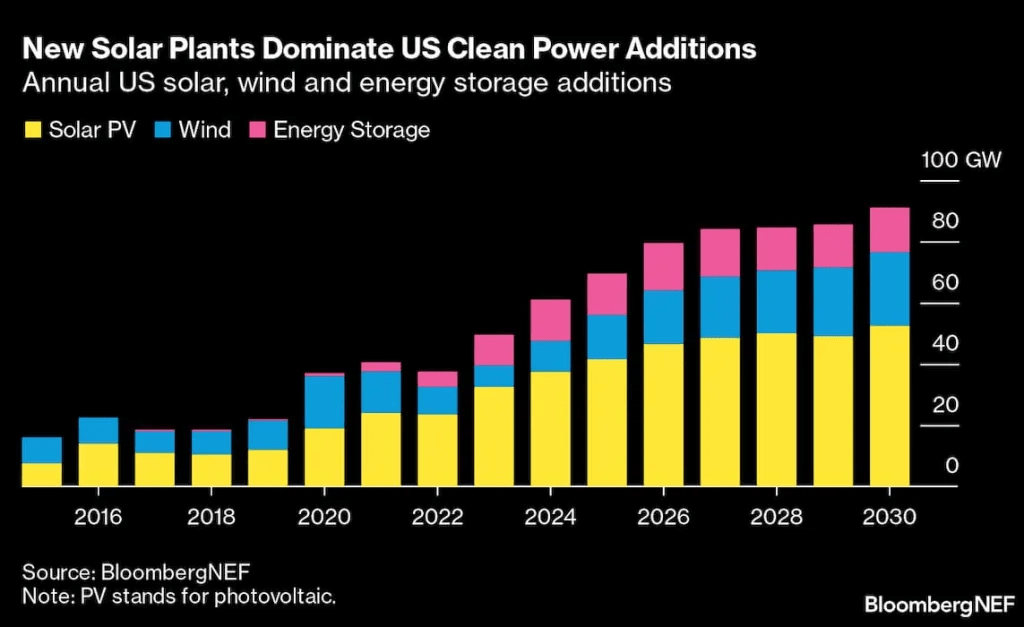

In addition, the commercial side of the solar industry got a big boost from last year’s Inflation Reduction Act (IRA). As part of that legislation, the existing tax credits available to the renewable energy industry were extended through the year 2025. The IRA also provided new production tax credits for solar manufacturers.

As a result of these incentives, companies like First Solar have seen their inventories shrink to historically low levels. For example, it’s been reported that First Solar has sold the bulk of its production capacity for solar film through the year 2026.

Demand from the commercial sector has been so strong that the Biden administration was forced to exempt some solar imports from the tariffs that were implemented during former President Donald Trump’s trade war with China. Last June, President Biden suspended some of the tariffs on solar imports from Southeast Asia in order to increase the availability of these products in the U.S. market.

However, just last week, the House of Representatives advanced legislation that would put those tariffs back in place, and on May 3, that measure was also passed by the Senate. It’s widely expected that President Biden will use his veto power to block this legislation to ensure that the tariffs are not reinstated.

The issue is contentious because American solar manufacturers don’t want low-priced solar imports flooding the market, making it harder for them to compete. On the other hand, American producers haven’t been able to keep up with demand, which means without assistance from foreign producers, it will be almost impossible for the U.S. to meet its ambitious renewables goals.

In order to override the veto, Congress will need a two-thirds majority in both houses.

If Biden’s veto is successfully overturned, that could reverse some of the damage that’s been done to the solar sector in recent weeks. Softening demand would theoretically be offset by an equivalent drop in supply, due to the resumption of the tariffs.

As such, investors and traders active in the solar industry may want to follow this ongoing narrative closely in the coming weeks. To track and trade the solar industry, you can add the following symbols to their watchlists:

- Canadian Solar (CSIQ)

- Daqo New Energy (DQ)

- Enphase Energy (ENPH)

- First Solar (FSLR)

- JinkoSolar Holdings (JKS)

- Maxeon Solar (MAXN)

- SolarEdge Technologies (SEDG)

- Sunlight Financial (SUNL)

- SunPower Corp (SPWR)

- Sunnova Energy (NOVA)

- Sunrun (RUN)

To follow everything moving the markets, tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.