Strong EV Sales Growth Forced ExxonMobil to Enter the Lithium Business

Here are 10 lithium companies to follow

- ExxonMobil recently acquired 120,000 acres in Arkansas, which are believed to be rich in lithium deposits.

- Exxon has also held preliminary talks with some of the world’s largest EV producers to potentially supply them with lithium.

- Lithium prices have been sliding since last October, dropping from roughly $85,000/ton down to $35,000/ton, making a potential entry into the sector more economically feasible.

After a strong year in 2022, sales of electric vehicles (EVs) have accelerated in 2023, and the United States is arguably the fastest-growing market in the world.

That new market reality has apparently left an impression on some of the world’s largest companies, particularly ExxonMobil (XOM).

At the end of July, news broke that Exxon was exploring strategic partnerships to supply lithium to some of the world’s largest EV manufacturers, such as Ford (F), Tesla (TSLA) and Volkswagen (VWAGY).

This news follows another report that Exxon has acquired 120,000 acres in Arkansas, with the intent of potentially mining and processing lithium in that region. While still in the early stages, the facility could pump out as much as 100,000 tons of processed lithium annually.

This part of Arkansas is viewed as strategically important because it falls within the Smackover Formation, which runs from Florida to Texas, and is believed to be rich in saltwater brine—the latter of which typically contains lithium.

If Exxon successfully launches a new U.S.-based lithium operation, that would significantly boost domestic supplies of this key global resource. Lithium has been critically undersupplied in recent years, as EV manufacturing has expanded rapidly around the world.

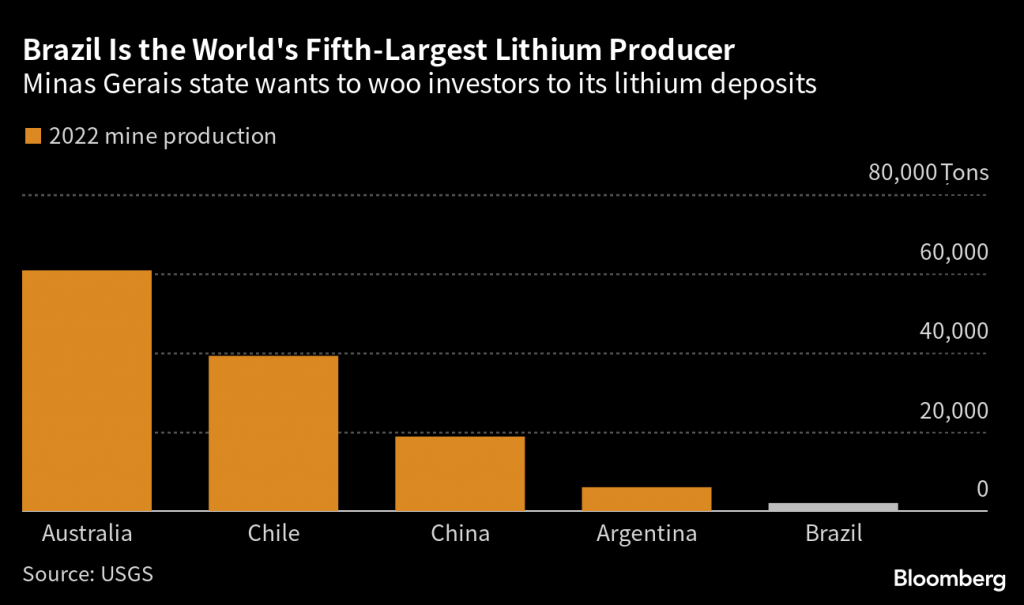

Currently, the world’s largest producers of lithium include Australia, Chile, China, Argentina and Brazil.

ExxonMobil’s reach

As part of the company’s Q2 earnings call, CEO of Exxon Darren Woods said that “brine and extracting the lithium is very consistent with a lot of the things that we do in our refineries and chemical plants and, in fact, in some of our upstream operations.”

Exxon hasn’t yet said if it would develop the Arkansas facility on its own, or potentially partner with another company that has specific expertise in lithium mining/processing.

Exxon’s aspiration to be a major player in the global lithium market is clearly growing by the day—especially if the longtime oil giant is already talking to EV manufacturers about future supply deals.

And Exxon isn’t hurting for cash. The company booked roughly $7 billion in profits during Q2 2023, and has a long history of putting extra capital to work.

On July 13, Exxon acquired Denbury Inc. (DEN) for $4.9 billion. Denbury specializes in carbon capture, utilization and storage (CCS) as well as enhanced oil recovery. Last year, Exxon also acquired a 50% stake in Biojet AS, which is a Norwegian biofuel company.

Earlier this year, the Wall Street Journal reported that ExxonMobil (XOM) was considering a takeover of Pioneer Natural Resources (PXD), a large American fracker in the Permian Basin. However, based on the recent Denbury acquisition, the PXD deal may have temporarily been moved to the back burner.

Based on Exxon’s new foray into the lithium market, it’s entirely possible the company may elect to acquire a lithium miner/processor at some point in the future, as well.

With a market capitalization of roughly $440 billion, Exxon is the 17th-largest company in the world and can certainly “pay to play” in the lithium sector, if it so chooses.

Current dynamics in global lithium market

Exxon has likely been exploring strategic alternatives in the lithium sector for some time, but may have gotten more serious in 2023 due to the recent correction in lithium prices.

Considering the company’s long history of success, the leadership at Exxon is keenly aware that it’s preferable to buy low and sell high, as opposed to vice versa.

Lithium prices—along with the prices of many other global commodities—spiked during the COVID-19 pandemic, but have dropped sharply since October of last year.

From August 2021 to October 2022, lithium prices rallied from roughly $15,000/ton all the way to $85,000/ton. However, from October of last year through today, lithium prices have corrected by about 55%, and are currently trading around $35,000/ton.

The recent drop has been attributed to several factors, including the recent slowdown in the Chinese economy, as well as increased global supplies of this key resource.

China is currently the largest market for global EV sales and boasts the world’s largest domestic fleet of EVs, with over half of the world’s electric vehicles currently domiciled in the Middle Kingdom.

China’s economy had been expanding after the country scrapped most of its COVID-19 restrictions at the end of 2022. But the economy in China has sputtered in recent weeks, as manufacturing activity in the country has steadily weakened.

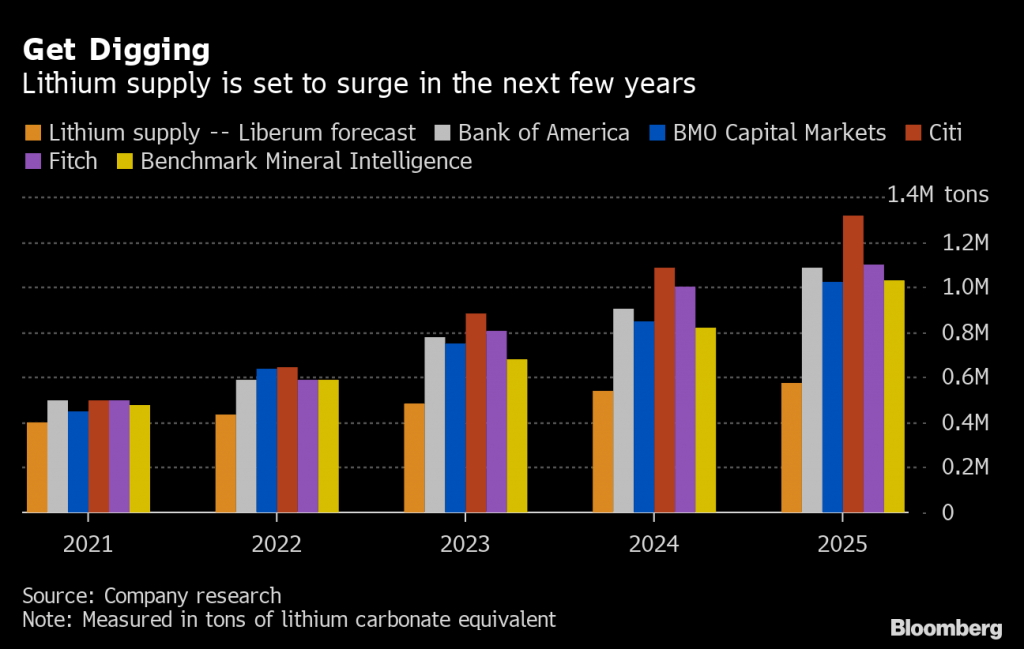

In addition to a weakening Chinese economy, lithium prices have also been fighting against rising global supplies of this key material. Lithium production was extremely limited just a few years ago, but global capacity has expanded significantly in the last two years.

New supplies are coming online in China this year, and in the next couple of years, some big mines in North America and South America are expected to come online.

For the time being, declining lithium prices have certainly helped make EVs more affordable, which may be a key reason sales of EVs continue to rise in 2023.

In June of this year, industry data revealed that new EVs were selling for about 20% less than they were 12 months ago, on average. And some of that decline was undoubtedly linked to falling lithium prices.

Like most other commodities markets, the supply and demand dynamics in the lithium market will continue to drive prices for the remainder of 2023 and beyond. Moreover, the prevailing price of lithium will continue to heavily influence how much it costs to build an EV.

To track and trade the lithium sector, readers can add the following tickers to their watchlists:

- Amplify Lithium & Battery Technology ETF (BATT)

- Energizer (ENR)

- EnerSys (ENS)

- FMC Corp (FMC)

- Global X Lithium & Battery Tech ETF (LIT)

- Livent Corporation (LTHM)

- Piedmont Lithium Limited (PLL)

- Pilbara Minerals Limited (PILBF)

- Sociedad Química de Chile (SQM)

For more background on the fast-growing EV sector, check out this recent article from Luckbox. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.