Trader Success Story: 44 Years of Options Success Across 100 Countries

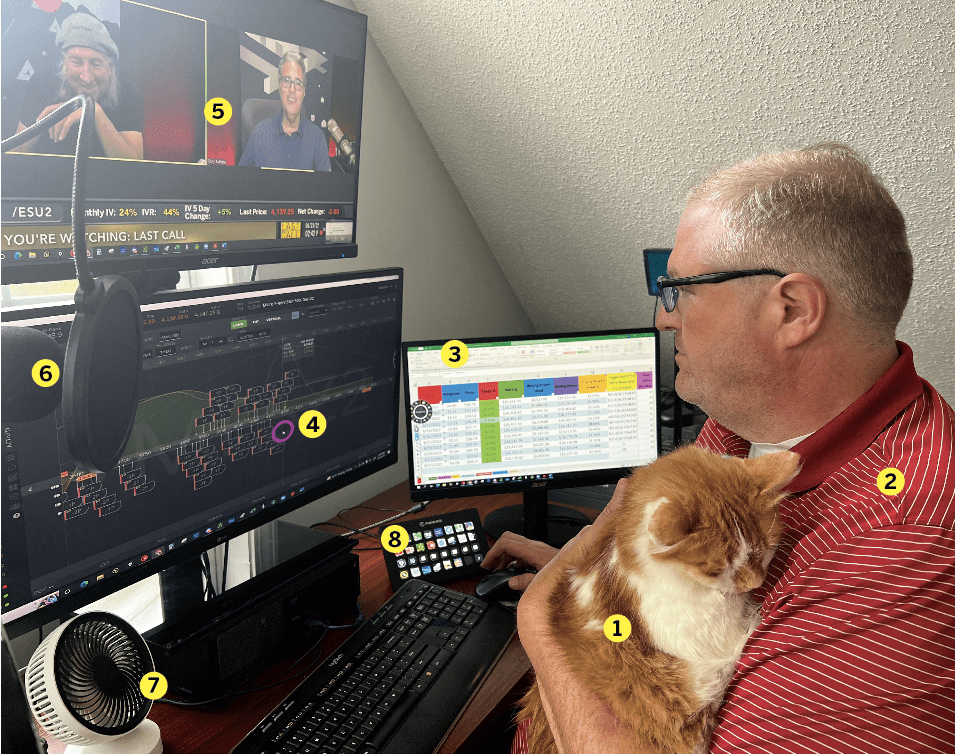

He can work anywhere with his systematic trading approach to portfolio techniques, position-sizing and risk management

- John, 55

- Florida

- Years trading: 44

John began trading equities at the age of 11, using the money he made mowing lawns to buy covered calls with his grandfather. He continued through college and eventually quit his 9 to 5 job to become a full-time digital nomad trader. By now, he’s visited more than 100 countries on his trading-supported journey.

But he had already been trading “tastystyle” since 2020 and has found a systematic approach that enables his location-independent trading. It includes position-sizing, risk management and portfolio techniques that can work from anywhere—even Antarctica.

In the video below, you can see what he says about his seven figure account and the systematic approach to trading.

How did you start trading?

My grandfather was an options trader. I had the propensity to understand trading and he taught me how to trade at 11 years old. We started with covered calls, then spreads and then branched out from there. I cut lawns in high school at $10-$15 per cut. Trading covered calls could earn say $100—quite the difference. However, it also taught me the value of risk mitigation.

Favorite trading strategy?

When bored, I trade SPX 0 DTE most days. I trade delta neutral strangles, credit spreads, debit spreads (especially when I’m directional or the IVR is low.) I also trade a few CRABS and jade lizards. I generally do not trade futures uncovered because of the risk and margin requirements.

Which financial instruments do you most frequently trade?

Not to be vague, but I am really product indifferent. I look for IVR, stock trading volume, bid/ask spread, strike volume, premium, delta, binary and non-binary events.

Tell us about the overall success that you have had trading.

I’ve been doing this for over four decades now. I still have more to learn and I don’t always get winning trades, but this is a long-term game. I’ve been able to fund living expenses and build wealth. I track each trade gain or loss and track the net against “life-event” costs, such as new cars, roof replacements, weddings, house purchases and long vacation trips.

Please tell us about your worst trading moment.

Before I understood risk mitigation and trade adjustments, I took a $30,000 loss when I was around 27 years old. I still think about it, but it was a good lesson to always, always, always understand risk.

Check out all the previous rising stars here.

Yesenia Duran — not an alien, not a zombie; just an editor.