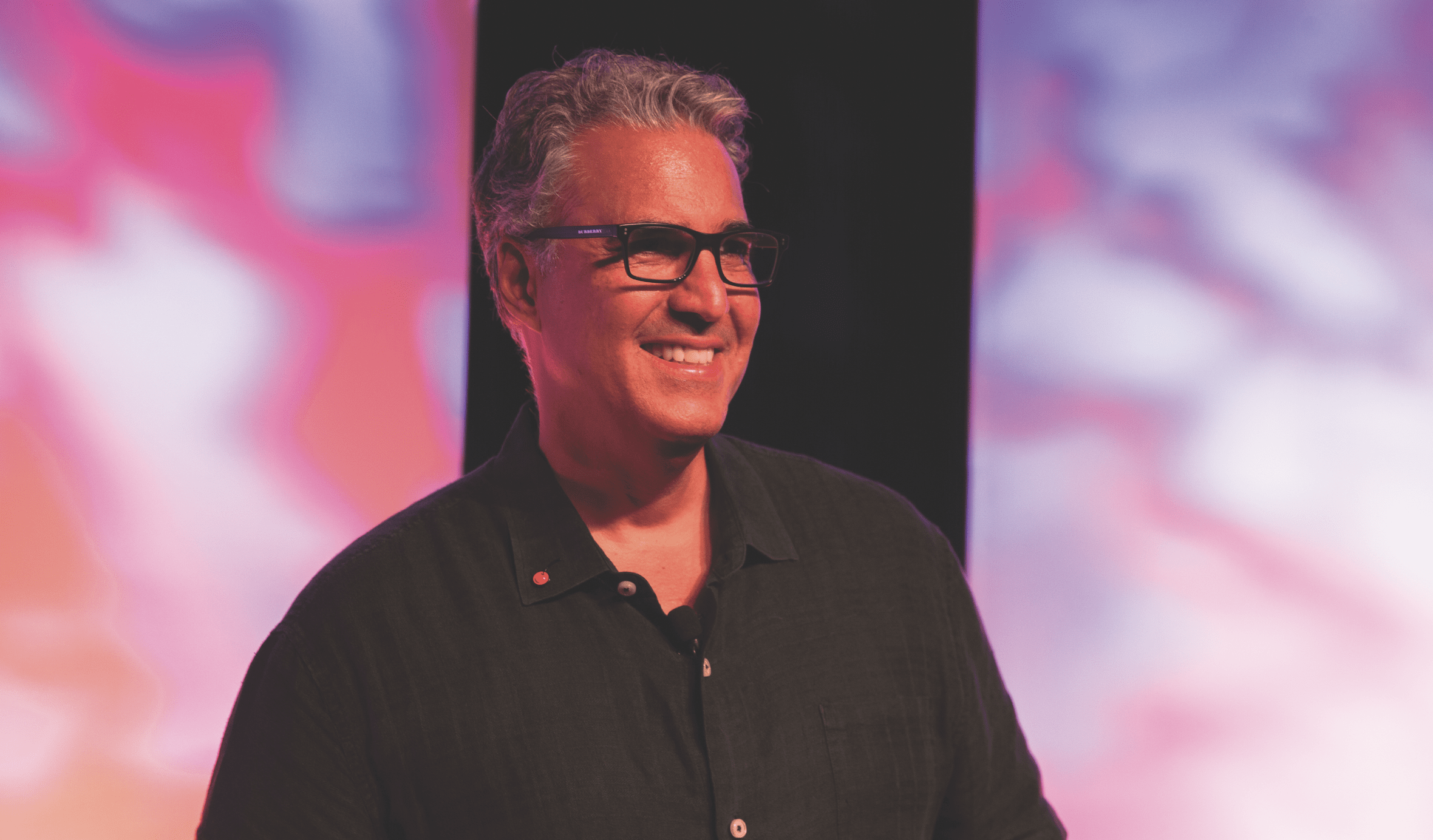

Meet the Trader: Fauzia Timberlake

The tastylive network converted this former financial planner to active investing

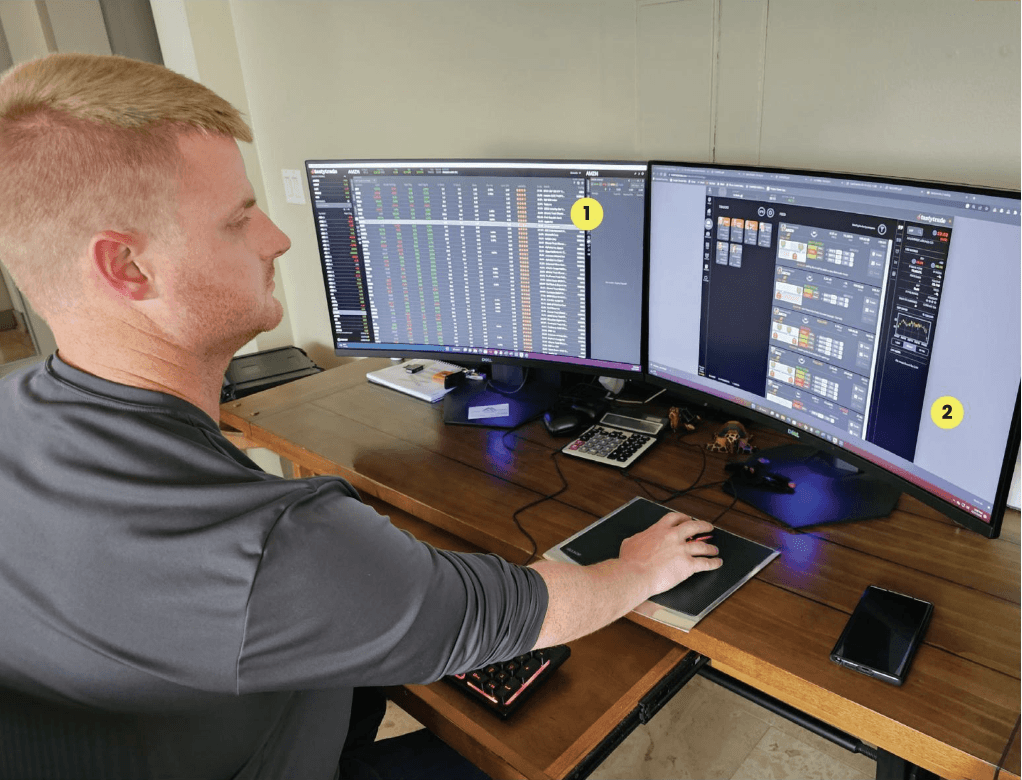

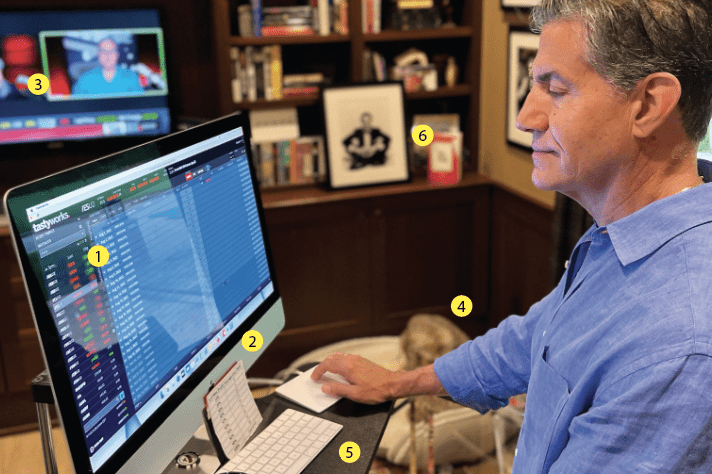

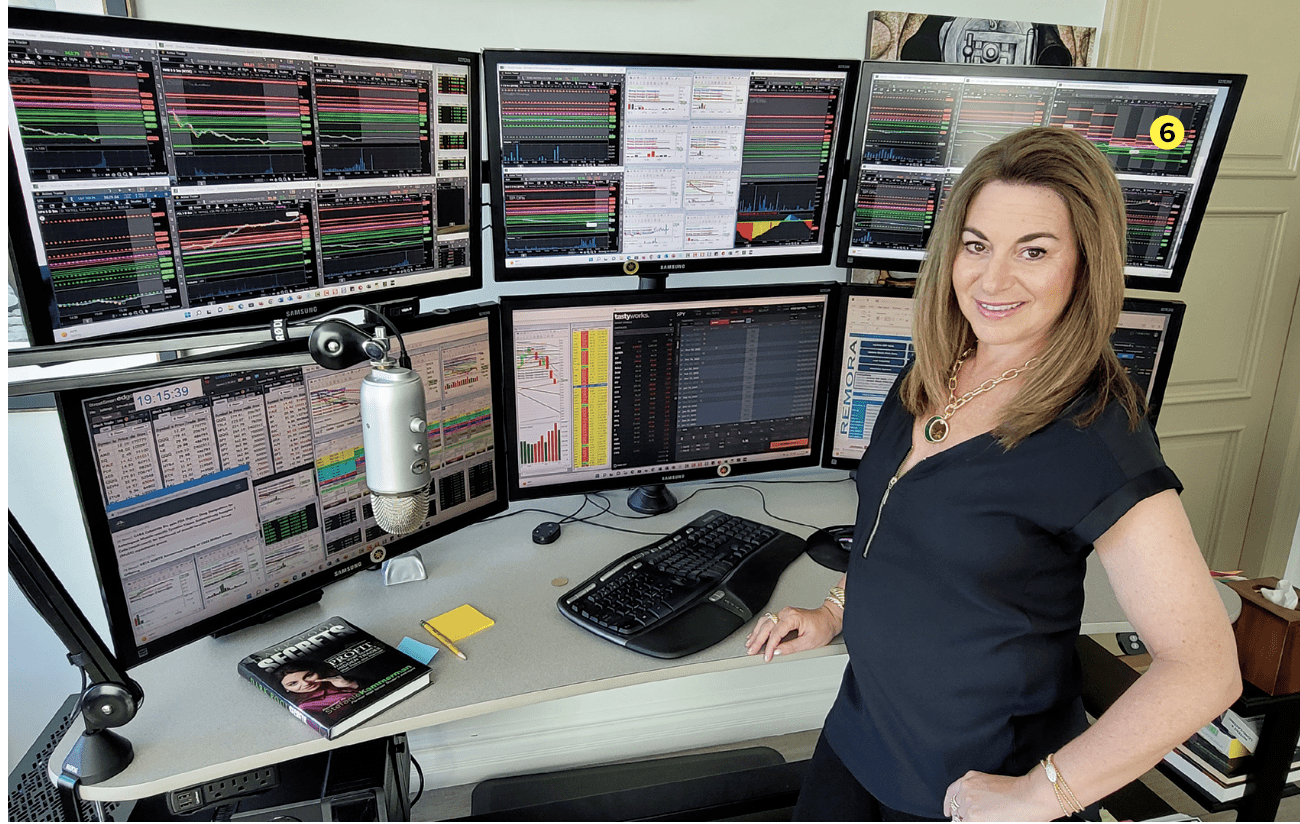

Screen on the right: SPX graph; On the desk: Trading notebook

Location: Las Vegas

Age: 68

Years Trading: 13

How did you start trading?

I was working as a financial advisor for a large wirehouse. I loved my clients and enjoyed building their portfolios but hated the sales

aspect of the business. And the sales aspect was the only thing that mattered to the brokerage! So, after 10 years, I sold my book of business and went back to school to become a certified financial planner.

While in school, I used the internet to start learning to trade. Someone pointed me to tastylive (called tastytrade at the time) and the rest is history. I watched endless hours of programming by day and re-watched selected programs at night.

I was hooked and never looked back.

Favorite trading strategy?

I have many favorite strategies and choose the one that best suits the underlying I am considering. If forced to choose one strategy, I would say I love selling strangles.

Average number of trades per day?

I trade every day and the numbers vary considerably based on market conditions. If I must pick an average, it might be five.

What percentage of your outcomes do you attribute to luck?

How do I answer this question? I adhere to tasty mechanics by buying or selling based on implied volatility conditions and diversification needs of my portfolio. I believe that no one really knows anything more than I do and that news is baked into the options values.

Given all this, I generally set up trades based on probabilities of profit and dutifully set GTCs and alerts. [A “good ’til cancelled” (GTC) order works regardless of the time frame, until it’s explicitly cancelled.]

Then, I count on the underlying to stay within its expected move. If it does and my trade is a success, should that be attributed to luck?

Favorite trading moment?

My favorite trading moments are during earnings seasons. If I were to pick a favorite trading period, it was after the market drop of 2020. I had pushed out in time most of my in-the-money short positions. Well, the market had

a V-shaped recovery and, over time, those positions were mostly closed successfully.

Subscribe for free at getluckbox.com.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.