Trends

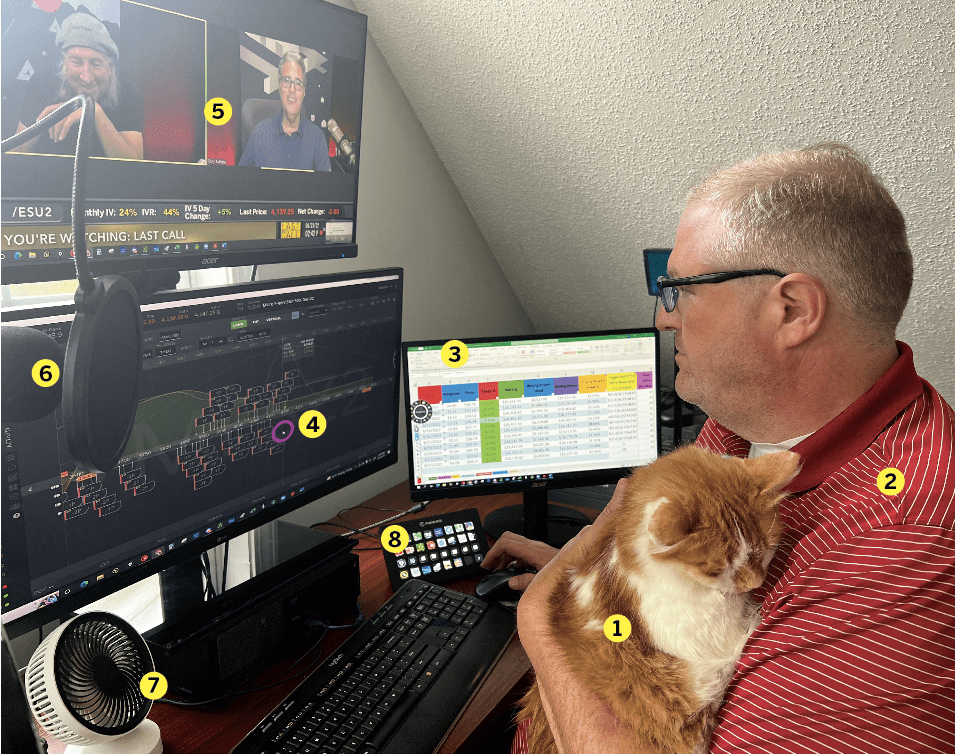

How a Professor Discovered a Winning 0 DTE Futures Strategy

He shows how his ”$1 per day" rule helped him string together 12 straight profitable months without a single four-figure loss

By Yesi D

- James William Rohlf, 73

- Buzzards Bay, Massachusetts

- Years trading: 44

A physics professor reveals how he achieved positive annual returns by using a mechanical strategy to trade crude oil options. Beginning with capital of $50,000, he generated $18,000 profit trading 0-2 DTE strangles three times per week. He shares the “$1 per day” rule he used to put together 12 straight profitable months without a single four-figure loss .

How (and why) did you start trading?

I started trading when I got my first job as a way to build personal wealth.

Favorite trading strategy?

Naked short strangles. Start a trade with a strike plus and minus one dollar, so one dollar per day to expiration—that way the volatility picks the delta for me. So, if the volatility is low, that means a small delta, and if the volatility is high thats a big delta, and that’s what i want.

Which financial instruments do you most frequently trade?

I trade /CL crude oil futures contracts for the liquidity and the volatility. Crude oil has been trading in a relatively narrow range in the last couple of years

Tell us about the success you’ve had trading.

Profit on every \CL contract (M, W, F), 150 expirations per year with very few rolls.

Tell us about your worst trading moment.

During the 1986 crash, I was holding way too many short puts on Digital Equipment Corp. But I never lose more than a few hundred dollars on a trade, never in the thousands.

Check out all the previous rising stars here.

Yesenia Duran — not an alien, not a zombie; just an editor.

Trader

-

How 0 DTE and 45-day Strategies Took This Trader To 24 Mil

By Yesi D

|Meet the latest active investor in tastylive's Rising Stars series -

Meet the Trader: Derek Mullen

By Yesi D

|The latest active investor in tastylive's Rising Stars series proves systematic trading repeatable mechanics can transform losses into success -

Meet the Trader: Jonathan Haas

By Yesi D

|Focusing on options while avoiding single stocks became his winning strategy -

From Engineer to Options Trader: How Gary Foster Achieved Trading Success

By Yesi D

|Meet an Iowa business owner who transitioned from John Deere engineer to consistent options trader specializing in covered calls on ETFs -

Trader Success Story: 44 Years of Options Success Across 100 Countries

By Yesi D

|He can work anywhere with his systematic trading approach to portfolio techniques, position-sizing and risk management -

Rising Star: Meet Michael Cardman

By Yesi D

|Using tasty mechanics reduces risk and attracts luck, and then we really get rolling when the VIX passes 50 -

Straightforwardly Successful

By Yesi D

|The idea that volatility is often overpriced and fear is inflated gave me the edge I needed -

Trading in Harmony

By Yesi D

|A couple trades together, but separately, with different returns. Somehow, it works. This is the tale of the very first couple's Rising Stars on the tastylive network. -

Meet Luckbox’s Trader of the Month: Brian Chung

By Yesi D

|This young meme stock trader has had his ups and downs -

Meet the Trader: Fauzia Timberlake

By Yesi D

|The tastylive network converted this former financial planner to active investing -

Meet the Trader: Caulin T. Struyk

By Yesi D

|Meet the trader Caulin T. Struyk in a Q&A about his trading experience. -

Meet Stephen Bigalow

By Luckbox

|Office location Houston Age 69 Years trading 48 How did you start trading? When I was 8 years old, my dad bought me one share of Eazor Express [a trucking… -

Meet Micheal Antzas

By Luckbox

|Home/Office location Tulsa, Oklahoma Age 63 Years trading 25 How did you start trading? The company I worked for 27 years ago offered a 401(k), and on the weekends I… -

The Apprentice: A Mathematical Edge

|As he learns trading, a teenager is already stockpiling financial wisdom—and cash In the case of 18-year-old Jacob Intrator, youth isn’t wasted on the young. While learning to trade equities,… -

The Master Trader & Educator

|“Those who can’t do, teach” is a truncation of a line from Man and Superman, a 1905 George Bernard Shaw play. It’s a maxim that’s often true in the world… -

THE JOURNEYMAN: THE PATH TO A 153,000% RETURN

By Ed McKinley

|Son Dao has made a fortune in almost no time by bucking the market’s bearishness. He turned $1,600 into $2.5 million in 17 months. Yes, Luckbox verified the numbers. Twenty-eight-year-old… -

Meet Stefanie Kammerman

By Yesi D

|Home/Office location Las Vegas Age 52 Years trading 28 How did you start trading? Happy hour! I got lucky and got offered a job as a trader’s assistant working in… -

Meet Bobby Gaines

By Yesi D

|Home/Office location Bowdon, GA Age 52 Years trading 11 How did you start trading? I was installing a Roku box on my television and found tastytrade! Initially, I wondered about…