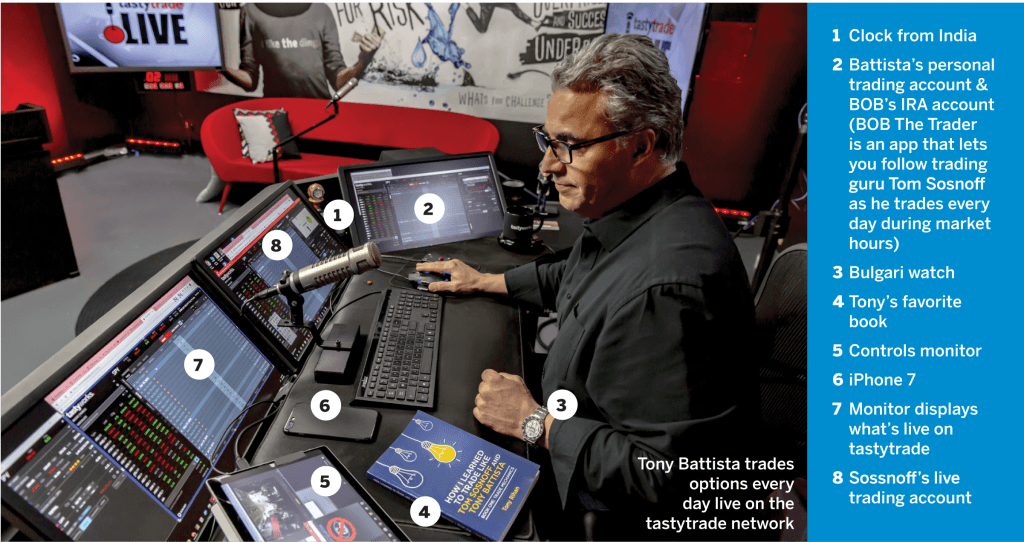

Tony Battista

Birthplace: Brooklyn, NY

Age: 56

Residence: Glenview, IL

Years trading: 26 years (22 at the Chicago Board Options Exchange)

Average number of trades per day: Typically 10 today, more than 500 a day from 1983-2005

Favorite options trading strategy: Everything we do is based on a math model around probability of success, and, on entry, the stock must have a high IV rank. A “strangle”—the simultaneous sale of a call and put—has the highest probability of success and benefits the fastest from contracting IV rank.

Your best trading day ever: The day of the crash Monday Oct. 19, 1987. The crash was the week of options expiration so my existing positions were already buttoned up, allowing me to react and not think about what was going on. In other words, I was able to just trade!

What percentage of your outcomes do you attribute to luck?: 30%

“THE BAT” TAKES PITCHES FROM LUCKBOX READERS

I like to buy beaten-up stocks, but the IV is always so low that selling puts and covered calls isn’t worth it. Suggestions? —Jason Ruble, Dallas

Vertical debit spreads are the answer! Buy a call two or three strikes in-themoney and sell a call two or three strikes out-of-the-money. You use significantly less buying power than a covered call or naked put and pay no extrinsic value to the stock. It benefits from an up move in the underlyings.

I hear Tom Sosnoff or Tony Battista say on the tastytrade program that a stock has an expected move of X just by looking at the Delta or some other factor. How is this done? A caller called in about an account that was going sideways. Tom then told the caller what the delta was of the positions he was holding. The caller said, “Oh, well, you are losing money,” and Tom agreed. How was this known from this conversation? —Paul Bursey, Lewis Center, OH

We are looking at implied volatility. Implied volatility is the market’s view of what will happen to a given security’s price in the future. It is a metric used by investors to estimate future fluctuations (volatility) of a security’s price based on certain predictive factors. Implied volatility can often be thought to be a proxy of market risk. It is commonly expressed using percentages.

An expected move is the amount that a stock’s range is predicted to move from its current price, based on the current level of implied volatility. Delta equals odds that an option will be in-the-money at expiration. A 30 delta equals a 30% chance that an option will be in-the-money at expiration. —@Tony_BATtista