TRADING SARDINES

Certain souls become passionate about trading. Market dynamics fill them with adrenalin, feed their competitive urges and sometimes pad their bank accounts. They’re glued to their screens, searching for an edge, trying to take home a profit and hoping to avoid a loss.

The game is pure and simply fascinating. Like life itself, the markets blend highs and lows, ups and downs, achievements and failures. For some, trading becomes a life’s work, a rewarding profession shared with other professionals.

Through tens of thousands of market positions and uncountable hours of analysis, they develop relationships with other traders that become part of a remarkable life story. Trading may not provide a pathway to enlightenment, but the grit, intention and willingness to take a stand and face the consequences combine to create an impressive way of looking at life. Those factors can also provide the backdrop for a very fine book.

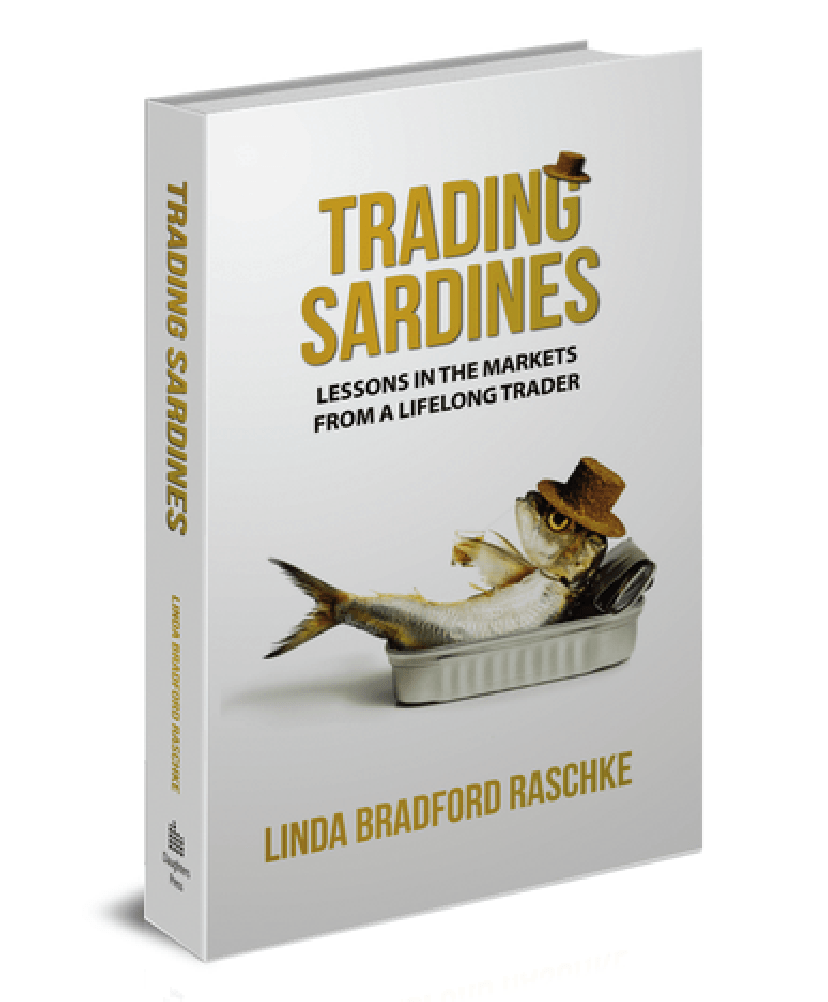

In Trading Sardines, Lessons in the Markets from a Lifelong Trader, author Linda Bradford Raschke describes the events that brought her into the world of the trade 40 years ago. As the years turned into decades, she witnessed unprecedented cycles of boom and bust and survived the profession’s transformation from the trading floor to the computer screen.

Raschke got her start as a floor trader in the pits of the Pacific Stock Exchange, keeping an eye on the ticker tape and bidding against wise old market makers. As technology and market dynamics changed, she persevered to become a successful and prominent trader.

Her personal history makes for a fascinating story, and she tells it in a vivid style. It’s a saga of how great trades can come together or fall apart, teaching readers lessons in trading and in life.

The author has researched the book extraordinarily well and written in a conversational mode that draws the reader in as she reveals trading methods and shares advice and commentary from a cast of professional traders she cultivated and collaborated with through the years.

Raschke says best practices in trading come down to fundamentals like the thoughtful use of analytics, gaining a sense of context through experience and avoiding trades so big that it’s hard to get out. There’s a recognition that, in trading, it all comes down to supply and demand: know when to be in and when to get out and what side to be on.

On the other hand, as the book makes clear, succeeding as a trader takes more than simply following maxims and tips. It requires deep insight into the market and the ability to read both the broad and subtle signs it communicates.

What’s more, traders need to learn the lessons life teaches. Raschke tells the tale of a personal bodybuilding trainer whose wise counsel about becoming and staying fit translated to trading the market. Here’s what the author took away from sessions with the trainer: “When you do proper homework and preparation at the end of each day, you are in a stronger position to start the next day. The first few successful trades give you a taste of the satisfaction gained in running a well thought-out program. This, in turn, increases the incentive to continue to eliminate the distractions and waste time engaging in frivolous activities.”

The trainer’s wisdom doesn’t end there. Raschke distills more of the teachings: “The person who starts to follow a consistent trading program will set higher goals. Stick with the basics, follow a methodology, be consistent, concentrate on your form, keep records of your progress, and above all practice positive thinking. “

The book is an engaging read by a dedicated trader with boundless intention to succeed. The author expresses deep respect for colleagues who taught her so much, and she loves the business that has rewarded her greatly.

It’s also a personal history that provides insight to traders who weren’t around before the cascade of changes in the 1980s. It also describes what’s important about the present and predicts what the future may hold. What’s most significant are the “lessons in the markets” woven from her dedication to her craft and her full real life. That’s the theme that will speak to any trader. They’re the lessons that are most meaningful to those of us who love the work.

Mike Hart, a former floor trader at the Chicago Stock Exchange and proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79