How the War in Ukraine Affects Key Commodities Markets

Prices in key commodities markets remain elevated due to the ongoing war in Ukraine

- Wheat, corn and sunflower oil prices remain elevated due to the war.

- Prices in the energy sector, such as oil and natural gas, have largely retraced back to pre-war levels.

- Steel prices have also dropped back toward the levels observed in early 2022, before the war intensified.

Global commodities markets have been trading in an unusual fashion since the onset of the COVID-19 pandemic.

Unfortunately, many of those challenges persist through today, due to the intensification of the Russia and Ukraine war in early 2022. For the commodities markets, it was almost as if one crisis was exchanged for another.

Russia and Ukraine are both rich in natural resources, which means the war in Eastern Europe has disrupted trade of some key global commodities.

For Russia, one of the main complications is Western sanctions, which are designed to slow down the Russian economy, with the ultimate goal of deterring Russian aggression and ending the war.

In the case of Ukraine, however, the situation is vastly different, because the country has sustained significant damage due to the war.

Ukraine was previously known as the “breadbasket of Europe,” when an estimated 70% of the land in Ukraine was used for farming-related activities. However, much of Urkaine’s agricultural capacity has been decimated by the ongoing conflict.

Before the war, the U.S. Department of Agriculture estimated that Ukraine was the world’s seventh-largest producer of wheat, harvesting an estimated 33 million tons during the 2021-2022 growing season. However, during the 2022-2023 growing season, that figure dropped by about 35% to 21 million tons.

Moreover, total grain exports from Ukraine—including wheat, corn and barley—are expected to drop from 86 million tons in 2021 down to 51 million tons in 2023.

That’s an immense shortfall in the world’s annual food supply, which is why the prices of many agricultural commodities are trading significantly higher than they were a couple of years ago. It also helps explain why inflation was so intense last year.

In some respects, some pockets of inflation simply can’t cool until the war in Ukraine ends. Otherwise, any significant drop in prices would have to come from reduced demand.

Commodities markets most affected by the war in Ukraine

During the onset of Russia’s invasion of Ukraine in early 2022, the world’s energy markets were the most sensitive to the emerging conflict.

Oil and natural gas prices skyrocketed on the heels of Russia’s invasion of Ukraine, and remained high through fall of 2022. However, energy prices have declined significantly in recent months.

Today, oil prices are down about 37% since peaking in June of 2022, while natural gas prices are down more than 70% since peaking last August.

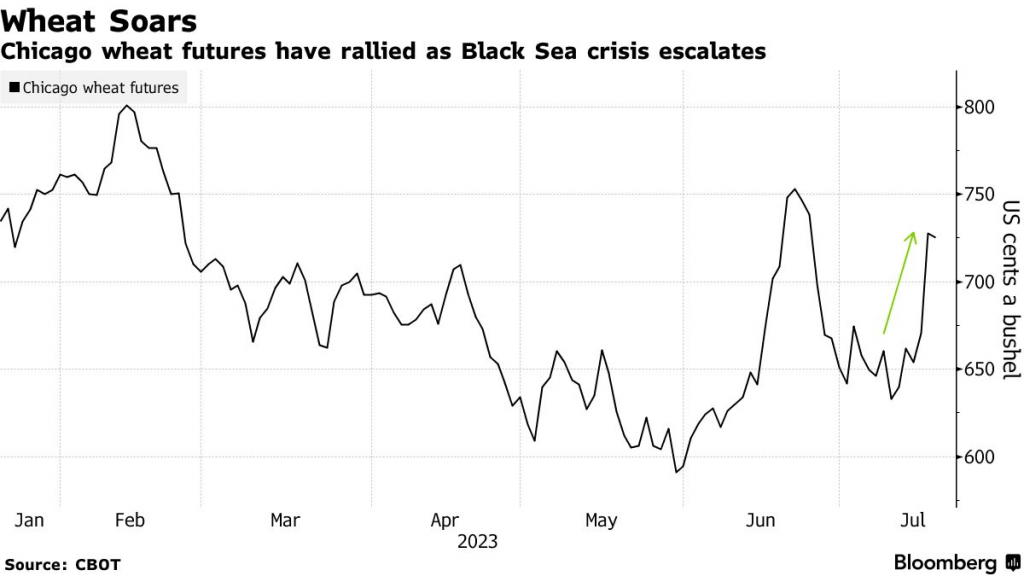

However, the prices of many other global commodities remain high and are still trading at the upper end of their historical ranges. As mentioned previously, wheat prices were significantly impacted by the war in Eastern Europe due to Ukraine’s key role in this market.

For example, at the start of 2020, wheat prices were trading about $5.15/bushel, but today wheat is trading closer to $7.50/bushel. That means wheat has appreciated by about 45% since the start of 2020.

And the future looks fairly grim because Ukraine’s agricultural production is expected to contract further. Gautier Le Molgat, an analyst at Agritel, estimates that for the 2023-2024 growing season Ukraine will export “six million metric tons less wheat and ten million metric tons corn less than in the previous season.”

As highlighted by Molgat, corn is another key global commodity that has suffered as a result of the war in Ukraine.

Back in 2021, Ukraine collected almost $6 billion in export revenue from corn. This year, however, that figure is expected to drop to about $4.5 billion. Today, corn trades for roughly $5.28/bushel, which is about 35% higher than at the start of 2020.

Looking beyond wheat and corn, sunflower oil is another key agricultural export for Ukraine. Back in 2021, the country’s total sunflower exports represented roughly 47% of the global total, at roughly $6.5 billion.

However, during the 2022-2023 growing season, Ukraine is only expected to export about $3.6 billion worth of sunflower oil. That means the sunflower oil market remains critically undersupplied, much like corn and wheat.

Today, sunflower oil trades for about $920/ton, which is nearly 50% higher than the price observed at the start of 2020, when it was trading closer to $600/ton.

It should be noted that in recent days Russia has been targeting key agricultural depots in Ukraine. For example, on July 19, the Russian military started bombing some of the port and associated grain storage facilities in Odesa, which is located on the Black Sea.

That means even if the war were to end in 2023, key infrastructure would need to be rebuilt before Ukraine could ramp up its agricultural exports to pre-war levels.

Impact on the global steel market

Looking beyond agricultural commodities, Ukraine has also traditionally been a large producer of steel.

In 2021, Ukraine produced about 21.5 million tons of steel, which ranked the country No. 14 on the list of largest producers. That same year, Ukraine exported about $4.6 billion worth of steel.

Unfortunately, Ukraine’s domestic steel industry has been severely crippled by the war. Two of the country’s largest steelworks—Azolstal and Illich in Mariupel—were both destroyed by Russian forces in the spring of 2022.

According to The New York Times, these two plants previously accounted for roughly 41% of the total steel production in Ukraine.

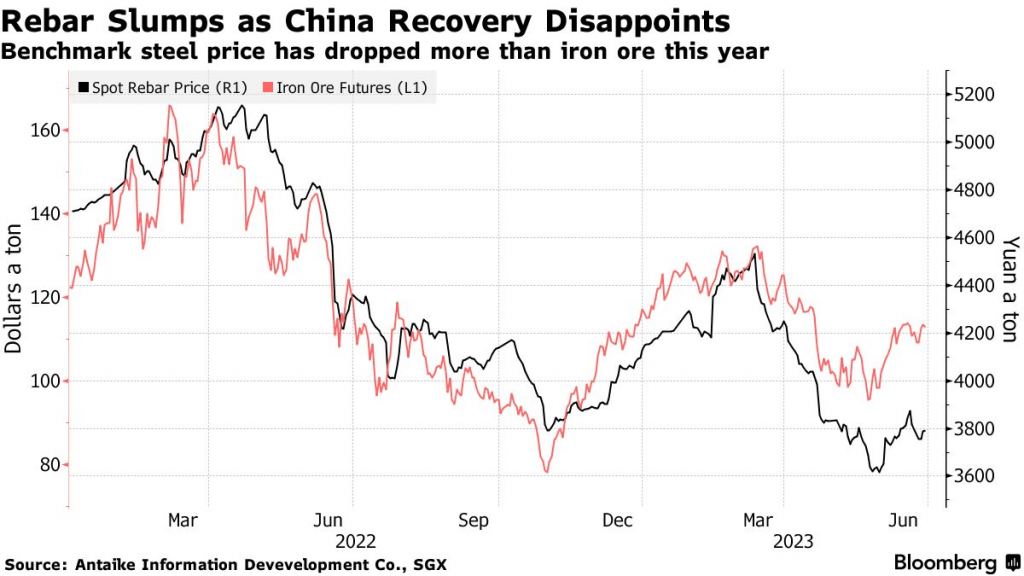

As a direct result of the war, Ukrainian exports of flat-rolled steel dropped by roughly 68% during the first 6 months of 2023, as compared to the first six months of 2022. However, global steel prices haven’t been as sensitive to Ukraine’s diminished contribution to the market.

Today, steel rebar trades for about $520/ton, which is almost exactly the same price as observed at the start of 2020. Steel prices did rally toward $800/ton shortly after Russia invaded Ukraine in the spring of 2022, but have fallen off a cliff in recent months.

The difference in the steel market, as compared with the agricultural commodities markets, is that other global producers were able to pick up the slack.

China produces roughly half of the world’s annual total, and was able to increase production by about 7% during the first half of 2023. As a result, Chinese steel exports recently hit a seven-year high.

Another factor to consider is that global manufacturing activity has contracted in 2023, which has also weighed on demand, and therefore, prices.

For these reasons, the global steel market is arguably a lot more balanced as compared with the wheat, corn and sunflower markets, which remain disjointed and undersupplied.

Future prospects for global commodities

The future is never certain, but if the war in Eastern Europe continues, it’s highly likely that the prices of some agricultural commodities will remain elevated.

And if the war was to intensify, that would also likely be constructive for commodities prices.

Another important factor to consider is the onset of El Niño, which tends to increase the likelihood of extreme weather events, such as drought and hurricanes.

The prices of cocoa and coffee are already elevated in 2023 due to El Niño, and previous supply disruptions linked to drought. That means any additional extreme weather events in 2023 could impact prices in other commodities markets, as well.

On the other end of the spectrum, a sudden resolution to the war in Ukraine, such as a ceasefire, could have the opposite effect—pushing global commodities prices lower. The onset of a severe global recession would also likely weigh on commodities prices, if one were to develop.

For active traders, that means there should be a multitude of fresh opportunities in the commodities markets during the remainder of 2023 and beyond.

For more background on trading wheat futures, check out this episode of Trading Strategies and Conceptson the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.