The BUZZ Doesn’t Live Up to the Hype

Even in the era of meme stocks, this pricey and unpopular sentiment fund is underperforming

Even people who’ve never owned stock or never played Grand Theft Auto heard about the GameStop phenomenon and the “meme stock” hype that gripped Wall Street last year.

GameStop (GME) shares ended 2020 at $18.84 per share, mounting an impressive rally from below $6 the previous summer. On Jan. 28, 2021, GameStop shares traded to an intraday high of $483 before closing the day at $193 per share.

Financial and mainstream news outlets reported ad nauseam on the aggressive short-squeeze of GameStop shares that played out on the Reddit community known as WallStreetBets. Naturally, the media furor fueled interest in finding the next stock primed for takeoff. Hungry potential investors flocked to Reddit forums and opened brokerage accounts, ready to capture the profits.

While frenzied individual investors strained to find GameStop 2.0, the financial industry took note. Looking to capitalize on the excitement, VanEck Funds Launched its BUZZ exchange-traded fund (ETF).

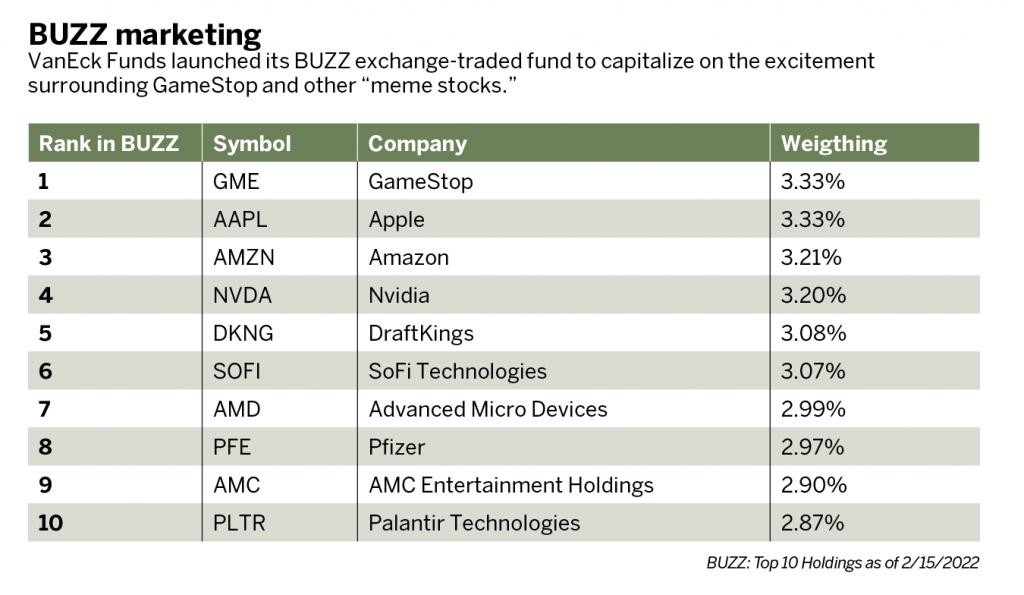

As a social sentiment fund, BUZZ invests in stocks that artificial intelligence (AI) ranks highly because of bullish sentiment online. In other words, people on the internet are “buzzing” about the stocks. Those with the most positive chatter are weighted higher in the BUZZ Index and therefore receive a larger investment allocation in the VanEck ETF.

The index and ETF include 75 stocks at any given time. They avoid illiquid or penny stocks by requiring each company to be worth $5 billion or more. The stocks also must generate an average of $1 million in daily trading volume.

The fund then rebalances at the end of each month to focus on the latest rankings of stocks generating excitement online. Check out the table Buzz marketing, above, to see the top 10 current holdings in BUZZ .

In theory, this ETF sounds fantastic. Investors can participate in a well-balanced portfolio of stocks that are trending online without needing to monitor Twitter or message boards. Additionally, the fund vets the stocks to make sure they qualify as sensible investments.

But despite all that prep work, the VanEck BUZZ ETF gets lackluster results.

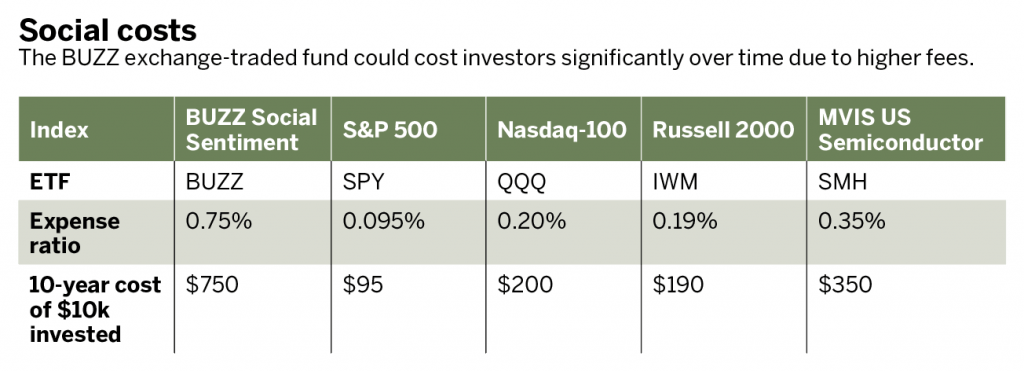

BUZZ disappoints when it comes to fund fees, a metric in which it’s far from competitive. As shown in the table “Social costs,” below, BUZZ charges a 0.75% expense ratio. That’s nearly four times as much as Invesco’s Nasdaq-100 ETF, which provides investors exposure to the tech-dominant Nasdaq-100 Index. For a fairer comparison, consider VanEck’s semiconductor ETF (SMH), which still has a lower expense ratio at 0.35%.

BUZZ also failed to inspire much enthusiasm among investors and traders and thus posts disappointing daily trading volume. After its launch in March of last year, BUZZ saw an average daily volume of 1.8 million shares in the first month. But in January 2022, BUZZ had daily volume of only 61,000 shares. The VanEck semiconductor ETF saw 5.6 million and 8 million shares traded daily on average in those same timeframes.

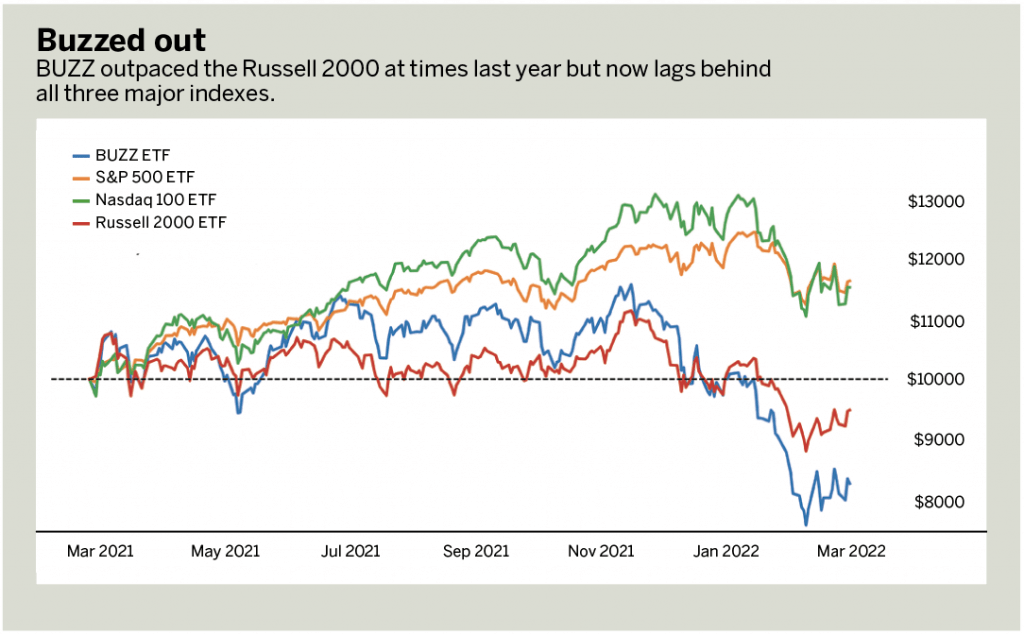

So, how has the expensive and unpopular BUZZ performed compared with the generic indexes? In short, not well. Investors who bought the VanEck BUZZ fund on its debut are not seeing a positive return.

To be fair, the market has been turbulent in recent months with all three major stock indexes selling off. However, a purchase of the S&P 500 or Nasdaq-100 ETFs on the launch day of BUZZ was still up money in mid-February. (See Buzzed out, below.) At some points last year, BUZZ was outpacing the Russell 2000 but now lags behind all three major indexes.

Investors looking for more aggressive ETFs than the overall indexes can potentially shift some capital to growth-focused ETFs that rely on basic fundamentals instead of Twitter traffic. The SPDR S&P 500 Growth ETF (SPYG) holds a portfolio of 239 growth-focused firms and has an expense ratio of 0.04%.

The ETF industry is revolutionary for individual investors. The ability to invest in liquid, low-cost, diverse funds enables people to participate in the growth of the U.S. stock market and build personal wealth.

But remain cognizant that ETFs are still products, and many rely on flashy marketing to draw investors. With less than a year under its belt, time will tell if BUZZ can work long-term and fulfill the dream of capturing social sentiment.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors @jamesblakeway