Essential Market Forecasting Tools

Traders benefit from understanding market trends that repeat over time

While the saying “history repeats itself” may seem like a nauseating cliche, it often holds true in economics, finance and trading.

Take the example of positive drift in the stock market, which suggests that an aggregate index of stocks will continue to rally over time. Not every stock will increase in price, but a broad-based index will grow as innovation continues at new and established companies.

Positive drift has generally held true since the advent of indexes such as the Dow Jones Industrial Average in 1882 and the S&P 500 in 1860.

Another idea that tends to repeat itself is that fear is overstated in the markets. Financial assets with liquid options markets have implied volatility values, which can be utilized to estimate the magnitude of future expected movement. An asset should fall within the expected the expected range 68% of the time. But history shows that stock indexes stay within that expected range more often than anticipated.

Take the iShares Russell 2000 exchange-traded fund (ETF) for example. It represents a portfolio of 2,000 small-cap U.S. stocks. Unlike the Dow, S&P 500 and Nasdaq-100, the Russell 2000 holds no more than 1% of its portfolio in any single stock.

From 2004 to the present, the Russell 2000 has landed within its expected 30-day range 82% of the time. Keep in mind that it’s only supposed to stay in the range 68% of the time. Thus fear—in either direction—is overstated.

Benefitting from history

Traders can begin taking advantage of positive drift and overstated fear by investigating the short put strategy in index ETFs. The short put is a simple bullish strategy where a trader sells a single put option with a strike price typically below the current price of the stock or ETF.

The strategy’s goal is for the stock or ETF to increase in price, stay the same price or not fall too much. For example, if XYZ stock is trading for $100 per share, a trader may look to sell the 95 strike to express the assumption that the stock will increase or at least not drop below $95. This trade wants the stock to stay above $95 and the 95 put to expire worthless, meaning the trader keeps the credit received for selling the put option.

New traders who are learning about implied volatility and expected movement can use the delta values to help them pick their options strikes. The delta value tells a trader the expected probability that an option will not expire worthless.

Think of the example above. If the 95 put has a delta of 30, then there’s a 70% theoretical chance the option will expire worthless. If the delta was 40, there’s a 60% chance the option will expire worthless.

But because fear is overstated, it makes sense to assume these numbers may play out differently in reality and the percentage of options that expire worthless is higher than the market projects.

Time for a test

Traders can use Lookback, tastytrade’s free new backtesting and analysis software, to test these ideas. It enables them to see how a chosen strategy, such as a short put option, performed in the past for a specific stock or ETF.

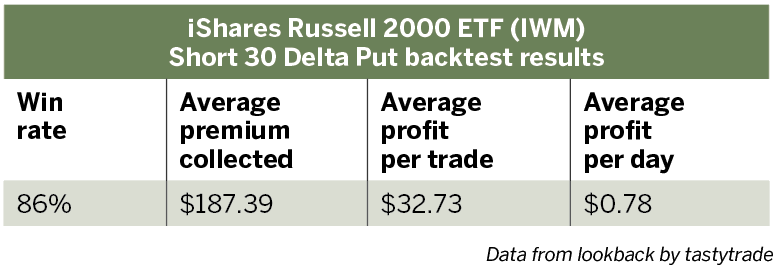

Consider again the Russell 2000 ETF. Traders who sell a 30 delta short put option in this ETF can assume the trade is profitable around 70% of the time. Asking Lookback to simulate the results of selling a 30 delta short put in the Russell ETF over the past 10 years, they can see the trade was actually profitable 86% of the time, with an average profit of $33. (See the table “iShares Russell 2000,” below.)

No matter how much skill or experience traders have, they can benefit from knowing financial history. On average, the stock market will continue to rise despite dips and selloffs along the way. But regardless of direction, the market will continue to overprice fear and overestimate future movement.

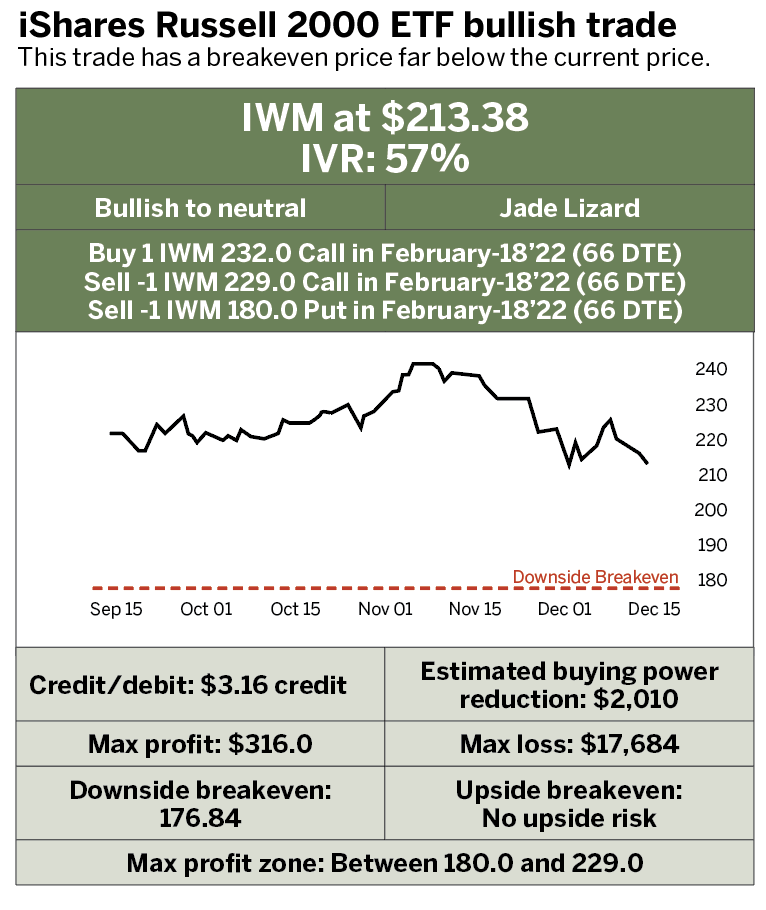

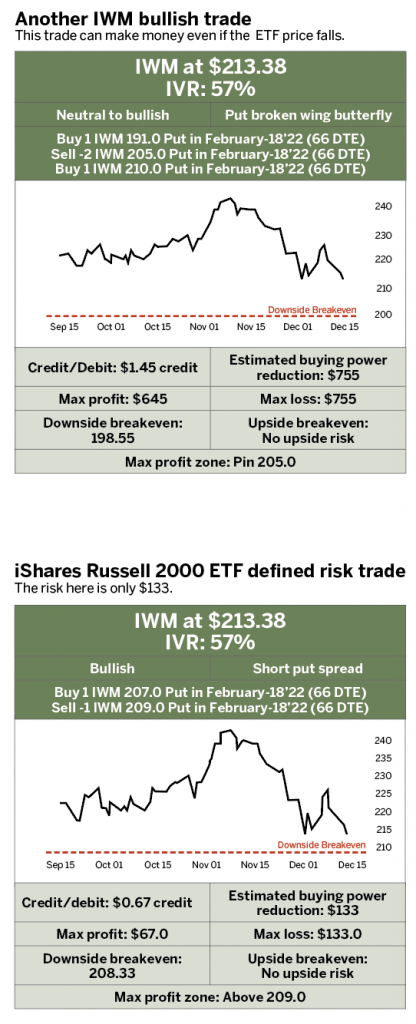

Traders seeking additional probabilistic trade inspiration should check out Alpha Boost, the free trade idea email service from Quiet Foundation. Luckbox used Alpha Boost to generate a variety of trade ideas in the Russell 2000 ETF. As always, in the markets and in life, be sure to do your due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors @james.blakeway

Quiet foundation helps investors find new trading opportunities.