Cable TV? Cut It Out

Cord cutting saw astounding growth in 2018, with more than 2.5 million American households

joining the movement. It continued picking up speed at a phenomenal rate as 1.1 million Americans canceled cable TV in just the last three months of 2018 alone.

As 2019 unfolds, consumers will find it easier than ever to cut the cord, cancel cable TV and still retain the ability to watch the shows they want.

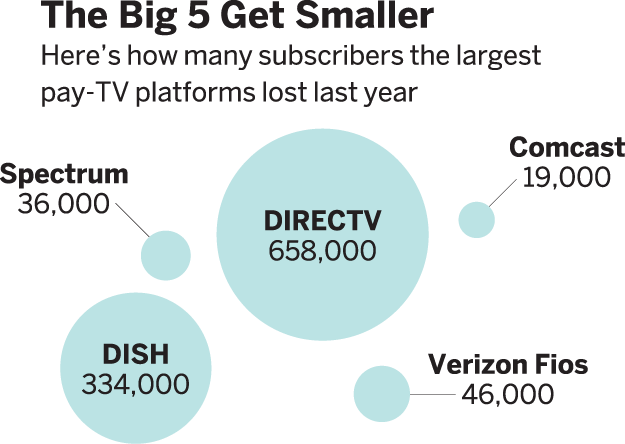

Cord cutting has had a devastating effect on the Big 5 pay-TV providers — AT&T (T), Charter (CHTR), Comcast (CMCSA), DISH (DISH) and Verizon Fios (part of Verizon Communications (VZ)) — which lost a combined 2.4 million subscribers in 2018, with smaller cable networks making up the remaining subscriber losses. Those numbers do not include the losses from smaller cable TV companies like Cox, many of which do not report subscriber numbers.

The news may be even worse for small cable TV companies. Some of them have even made the startling decision to walk away from offering TV services to their customers, like RTC Communications, which announced that it will end its TV service starting in July. Even the bigger cable companies are struggling. Recently, Cable One’s (CABO) CEO announced that of its 800,000 customers only 240,000, or 30%, pay for TV service; the other 70% pay only for broadband internet.

“We don’t see bundling as the savior for churn,” Cable One CEO Julie Laulis says. “I know that we don’t put time and resources into pretty much anything having to do with video because of what it nets us and our shareholders in the long run. We pivoted to a data-centric model over five, six years ago, and we’ve seen nothing to derail us from that path.”

Cable One is not alone in having more internet customers than TV customers. Since 2015, Comcast has experienced similar trends and recently reported that it now has about 3 million more internet customers than cable TV customers.

With so many small cable TV companies not reporting numbers, it’s difficult to know with certainty how fast cord cutting is growing.

What is cord cutting?

Cord cutting is canceling a traditional pay-TV provider, like cable or satellite TV, in favor of nontraditional options, such as streaming, DVDs and antennas for free over-the-air TV.

Many argue that cord cutting should include the price of cable internet. However, most Americans view internet service as a necessity but considered pay-TV a luxury. Therefore, cord cutters count their savings based on the how much they save by eliminating paid-TV services.

Others argue that cord cutting counts only if a user also cuts the internet cord, but most cord cutters seem happy just saving money on TV.

Broadcast TV will probably last until 2030

— Netflix CEO Reed Hastings

The end of broadcast TV?

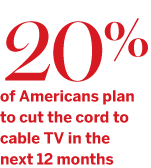

According to UBS, 20% of Americans plan to cut the cord in the next 12 months (from the time the survey was taken). That works out to more than 39 million Americans actively planning to cut the cord.

Netflix (NFLX) CEO Reed Hastings has for years predicted the death of broadcast TV. During a speech in Mexico City last month he once again did so, declaring that “broadcast TV will probably last until 2030.”

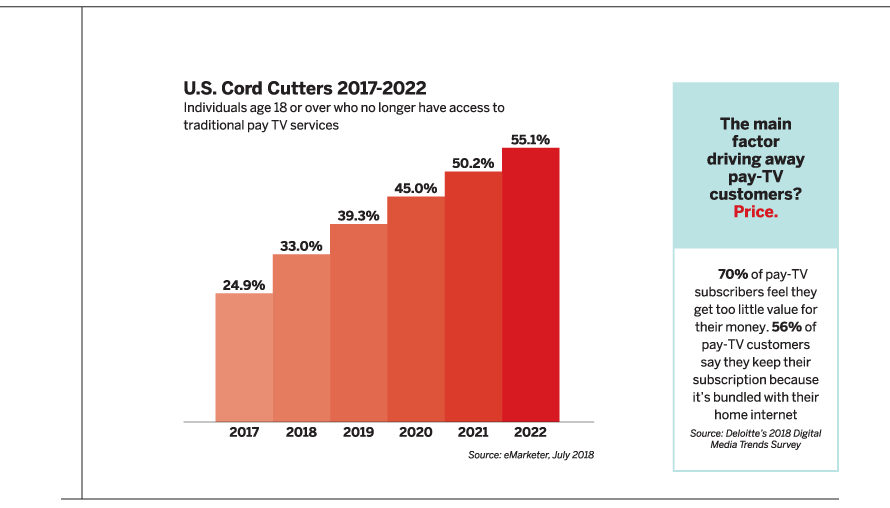

No one really knows when or how long it will be until cable TV dies, but the golden days of cable TV have ended and cord cutting is growing faster now than at any other time in U.S. history.

How much cord cutting saves

A recent cg42 study published in Fortune says the average cord cutter saves $85 a month even with the cost of internet. Nationally, that works out to $2.55 billion saved every month.

A study by Lendedu puts the average cord cutting savings closer to $115 a month, which means total savings of $3.45 billion.

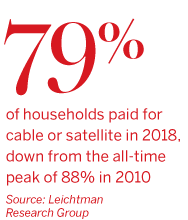

Around 30 million people are cord cutters, according to a study by the Leichtman Research Group Inc. However, some have suggested as many as 33 million have joined the ranks of U.S. cord cutters, while others put the number closer to 35 million.

Savings vary by family. Some families are large; others are small. Some families watch a lot of TV and are likely to pay for more services. Other families watch less TV and are likely to subscribe to fewer services, resulting in larger savings.

Bottom line

No matter what numbers one uses, cord cutting is saving Americans millions of dollars every month, and that number will continue to rise as cord cutting grows. More important, that means Americans have billions of dollars to spend on things other than watching TV.

While still relatively young, cord cutting is drastically disrupting the TV industry. The disruption mirrors what happened in the music industry in the early 2000s when iTunes and MP3s took over.

How exactly the disruption of cord cutting will play out in the long run remains unknown. Cable companies are fighting against streaming in much the same way the music industry fought iTunes and MP3s … and we all know what happened there.

Where will cord cutting be five years from now? What will happen once it becomes impossible to fight the growing trend of cord cutting? Observers can only guess what will occur once the nation reaches the point of no return and cord cutting becomes a truly major force in the world of television.

When that will happen remains unknown. Some speculate that cord cutting will become larger than cable TV in less than three years. Others suggest that with a strong economy it could take five to 10 years for cord cutting to grow larger than traditional pay-TV services in the United States.

What is known is that cable companies are struggling to slow down the cord-cutting boulder that is rushing headlong on a downhill path toward them and is picking up speed by the day.

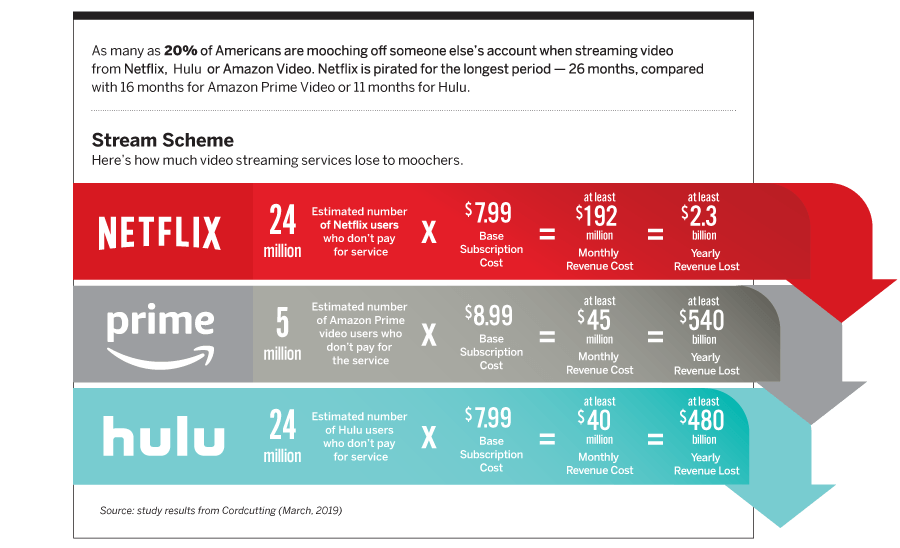

Counting Cord Cutters & Streaming Schemers

In 2018, the total number of pay TV subscribers dropped 4.1% from a year earlier, the highest rate of decline since the trend of cord cutting emerged in 2010. About 985,000 more customers dropped cable or satellite in Q4 than signed up for new service industry wide.

Source: MoffettNathanson Research

The average pay-TV bill in 2017 totaled $100.98 per month, which represents a 5.5% compound annual growth rate between 2000-17.

That’s an opportunity for the lower-cost “virtual” pay-TV entrants. Multichannel streaming services will reach nearly $2.82 billion in revenue in 2018, rising to more than $7.77 billion by 2022. Among those services, average revenue per subscriber is roughly one-third that of traditional cable TV. Source: Kagan Research

Luke Bouma, who launched Cord Cutters News in 2014, has become a prominent voice of cord cutting in print, online and on the air. @cordcuttermnews