Changes at Exchanges

Like many industries, financial exchanges have consolidated in the past few decades. The world-famous New York Stock Exchange is now owned by the Intercontinental Exchange (ICE). The Nasdaq (NDAQ) acquired both the Boston and Philadelphia stock exchanges. The CME Group (CME) absorbed the New York Mercantile Exchange and later merged with the Chicago Board of Trade.

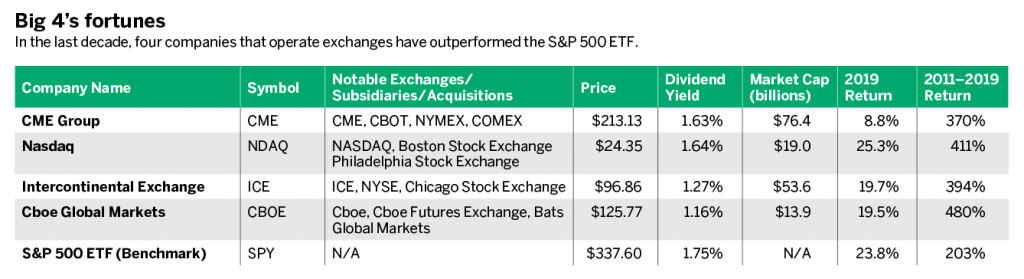

All three of the aforementioned firms, as well as the Chicago Board Options Exchange (CBOE), are publicly traded. (See “Big 4’s fortunes,” below.) These four companies now represent a combined $163 billion in market cap value and are all components of the S&P 500 Index. For some context: CME Group, the largest of the four, now has approximately the same value as Caterpillar (CAT: $76.3 billion). Even the Cboe is a multibillion-dollar corporation, with a market cap greater than Kohl’s (KSS: $6.9 billion) and The Gap (GPS: $6.8 billion) combined.

As long as these, now larger, exchanges provide liquid markets and facilitate efficient transactions, why should traders or investors care about consolidation? Quite simply, opportunity.

Investors can purchase ownership in the companies that facilitate their investments, such as Nasdaq. Likewise, traders can buy or sell options contracts where the underlying stock is the Cboe, the same exchange that provides the marketplace for such transactions. Just as an avid online shopper might enjoy investing in Amazon, an avid trader intuitively appreciates the case for owning stock in an exchange.

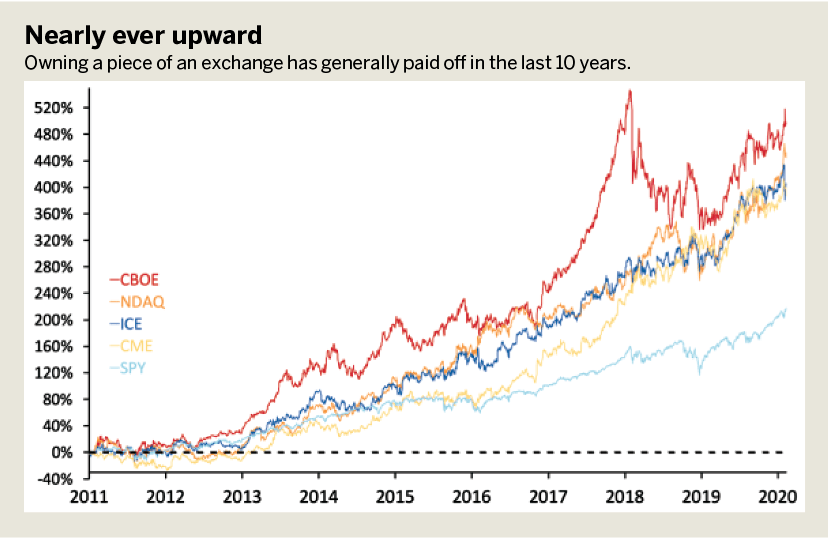

All four large exchange companies generated strong returns for investors during the past few years. Despite lagging behind the S&P 500 in 2019 (an average of 18.3% versus 23.8%), the performance of the exchanges over the past decade translated to meteoric returns, far outpacing the overall equity market. (See “Nearly ever upward,” below.)

Investors in all four exchanges receive quarterly dividends. While they yield less than the aggregate S&P 500 funds, the exchanges are still potentially more attractive as an income and growth asset than popular cash-burning tech stocks.

Digging deeper, the exchanges also outpaced the overall financial sector in recent years. Take, for example, XLF, a popular financial sector exchange-traded fund. It holds shares in all four exchanges, in addition to 62 other financial service stocks. XLF returned 255% from 2011-2019. This was far below the average of 414% for the exchange stocks.

The high praise for the recent performance of the exchanges also highlights their current drawback for investors: They are likely overvalued. Analysts indicate that fair values for these four stocks are likely well below their market prices. This, coupled with exuberant recent rallies, makes it harder to justify purchasing at these lofty levels.

Quiet Foundation’s free portfolio analysis tools provide some additional context around these stocks. An equal-weighted portfolio analysis indicates a fairly high diversification score among the exchange stocks because of their low correlation to one another and a low correlation to the S&P 500. Combined, the four stocks have underperformed the S&P 500 in the past three months but, as previously indicated, this is after multiple years of outperformance.

Long-term investors may want to pass on these stocks and reevaluate if they fall to more logical price levels. However, for active traders, some opportunity may still exist. All four exchange stocks have listed options contracts available to traders.

Of the four, the Intercontinental Exchange has the most liquid options, with high open interest and nickel-wide markets. Traders with a bearish sentiment on the ICE exchange may look to buy put spreads or potentially sell call spreads (in the event of heightened implied volatility). Regardless of seeking current opportunity or waiting for more turbulent markets, investors should continue to do their due diligence.

Evaluate any portfolio with Quiet Foundation, click here.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.