Media Matters

Emerging financial technology helps investors understand their portfolios

Netflix (NFLX) and Spotify (SPOT) are making aggressive bids for the public’s eyes, ears and expendable income, forcing the entertainment industry titans of yesteryear to innovate, or acquire innovation, in their struggles to stay relevant and profitable.

The threat of takeovers in the video entertainment industry and the uncertainty of licensing deals are keeping prudent investors glued to screens or printed pages to monitor the industry’s news. The headlines include the Disney+ (DIS) video streaming service’s attempt to poach Netflix subscribers. Disney hopes to become the new home for its own content and would remove it from other services as the licenses expire. That would put programming pressure not only on Netflix but also on other services such as Starz (STRZA) and TNT, which is related to WarnerMedia (TWX).

Music entertainment is a whole different animal, pitting Spotify head-to-head with Apple (AAPL) and Amazon (AMZN) music. While video producers are differentiated because they don’t have the same TV series or the same movies, firms that stream music have similar libraries. That means that technology and pricing dictate which music providers prevail.

The video entertainment industry is rife with mergers and acquisitions. It’s tough for investors to pick a single horse to bet on, and it’s unlikely that any one of these companies will continue to outpace all others.

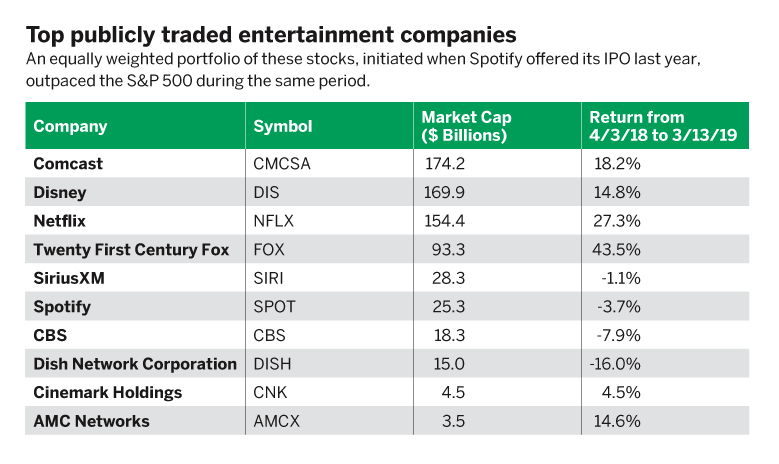

However, it’s possible that all these stocks have a role to play in a portfolio focused on consumer discretionary spending and the entertainment sector. An equally weighted portfolio of these stocks, initiated when Spotify offered its initial public offering last year, has returned 9.6%, compared with the S&P 500, which has returned 6.4% in the same time period. (See “Top publicly traded entertainment companies,” below.)

To highlight the strengths and weaknesses of a sector-specific portfolio like this, investors can run an analysis through the free Quiet Foundation (QF) Exploratory Portfolio Intelligence (EPI) system. That can provide a deeper look at the stocks’ relationships to one another and the overall market.

As an example, running these 10 stocks (equally weighted) through the EPI analysis results in a score of 66 (out of 100) and a QF rating of “On Track,” the second highest rating.

In the EPI report the QF takes a deeper look at the diversification, which received a poorer score because of a high correlation among these stocks. They tend to move in the same direction day-to-day.

This analysis also provides insight into future potential movement of this portfolio over the next year. These stocks have a higher probability than the S&P 500 of a 10% move in that time frame. The EPI output highlights the liquidity and potential opportunity of these stock holdings. All of the companies, other than AMC Networks (AMCX), trade more than 1 million shares per day, a common threshold for a liquid stock.

Liquidity is important in such a dynamic sector because it enables investors to reallocate capital quickly as the industry shifts. The opportunity metric refers to the portfolio’s prospects to use options positions against the stock holdings. Of these companies, most have exchange-listed options, with Comcast (CMCSA), Disney, Netflix and CBS (CBS) standing out as the more liquid contenders.

These stocks have a higher probability than the S&P 500 of a 10% move

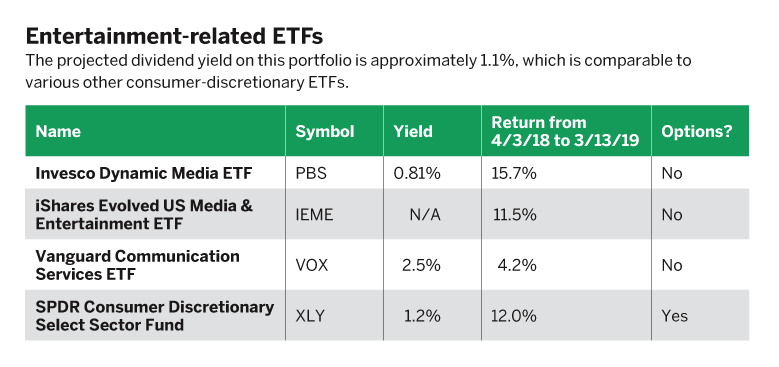

In “Entertainment-related ETFs,” right, the projected dividend yield on this portfolio is approximately 1.1%. This is comparable to the various consumer discretionary ETFs available in the marketplace.

Overall, the audio and video entertainment industry provides a blend of older, dividend paying stocks with newer, tech and growth-focused companies. To wade into this sector, investors should be as nimble as these corporations moving forward. Whether using ETFs or individual stocks, wise investors may look to keep the QF EPI system in their arsenal, aiding in portfolio allocation analysis.

Disclaimer: Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report is based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com

James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment advisory service for self-directed investors.