Robo-Advisors: Not ‘On Track’

Financial technology helps proactive investors understand their portfolios

Traditional exchanges closed their open outcry pits as markets moved to laptops and smartphones, giving virtually everyone in the country access to the stock and derivative markets from the comfort of home or on the go.

While many have welcomed their new-found investment freedom, some remain reluctant to take the plunge, blaming lack of time and a dearth of knowledge. The latter still turn to financial advisors for investing decisions on all or part of their wealth.

Some want the advice of an “expert” but don’t want to leave home or even talk to anyone.

The robo-advisor, the newest disruptor of the financial advice industry, dispenses lower-cost investment advice based on algorithms instead of human interaction. The algorithms use the investor’s income, financial standing, age and retirement goals to determine investment allocations.

Betterment, a company launched in 2010, occupies a position near the forefront of the robo-advisory wave, managing more than $14 billion for its customers. It offers low costs and minimal barriers to entry with and a 0.25% annual management fee. A Betterment account provides customers with access to their asset management program, weighting a diverse portfolio of stocks and bonds through the use of exchange-traded funds (ETF). It’s all algorithmic, with no contact with a registered advisor. However, for a slightly higher annual fee of 0.40%, customers can “upgrade” their accounts to include actual human contact with a Betterment advisor — providing they have $100,000 at the firm.

Automatic pilot

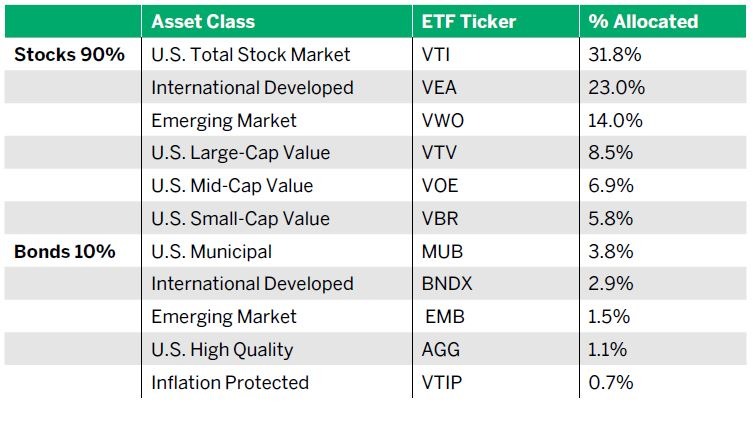

Here’s a look at Betterment’s 90/10 General Investing portfolio allocation.

On Betterment’s frontend website, a planned portfolio for anyone under the age of 50 (regardless of income) includes 90% stocks and 10% bonds. A deeper dive shows the full spectrum of the portfolio composition (see “Automatic pilot,” above).

The robo-advisor, the newest disruptor of the financial advice industry, dispenses lower-cost investment advice based on algorithms instead of human interaction

Betterment relies on ETFs, which typically have lower net expense ratios than managed mutual funds. A portfolio with Betterment’s weightings, initiated at the beginning of 2018, lost 9.1%. For comparison, the S&P 500 ETF (SPY) lost 6.4% in 2018. A portfolio split 90/10 between SPY and the iShares 20+ Year Treasury Bond ETF (TLT) lost 5.9%.

As with any portfolio comprised of stocks, ETFs and mutual funds, Betterment’s portfolio can also be run through the free Exploratory Portfolio Intelligence (EPI) analysis service provided by Quiet Foundation. This portfolio was entered based on the weightings included in the table, initiated at the beginning of 2019. The result was a score of 50 (out of 100), earning the portfolio a rating of “Satisfactory.”

The “Diversification Wellness” score on the EPI report was low because of a high internal correlation between the positions. Of the stockbased ETFs, five of the six (76% of the total portfolio) had a correlation with the S&P 500 above 0.9. These holdings tend to move in the same direc tion as each other and the overall U.S. stock market. This portfolio also lagged behind the S&P 500 in the last three months, gaining 11% compared to the S&P’s 13%. However, the bond allocation does help the portfolio see slightly lower volatility, 12.7% versus 13.2% for the S&P.

The EPI report gave a higher score in liquidity, as eight of the 11 ETFs have more than 2 million shares traded on average per day. The opportunity score was lower, indicating that most of these symbols do not have liquid options markets. This indicates limited prospects for enhancement strategies, using options against long holdings.

All in all, robo-advisors such as Betterment may be a practical choice for the passive investor looking to delegate investment authority over their assets. However, it may not be the best choice for the financially literate, confident, pro-active, self-directed (luckbox-subscribing) investor.

James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides a fee-free investment advisory service for self-directed investors.