The Active vs. Passive Overlap

Long-term investors and active traders have more in common than they might think

So-called professionals sometimes urge novice investors to turn their backs on active trading. Instead, beginners should entrust their money to an adviser or stash it in a mutual fund and leave it there, the pros like to say.

Those passive approaches might work for some, but nothing is stopping investors from taking control of their own fates. Modern financial markets and today’s trading technology enable just about anybody to become an active investor.

Active investors study the markets and develop strategies to make money by buying and selling stocks and options, as opposed to passive investors who simply hold onto stocks and hope their value increases.

What makes more sense? Well, novices don’t have to decide on the spot which type of investor they’d like to become. In fact, they can be a little bit of both.

They can accomplish that duality by opening smaller accounts and using them to make frequent trades, while still hanging onto more passive retirement accounts, such as IRAs or 401(k)s.

After all, there’s no mandate that an active trader must stake every dollar on buying and selling stock options. It’s not necessary nor prudent.

But regardless of how much capital one allocates or how often one decides to trade, product selection is extremely important.

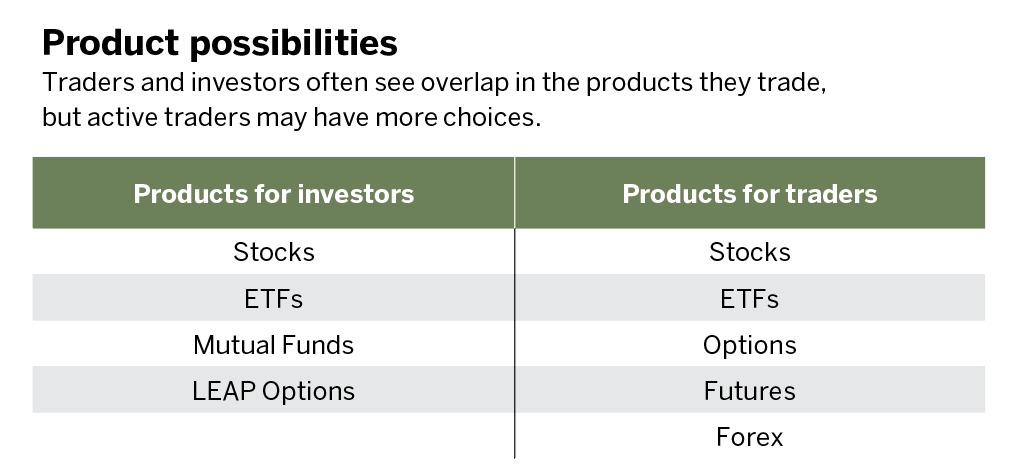

The financial world is finite, which means active traders and long-term investors sometimes wind up using the same financial products—even though they used differing metrics to choose them.

Stock selection provides a classic case in point. A long-term investor building a lower-risk portfolio may favor “blue-chip” stocks in companies that operate well-established businesses and potentially pay a dividend.

One example is Procter and Gamble (PG), which produces consumer staple brands like Gillette, Oral-B and Tide. It’s returning a 2.5% current annual dividend yield to investors.

Because Procter and Gamble combines a long history with well-known brands, it could appeal to long-term investors and to short-term traders alike.

But traders looking for fast profits typically want stocks that move faster than blue-chip firms. That’s why they often gravitate toward companies in the technology sector with more erratic price action, such as Tesla (TSLA). It’s known for volatility and doesn’t pay a dividend.

Another type of product suitable for both passive investors and active traders—Exchange-traded funds (ETFs)—provides a basket of stocks or other financial instruments. Some popular ETFs for both active and passive investing track the overall stock market, such as S&P 500 index funds.

For active shares and options trades, the definitive S&P 500 fund to trade is SPY, the SPDR S&P ETF. Traders buy and sell tens of millions of shares in that ETF per day, with high options liquidity.

For options, short-term traders look to three metrics to signify a liquid trading vehicle: option volume, option open interest and bid-ask spreads. Volume for options, like shares, simply signifies the number of contracts traded that day. Open interest indicates the number of open contracts. The bid-ask spread shows the difference in prices for which a trader can sell or buy the contract. The tighter the spread, the more liquid the contract.

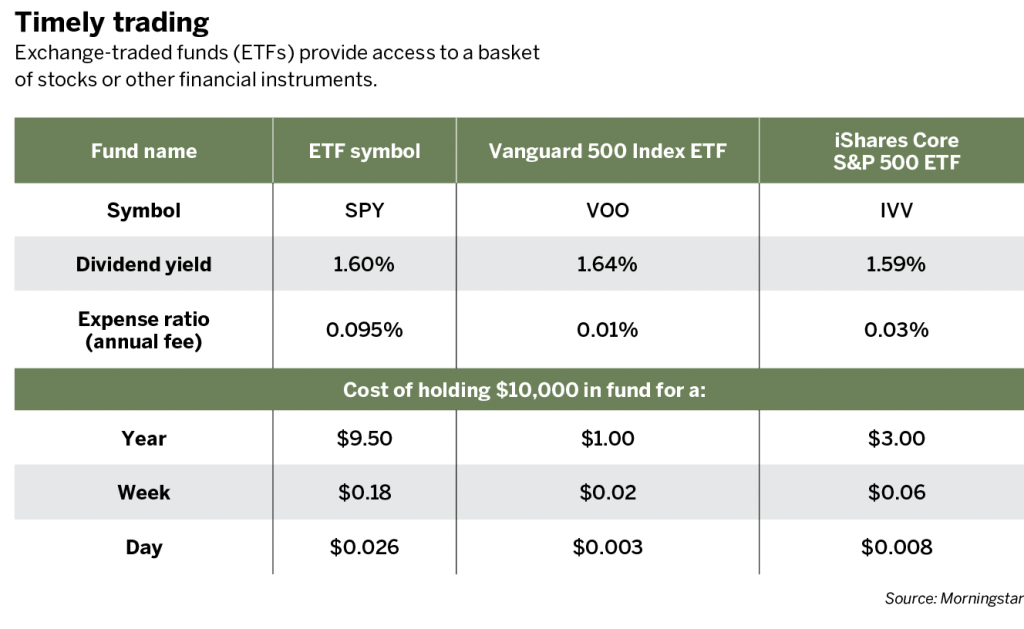

Instead of liquidity, long-term investors are often more concerned about the fees associated with holding an ETF over many years. At 0.095%, the management fee for the SPDR S&P 500 fund is relatively low compared to other ETFs. However, investors who want the lowest portfolio fees have other options. Consider the table “Timely Trading” that compares SPDR Fund fees to those of Vanguard and iShares funds.

Fees for larger positions in ETFs can add up over the years, so long-term investors may want to keep an eye on them. However, the fees seem nearly negligible during short-term trading, which leaves traders free to focus on liquidity.

Long-term investors and active traders may also look for access to the same asset classes but through different types of products. Consider the euro, a hot-topic currency given its decline against the value of the U.S. dollar in 2022.

Longer-term traders may look to ETFs to hold the euro for an extended time, betting on the euro’s recovery and the eventual decline of the U.S. dollar. A popular ETF for that goal is FXE, the Invesco CurrencyShares Euro ETF.

However, euro ETFs have extremely low volatility and not much day-to-day movement. Traders who want direct access to currency markets can use cash forex markets or futures products.

For example, /M6E, the CME Micro euro futures contract, enables traders to speculate on the direction of 12,500 euros and requires only $365 in initial capital.

There’s plenty of room for both long-term investors and active traders to coexist in harmony. Sometimes they may even be one and the same. But regardless of the investment time horizon, strategy choice or product selection, traders should be mindful of risk and always practice due diligence.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors. @jamesblakeway