Dollar Days: Looking Beyond the U.S.

As the U.S. dollar declines from the heady highs of 2022, it’s time to revisit the Australian and Canadian dollars

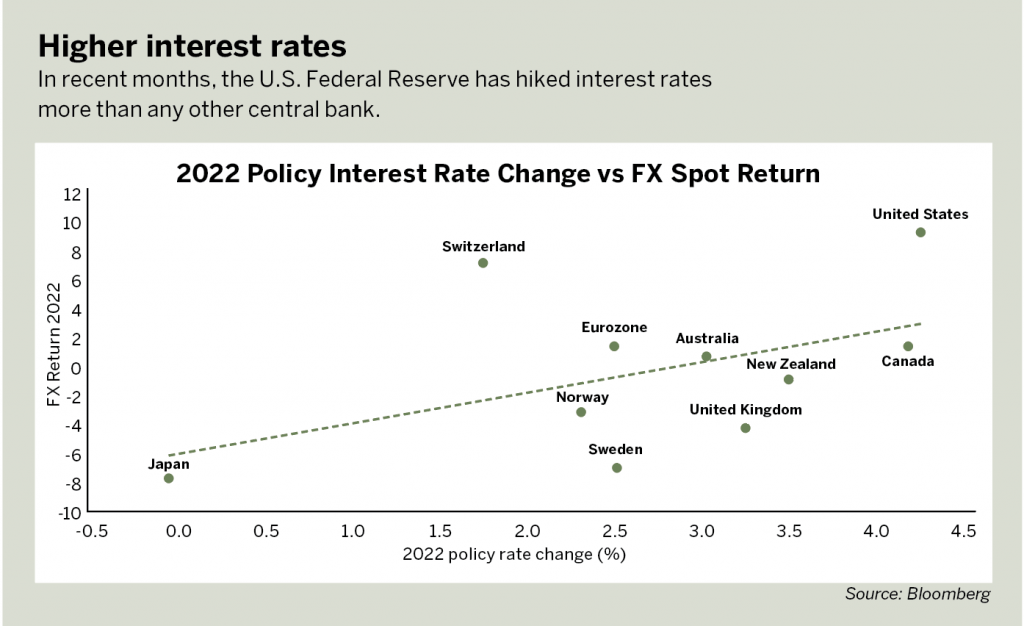

The value of the U.S. dollar soared in 2022 as currency markets followed a familiar script.

This happened because the Federal Reserve delivered more interest rate hikes than any other top central bank, delivering a blistering 4.25% in just 10 months.

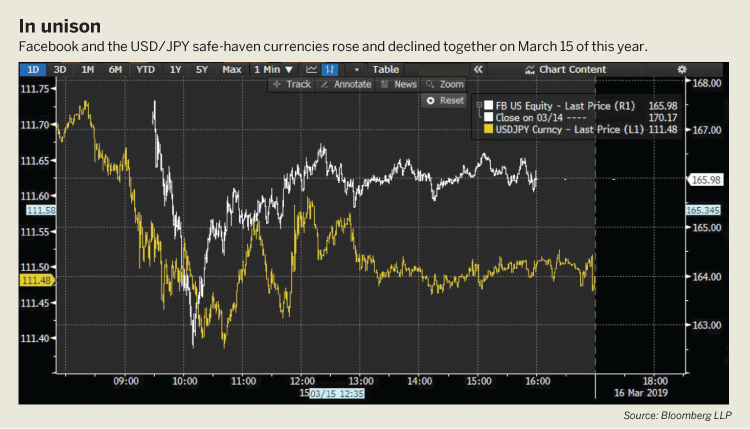

Owning U.S. dollar-denominated assets suddenly offered the highest yield net of inflation in nearly 20 years. The Bank of Japan didn’t move rates at all, and the yen (JPY) became the year’s weakest major currency.

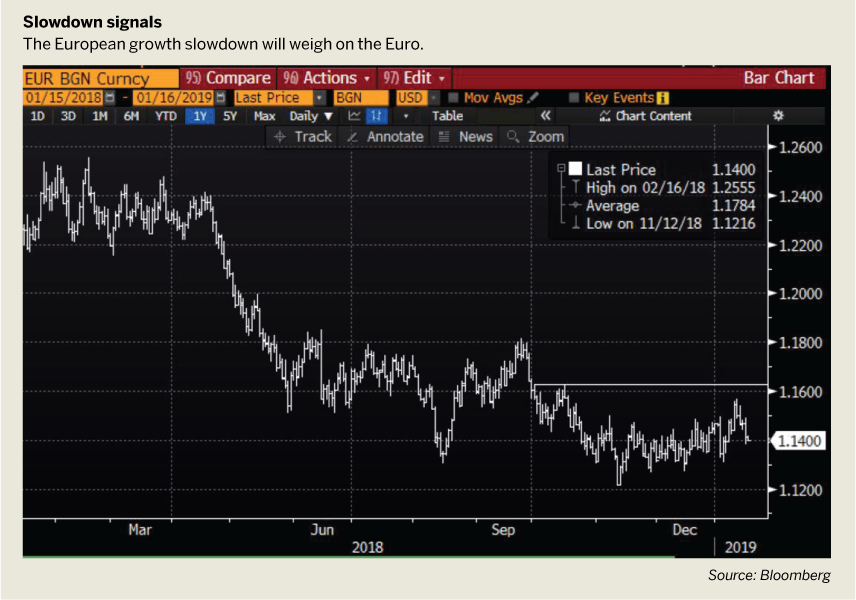

The other majors landed mostly as expected. The pace of rate hikes in the Eurozone broadly matched those of Norway and Sweden, but the euro (EUR) outperformed against the krone (NOK) and krona (SEK).

That makes sense because the high cost of borrowing cooled economic activity and soured the appetite for risk-taking in business ventures and investing.

Against that backdrop, capital tends to look for safety in “end demand” economies where the rich importers live. It flows away from “vendor” economies with greater dependence on exports.

Just think about who’s likely to feel financially safer in an economic downturn—the customer at the fancy coffee shop or the barista.

This calculus also helps explain why currencies weakened in commodity-exporting countries like Australia, Canada and New Zealand, even when their central banks outpaced the interest-rate actions taken by the European Central Bank (ECB).

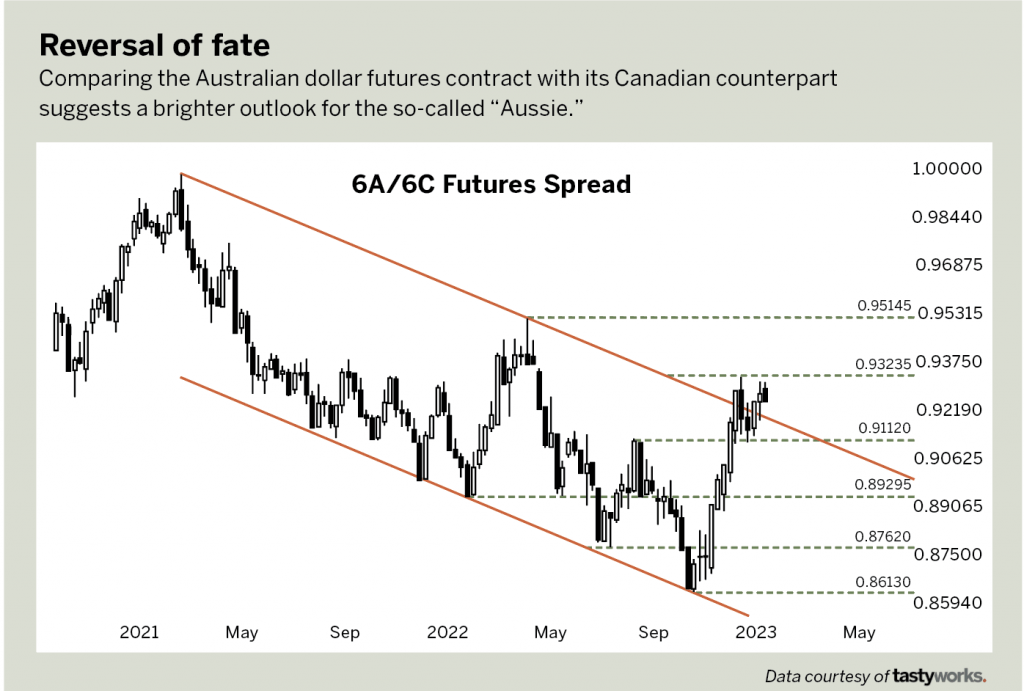

The “Aussie” may soon end a two-year downtrend against the Canadian dollar.

However, the currencies of those three countries bested the krone and the krona as faster rate hikes from the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) and the Bank of Canada (BoC) offered an edge.

Political factors helped account for what happened. The Swiss franc (CHF) stood tallest among European majors despite a relatively smaller rates lift from the Swiss National Bank (SNB). The currency has a reputation as a regional haven.

Most of Europe’s economies have been exposed to the conflict in Ukraine, making Switzerland attractive as a comparative safe harbor yet again.

Meanwhile, government turmoil in the United Kingdom has anchored the value of the British Pound (GBP) despite a relatively energetic Bank of England (BoE). The country had three prime ministers between the start of September and the end of October.

The way forward in 2023 seems less clear-cut. Market pricing suggests most of last year’s rate-hike leaders will see their advantage narrowed as laggards play catch-up. That means the largest monetary policy changes might benefit the euro and British pound.

However, yield-chasing may go out of fashion, ceding the spotlight to capital preservation and boosting the U.S. dollar as the most liquid cash-out venue of choice. It could come as sharply higher lending rates take a toll on growth and financial stability.

The global economy has been shrinking at an accelerating pace since last August, according to purchasing managers surveyed by S&P Global and JPMorgan.

At the same time, spikes in short-term U.S. dollar borrowing costs akin to those seen in 2007 ahead of the global financial crisis are a sobering sign of credit stress. They came as markets struggled and ultimately failed to digest an earlier round of rate hikes, and traders seem worried something similar is back—thanks to central banks’ latest efforts.

So, it seems appealing to plot a path away from risk on/off extremes to create a nuanced stance. Weighing the prospects of the Australian and Canadian dollars provides a case in point. They reside on the same “risk-on” side of the sentiment divide, which may dull the influence of big swings in the overall market mood.

Meanwhile, a genuine divergence in their economic stories may be developing. The Australian dollar is strongly exposed to China, its largest export market. Beijing’s sudden turn away from the highly restrictive zero-tolerance COVID policy stirred hopes for an economic revival, after current spikes in case numbers subside.

The Canadian dollar is similarly anchored to the U.S., where economists place the odds of a recession within a year at a dismally high 65%.

Australia’s central bank is also expected to deliver another 75-100 bps in rate hikes in 2023, while Canada’s central bank retreats into wait-and-see mode.

The markets seem to have noticed. The performance of the /6A Australian dollar futures contract against its /6C Canadian dollar counterpart suggests the so-called “Aussie” may be set to end a two-year downtrend against its North American cousin.

Confirmation on a sustained breach of 0.9324 may set the stage for a rise toward 0.9515 at first. Alternatively, slipping back below 0.9112 might neutralize upward pressure, at least in the near term.

Ilya Spivak heads tastylive Global Macro and hosts the network’s Macro Money show. @ilyaspivak