From Russia, With Wheat

Putin is holding down the price of exports

When the world’s largest and fifth-largest producers of wheat wage war against each other, one might expect disruptions in the grain supply. But one would be wrong.

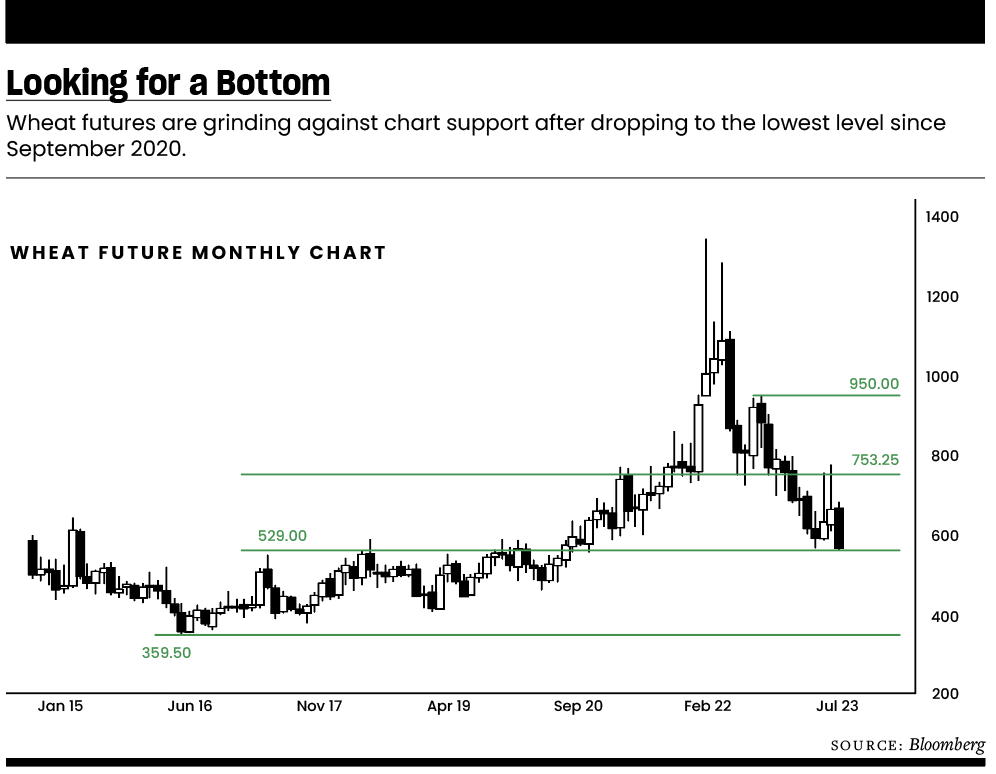

Wheat prices spiked briefly in the first half of 2022 when Russia invaded Ukraine, then cratered. By May 2023, the benchmark Chicago soft red wheat (SRW) future (ZW) plunged to its lowest level since November 2020. It happened despite the fact Russia, the world’s largest exporter, had 14.4% of the market as of 2021, and Ukraine accounted for 9.5%.

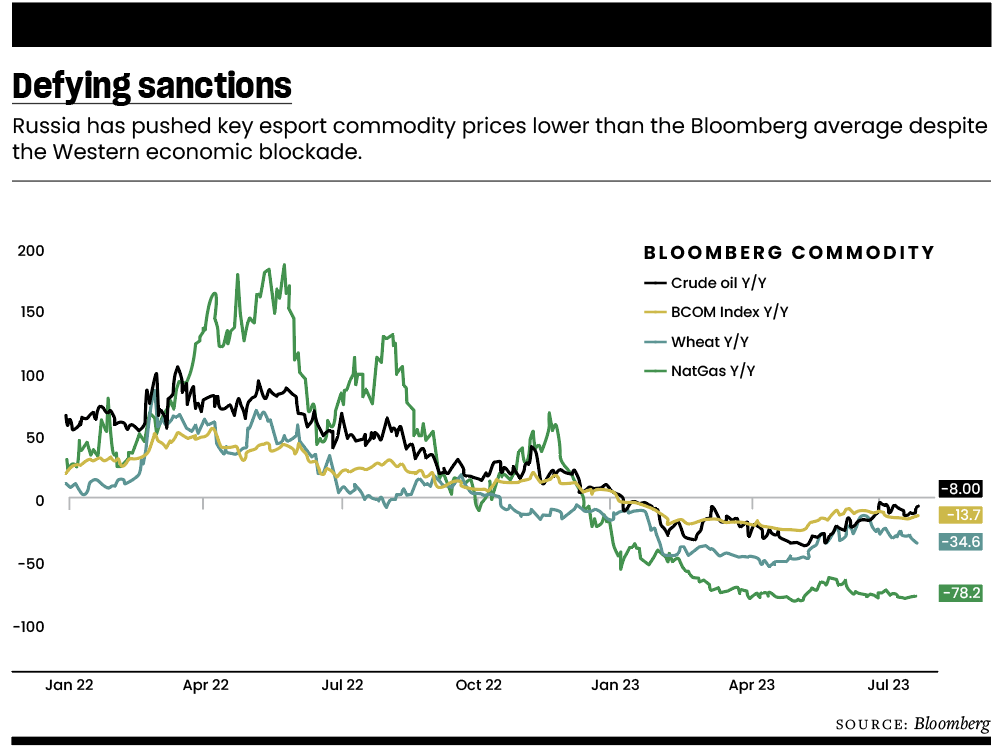

And the pattern isn’t confined to wheat.

Russia’s cheap exports

Russia appears determined to remain a dominant exporter by settling for low prices on global markets. Prices for its top two commodities—wheat and natural gas—are down significantly more than the Bloomberg average of global raw materials costs.

So, what is President Vladimir Putin up to here?

Russia is probably trying to protect its market share even while hamstrung by Western sanctions. It has only a few outlets left to raise money, including for the war. Giving up ground would be doubly damaging because the main competition in key markets comes from countries backing Ukraine in the conflict, most notably the United States.

Industrial wheat farming

Now, a bit of history.

The domestication of wheat was a watershed development in human civilization. It isn’t terribly difficult to grow, can be adapted to a variety of climates and doesn’t need much babying between planting and harvesting. That winning combination enabled humans to feed themselves without giving up every waking moment to the pursuit of calories.

The freedom the crop provided proved advantageous for wheat-eating civilizations and explains why control of wheat-producing lands (and the people who work them) was so hotly contested before agriculture industrialized.

And then it did.

Labor-saving machines and chemicals—fertilizers, herbicides and the like—helped farmers grow food on previously unproductive land. Easy-going wheat was pushed out to those marginal areas, while prime farmland was freed up for cultivating choosier crops and raising livestock. Globalization spread this specialization.

On one hand, the explosion in food production helped support dramatic population growth and economic development in parts of the world where it could not have happened otherwise. On the other, it has inextricably linked food security with the smooth functioning of global supply chains.

Deglobalization begins

But now a broad-based retreat from trade liberalization has emerged as a critical concern. The problem is epitomized by the deepening row between the U.S. and China, the world’s largest and second-largest economies. The former is the most singularly impactful consumer market. The latter is the top value-add hub.

Increasingly frictionless trade over recent decades did wonders for reducing the cost of doing business and gave birth to the just-in-time, internationalized way of producing almost everything we know today. Putting this process in reverse will do the opposite. Costs will rise and access will be compromised.

The impact of this reshuffling on wheat is likely to come in two acts.

Chicago soft red winter wheat, the most liquid wheat futures contract in the world, is used in pastries, cakes, cookies, crackers, pretzels, flat breads, and for blending flours.

First, any place unable to secure essential inputs for industrial agriculture will struggle to maintain output. The resulting supply crunch may send prices sharply higher. Next, wheat may reconquer higher-quality land where it can thrive without so much overhead. Trickier crops now growing there may then surge in price, but wheat ought to moderate.

This brings us back to Russia and Ukraine. Loopholes in sanctions and ship safety guarantees don’t matter if the grain isn’t grown and harvested in the first place. The longer the conflict drags on, the more agricultural infrastructure is disrupted or destroyed.

Flooding the market via the Black Sea may thus come to a crashing halt sooner rather than later. Whatever price spike follows may then mark a bottom to which wheat will not return for some years as Act 1 of the deglobalization transition gathers steam. That sets the stage for a big-splash rally.

Turning to the monthly chart, wheat futures are grinding against support at 529.00, a former range top. Initial resistance stands at 753.25, with a break above that opening the door for a test of 950.00. Alternatively, piercing support may expose the multi-year low at 359.50.

Ilya Spivak heads tastylive global macro and hosts the network’s Macro Money show. @ilyaspivak

Subscribe for free at getluckbox.com.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.