Fed Hike Hype

Higher interest rates will keep the markets volatile

When the Federal Reserve raises interest rates, financial markets can turn volatile. The hikes in the early 2000s bore this fruit and so did the initial efforts to end quantitative easing (QE) and raise rates in the mid-2010s.

Now, the Fed has finished tapering its pandemic-era QE program and started its rate hike cycle, so the markets are by no means finished with their current bout of volatility.

But what’s next? Well, traders can use the Gartner Hype Cycle to see how the Fed’s tightening may play out. (For another take on the cycle, see The Technician, here.)

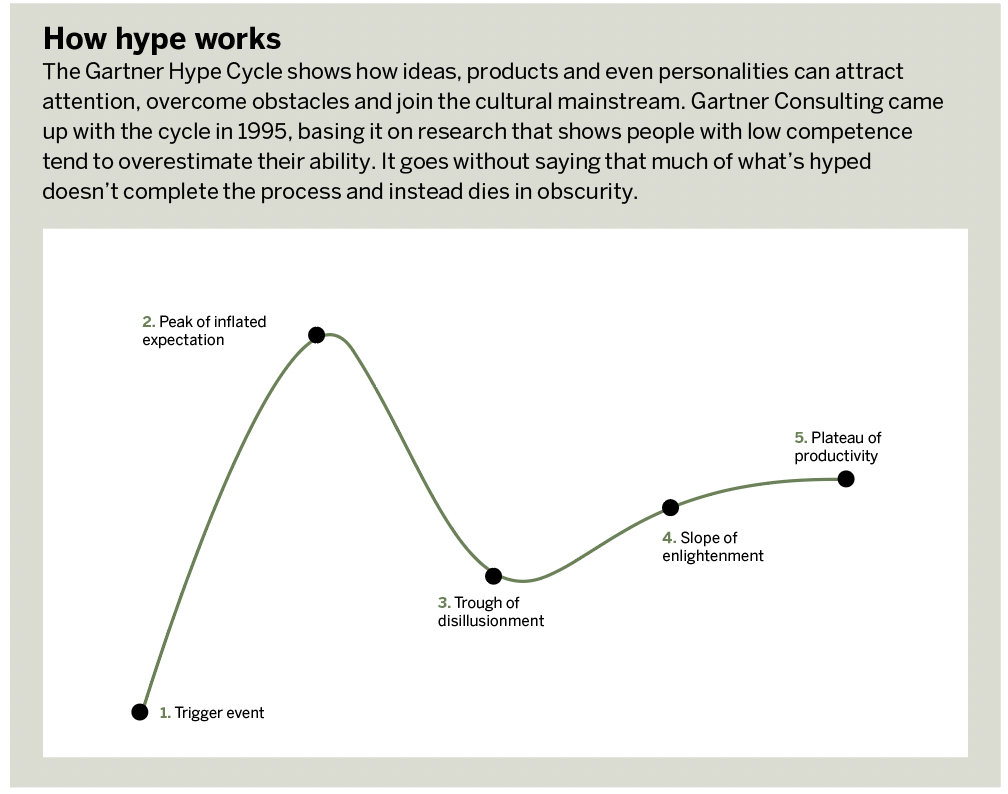

The hype cycle maps out a pattern of events that typically occurs when a product, event or idea moves from niche awareness to mainstream adoption.

It begins with a trigger event that generates enough hype to push the public to a peak of inflated expectation. When the public realizes nothing can live up to the hype, disillusion takes hold.

At that point in the cycle, one of two things can happen: The trigger event fails because it’s rendered immaterial, which ends the cycle, or evidence materializes to substantiate some of the initial hype that surrounded the trigger event.

If the latter plays out, hype builds anew into a slope of enlightenment. The final stage, the plateau of productivity, arrives as mainstream adoption is achieved. By then, the broader population is not only aware of the trigger event but also understands it and can rationalize it.

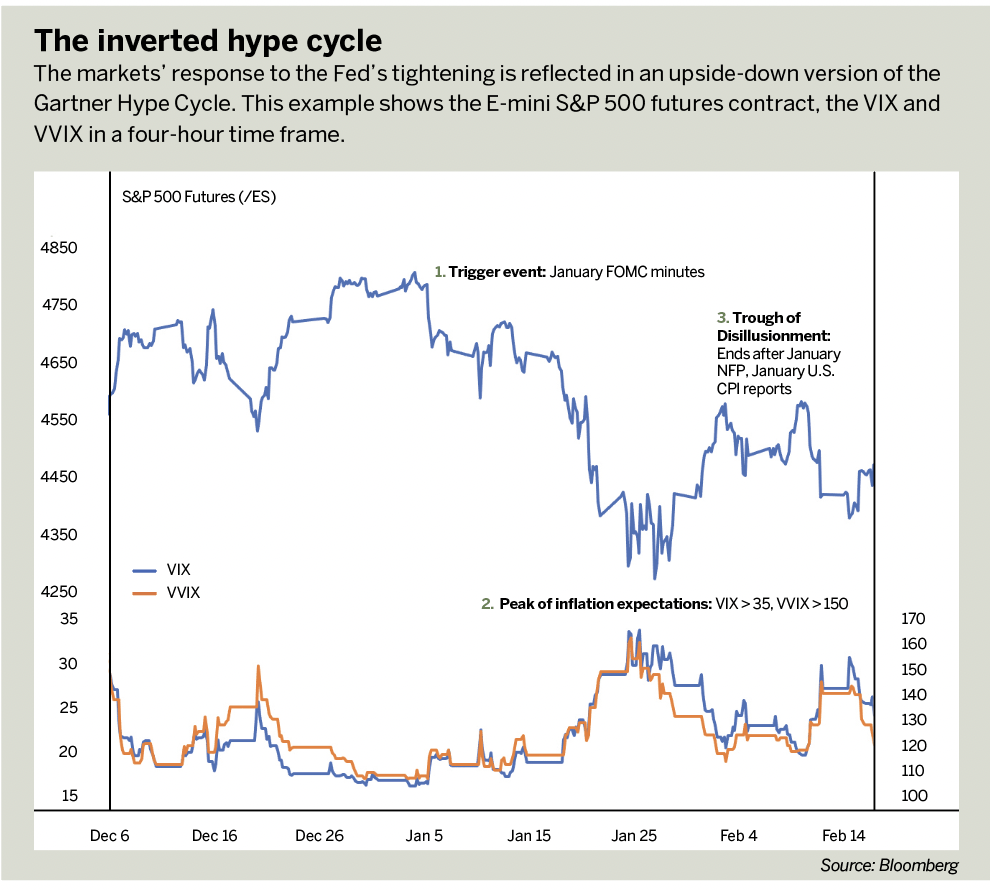

The stages of the markets’ response to the Fed’s tightening efforts follow the ebbs and flows of the Gartner Hype Cycle—only inverted.

In the markets, it might go this way:

1 ⊲A trigger event occurs when a rate hike produces a sell-off in risk assets, and all of the weak hands are wiped out.

2 ⊲Exhaustion sets in at a peak of inflated expectations about tightening.

3 ⊲As the Fed has not yet changed policy materially, interest in buying returns, leading to a rally in asset prices into a trough of disillusionment about tightening.

4 ⊲ As evidence accumulates that the Fed will be forced to tighten policy, a slope of enlightenment leads to increased pressures to sell.

5 ⊲ The rate hikes come to pass, and financial markets level off into the plateau of relative productivity.

The stock market may have already passed through Stages 1-3 of the inverted Gartner Hype Cycle and may have started moving into Stage 4. (That trend is reflected in The inverted hype cycle, above.)

1 ⊲ The trigger event occurred in January, when the minutes from the December Federal Open Market Committee suggested that not only would rate hikes arrive quickly but also that the Fed would embark on quantitative tightening (QT) this year.

2 ⊲Over the next several trading sessions, the VIX, which measures the implied volatility of the S&P 500, spiked above 35. Meanwhile VVIX, which measures the implied volatility of the VIX, moved above 150, representing the peak of inflated expectations about tightening.

3 ⊲Exhaustion set in, making for a short-term rebound in asset prices to a trough of disillusionment about tightening.

4 ⊲ The inverted hype cycle entered Stage 4 in February, when the better-than-expected January non-farm payrolls report showcased a resilient labor market, and the January consumer price index indicated inflationary price pressures had reached a 40-year high.

Those data points were the material evidence financial markets needed to embark on their Stage 4 slope of enlightenment, whereby acceptance began to increase that the Fed would be tightening policy rapidly over the coming months.

So, what does the inverted Gartner Hype Cycle tell traders about the near-term path of the financial markets? If stocks are in the midst of Stage 4, then there’s still pressure to sell. In fact, given the historical precedence in the early stages of Fed tightening efforts, stock prices may remain volatile with a downside bias through the middle

of 2022.

Only when the Federal Reserve has actually begun to raise rates and has embarked upon the path of QT will stock markets reach their Stage 5 plateau of productivity, the time and place where buying opportunities may begin to emerge in earnest.

Christopher Vecchio, a senior currency strategist for DailyFX, forecasts economic trends in a number of countries. @cvecchiofx