Trades

Oil, Ukraine and the Krone

By Ilya Spivak

Europe’s energy shortfall will boost Norway’s currency

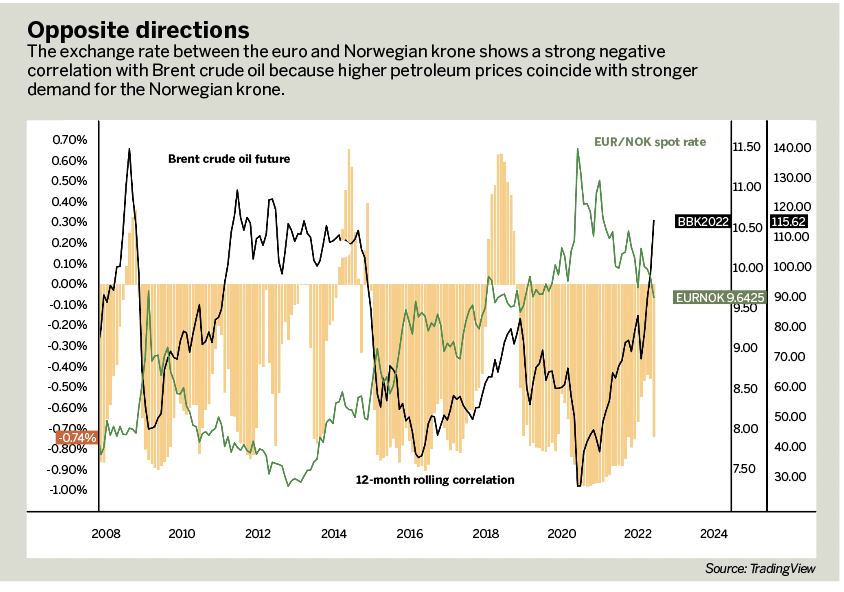

The Norwegian krone tends to rise against the euro when crude oil prices are on the upswing. Indeed, the 12-month rolling correlation between Europe’s benchmark Brent crude oil contract and the euro/Norwegian krone currency pair (EUR/NOK) exchange rate has spent most of the 14 years since the 2008 financial crisis in strongly negative territory.

That makes sense. Norway is a prodigious exporter, with an account surplus averaging more than 6% of gross domestic product over the past four decades. Much of this commercial success hinges on selling crude oil, natural gas and refined petroleum to the Eurozone. Germany, the Netherlands and France add up to over a third of...

Macro

-

Gold Doesn’t Rule

By Ilya Spivak

|The bright yellow metal hasn’t kept pace with most stocks and bonds -

Crude Oil and a Revolution in Retreat

By Ilya Spivak

|Plus, how to pick a winner among GM, Ford, Toyota and Tesla -

The Dollar, Boomers & AI Stocks

By Ilya Spivak

|A shortage of workers is boosting wages, but AI may soon help the economy do more with less Wages are on the rise. Even after a year of inflation-fighting interest… -

Dollar Days: Looking Beyond the U.S.

By Ilya Spivak

|As the U.S. dollar declines from the heady highs of 2022, it’s time to revisit the Australian and Canadian dollars The value of the U.S. dollar soared in 2022 as… -

The U.S. Dollar Will Crash

|A mean-reverting macro currency trade explained by a meaty metaphor Extreme prices can make an active investor salivate. Contrarians and trend followers alike tend to view hamburger meat as Kobe… -

Fed Hike Hype

|Higher interest rates will keep the markets volatile When the Federal Reserve raises interest rates, financial markets can turn volatile. The hikes in the early 2000s bore this fruit and… -

Hikes at the European Central Bank

|The reliably timid ECB is hinting at raises in interest rates Something shocking happened in early February—the European Central Bank opened the door to rate hikes later this year. For… -

US-China Trade Impacts Aussie Dollar

|U.S. equity indexes have hit historic highs, but the price action included periods of drawdowns throughout last year. Some drawdowns were related to negative U.S.-China trade war headlines, a major… -

2020 Foresight

|January’s the time to gauge macro themes that will shape trading and investing in the coming year. “Why bother?” some ask. Unforeseen news and updated data will change investor sentiment… -

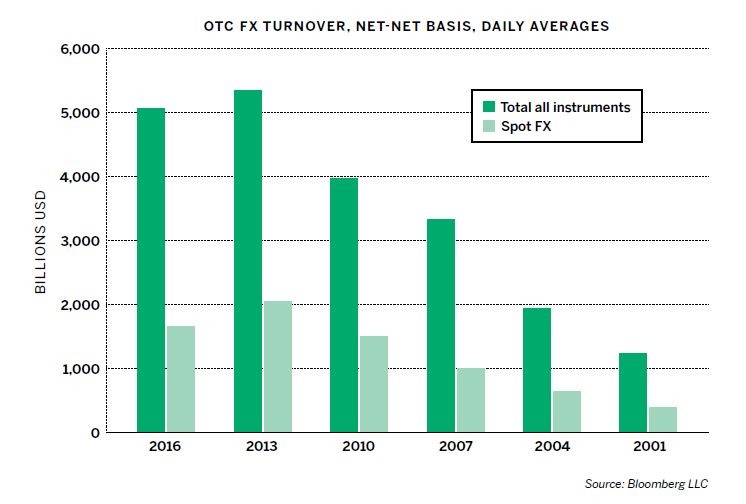

Take a look at the Krona

|The U.S. dollar(USD), the world’s most traded currency, is followed in trading volume respectively by the euro (EUR) and the Japanese yen (JPY), according to the The Bank of International… -

5 Tips for Choppy Markets

|These markets are untradeable—there’s too much uncertainty. I’m getting chopped up.” Does that sound familiar? It might. Portfolio managers and traders have been expressing those sentiments on financial television most… -

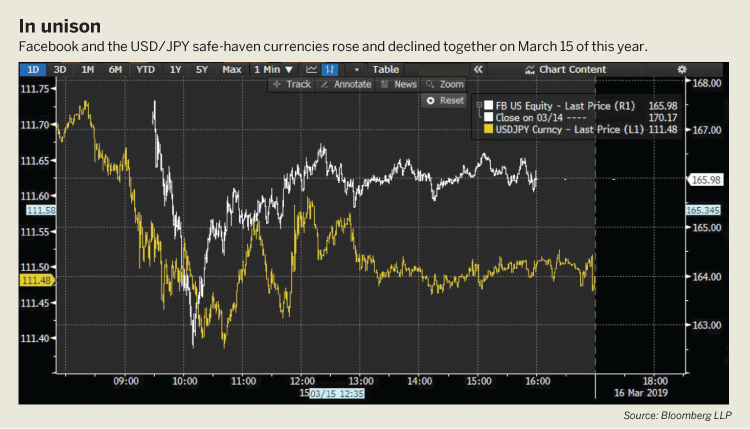

Risk-Off FAANG Trades

|Opportunities in global market directional trends FAANG, an acronym for a collection of tech and communication companies that have changed the way most people live, is comprised of Facebook (FB),… -

Trading Around Uncertainty

|Some financial media experts say that all trading and investing is uncertain by nature. Therefore, why should uncertainty in the markets matter? Well, while there’s some truth to this sentiment,… -

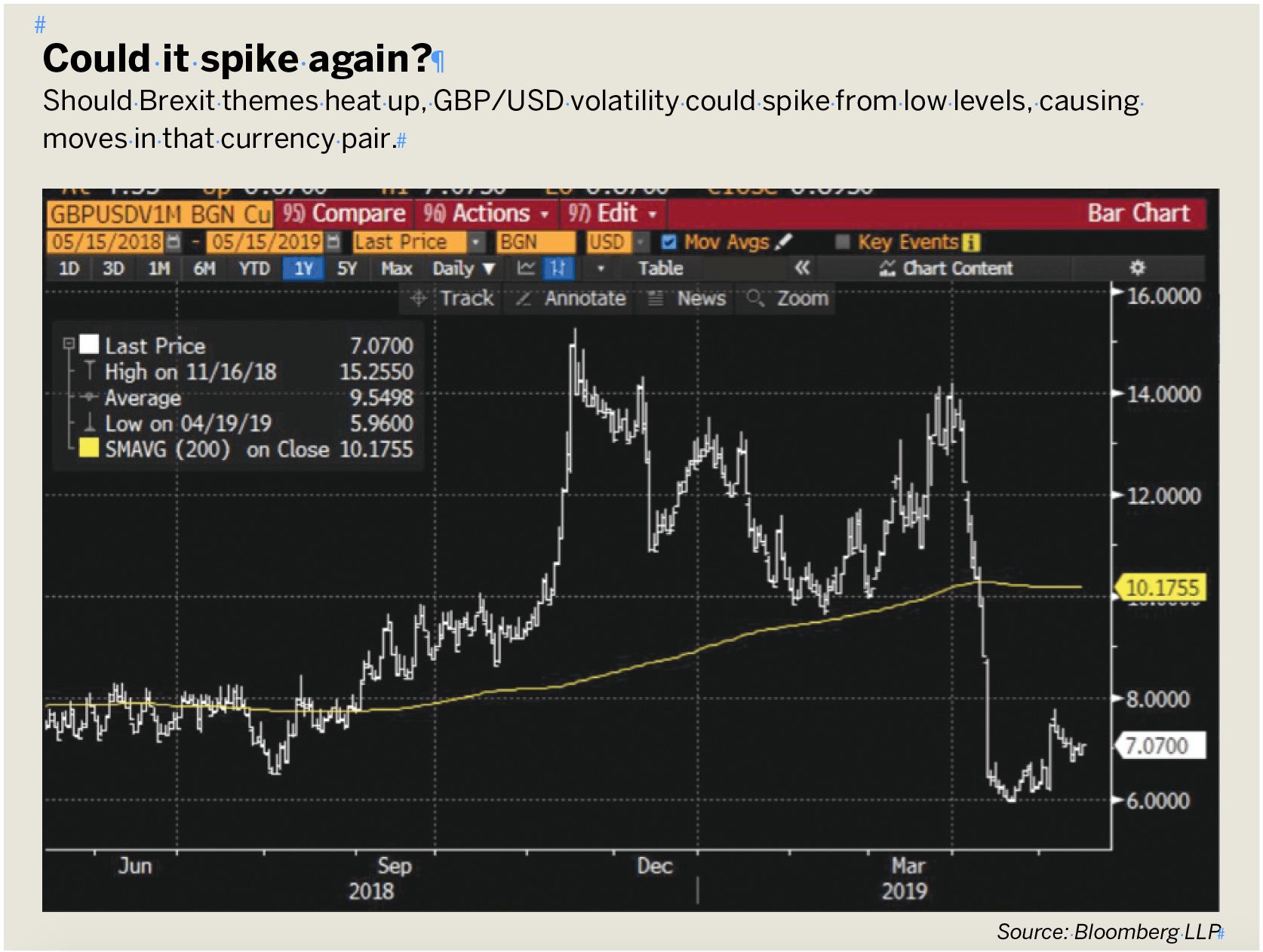

Unresolved Macro Themes Forecast Forward Volatility

|Global directional trends lobal macro trading benefits from volatility because moving markets create opportunities to trade. It’s also true that macro themes tend to simmer in the background and then… -

An Aussie Currency Trade

|The Bank of International Settlements (BIS) operates as a bank for central banks, offering financial services to help central banks manage foreign reserves. It’s also known for its Triennial Survey… -

The Forex FAANG Trade

|Intraday declines on tech giants can indicate a short dollar-to-yen trading opportunity -

Don’t Fear a Market’s Uncertainty; Manage It

|"The most important thing is never certainty. Certainty comes when it is ready. The most important thing is having a clear and healthy framework for dealing with uncertainty, which is…