US-China Trade Impacts Aussie Dollar

U.S. equity indexes have hit historic highs, but the price action included periods of drawdowns throughout last year. Some drawdowns were related to negative U.S.-China trade war headlines, a major macro theme that will continue to roil the markets this year. That leaves no escape from the headlines for Australian currency.

The Australian “Aussie” dollar (AUD), as a high beta currency, is influenced by movements in U.S. equity indexes and the global growth cycle. The Aussie dollar typically feels risk-on or risk-off on market days. As a result, some of the China-U.S. trade war announcements that affected the U.S. equity markets also affected the Aussie dollar.

China accounts for just over 30% of Australia’s exports. In its December monetary policy announcement, the Reserve Bank of Australia noted “U.S.-China trade and technology disputes continue to affect international trade flows and investment as businesses scale back spending plans because of the uncertainty.”

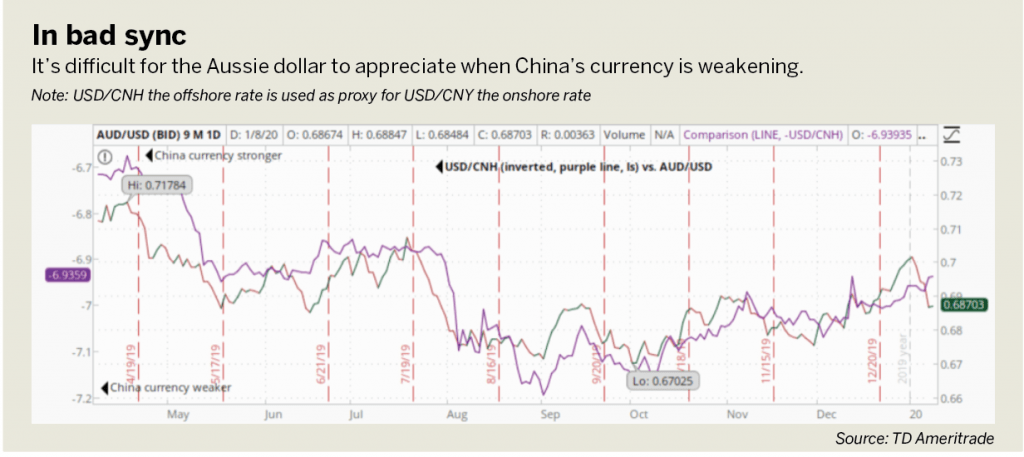

China has taken steps to support its economy, and its currency has weakened as well.

As shown in “In bad sync,” below, it’s difficult for the Aussie dollar to appreciate when China’s currency is weakening. When the Chinese yuan (CNY) is weakening versus the U.S. dollar (USD), AUD/USD usually weakens along with it.

To gauge how the Aussie dollar could trade in the session ahead, get a feel for whether it’s a risk-on or risk-off trading day.

For another gauge, check the People’s Bank of China (PBOC) “fix” for USD/CNY. The PBOC allows the spot rate for USD/CNY to trade with a range of 2% above or below the day’s official fix. The “fix” or “yuan reference rate” for USD/CNY is announced daily at 9:15 a.m. Beijing time. If it’s noticeably stronger or weaker than the previous day’s fix, then that can help set the tone for the Australian dollar for the trading day ahead.

Unfortunately, this year has started on a sad note for Australia because of devastating bushfires. Given the scale of the fires, they could damage the economy by imperiling consumer confidence and curtailing tourism.

Spending on recovery or rebuilding efforts may be delayed until fires are over—it won’t be immediate. Ahead, the Reserve Bank of Australia may cut its policy rate further in response, which would weigh on the Aussie dollar.

In addition, those macro themes—if they heat up—could result in risk-off sentiment days in the financial markets and for the Aussie dollar.

Buy a six-month 0.6600 AUD/USD put to reflect downside risks discussed above.

Amelia Bourdeau is CEO of marketcompassllc.com, an advisory firm that provides global macro education and trading strategies to investors of all levels. @ameliabourdeau