Take a look at the Krona

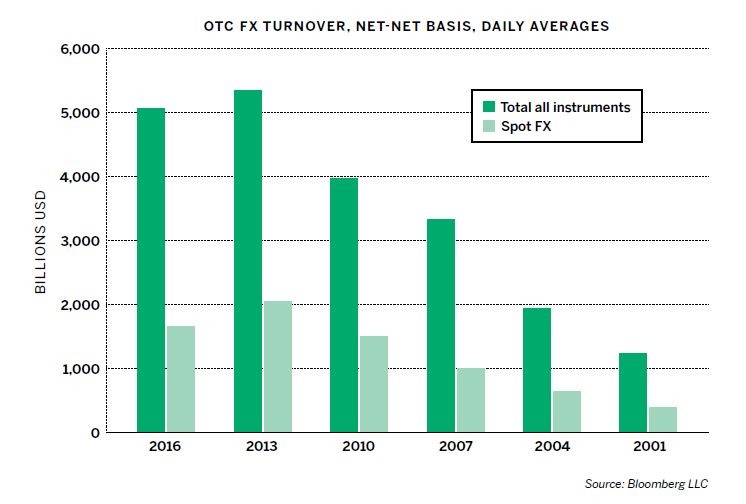

The U.S. dollar(USD), the world’s most traded currency, is followed in trading volume respectively by the euro (EUR) and the Japanese yen (JPY), according to the The Bank of International Settlements (BIS) Triennial Central Bank Survey on Foreign Exchange Turnover (April 2019). The world recognizes those three currencies as the powerhouses of developed market, or G10, currency trading. But what about the other G10 currencies?

Consider two of the lower-profile G10 currencies—the Norwegian krone (NOK) and Swedish krona (SEK). Those currencies are cheekily known on trading floors by their nicknames “Nokkie” and “Stokkie.” They’re also referred to collectively as the “Scandi” currencies. The krona ranks as the 11th most-traded currency in the world, and the krone is 14th, according to the BIS.

Traders keep the Scandi currencies on their radar screens because when krone and krona move, they tend to move quickly and by sizeable amounts, sometimes even intra-day. While not the top three powerhouse currencies traders trade day-in and day-out, the Scandi currencies are the side hustlers. Traders can capture solid, short-term gains on occasion with them if they monitor them and pay attention to upcoming relevant event risk.

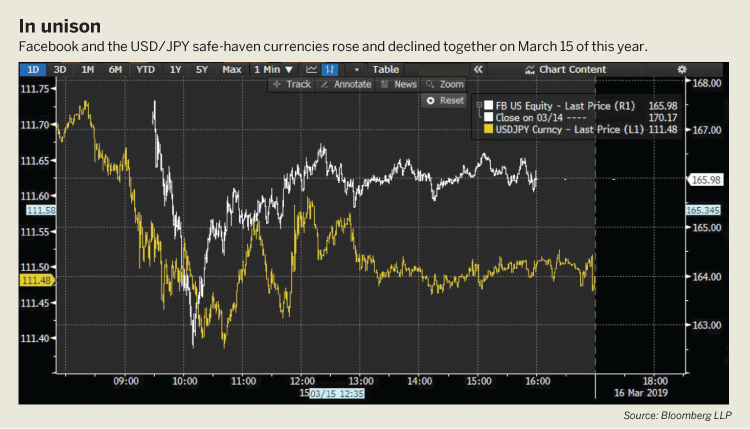

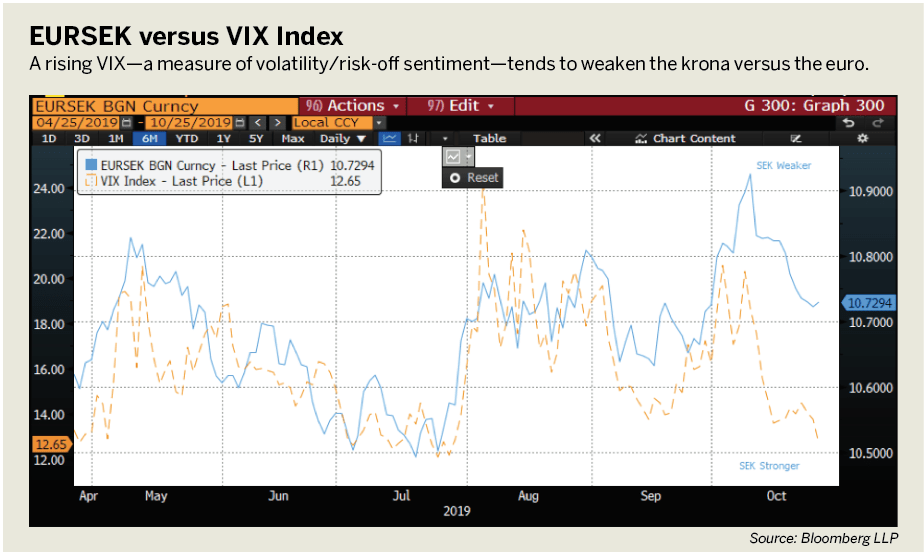

Why? Traders consider the Scandi currencies “high beta,” meaning they can be sensitive to the overall risk-seeking sentiment in markets. For instance, risk-on days in equity markets can see the Scandi currencies strengthen and risk-off days can mean they weaken. In addition, Norway exports oil, making the krone an “oil” currency that’s sensitive to price changes in petroleum.

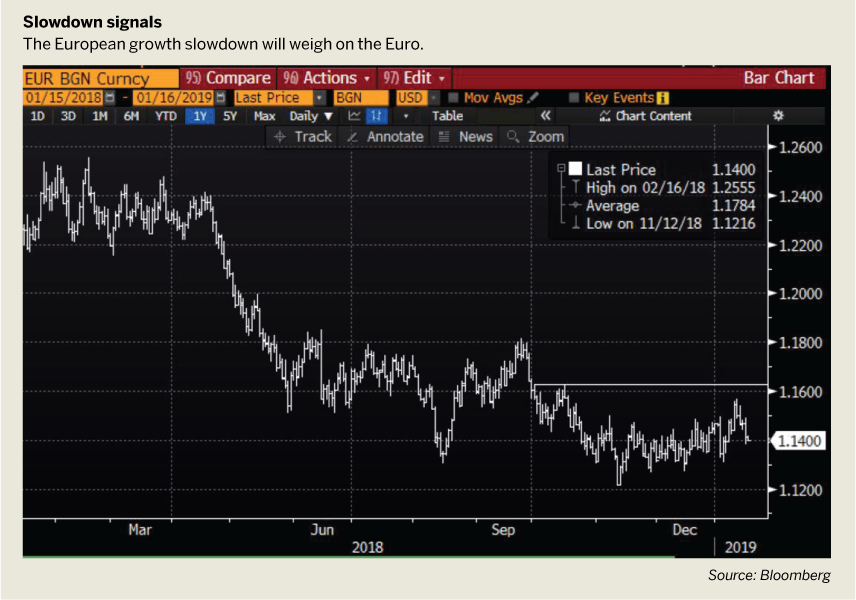

So far this year, Scandi currencies have been the worst performing G10 currencies against both the U.S. dollar and the euro. The krone has fallen 5.2% versus the U.S. dollar and 2.9% versus the euro. The krona has fallen nearly 7% versus the U.S. dollar and 4.7% versus the euro. As stated above, when the Scandies move, they tend to move a lot. But why are the Scandi currencies the worst performers versus the U.S. dollar and euro when the S&P 500 Index (SPX) is up 20.4% year-to-date?

According to that one metric, risk-seeking appetite among investors seems to be positive or “risk-on,” meaning Scandi currencies should also be strong. However, looking at just the overall rise in the S&P 500 Index this year hides the fact that notable risk-off periods have occurred throughout the year.

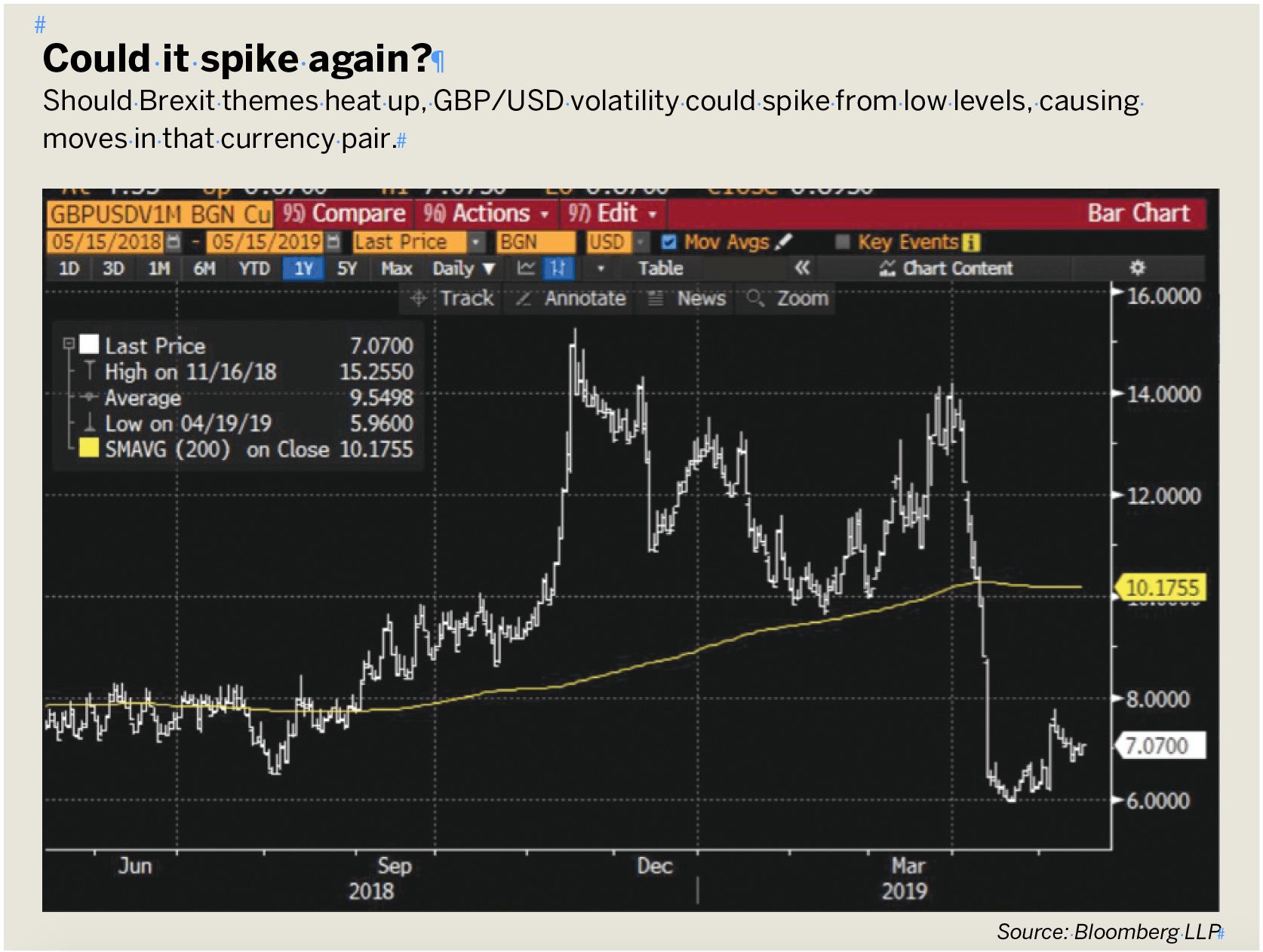

Last month’s Macro column, 5 Tips for Choppy Markets, was devoted to that flip-flop or risk-on/risk-off phenomenon. Continued market uncertainty about the big, unresolved macro themes—the U.S.-China trade war, Brexit and the slowing U.S. and European economies—have weighed on overall investor risk-seeking appetite, therefore negatively impacting the high beta Scandi currencies. In addition, the Swedish economy has been slowing, negatively affecting the krona.

Trade Idea The Scandi currencies are very thinly traded, but they can present select profit opportunities. Ahead, the krona should remain weak as the Swedish economy plods through a slowdown and inflation remains subdued. Riksbank, the central bank of Sweden, has forecasted a policy rate hike will occur within a month, but analysts disagree. In addition, some analysts think Riksbank could cut its policy rate early next year. That Riksbank monetary policy uncertainty should weigh on the krona versus the euro. Buy six-month 11.10 EURSEK call.

Amelia Bourdeau is CEO of marketcompassllc.com, an advisory firm that provides global macro education and trading strategy to investors of all

levels. @ameliabourdeau